One of the most commonly asked questions I get from would-be entrepreneurs is: “How do I get money for my business idea?”

I’ve answered it before, but it’s worth answering again because the question keeps coming up. Let’s start with a bit of harsh truth: It isn’t easy.

You may have heard the expression that if you build a better mousetrap the world will beat a path to your door. That implies that there is always lots of money looking around for good ideas.

On the contrary, money rarely chases after ideas. Most of the time, money chases money.

Take the business I am in: information publishing. Not a week goes by when I don’t hear a proposition from someone who has a “brilliant” idea for a publication. It might be a new investment newsletter or a magazine about retirement or a website on health and fitness. “I can’t tell you what the idea is,” they usually say, “but when you hear it you will realize how special it is and you’ll be happy to fund it.”

Sometimes people want me to sign non-disclosure agreements. Apparently they fear that I will “steal their idea” and not pay them for it.

In my 25+ years of listening to publishing ideas, I have signed only two or three such agreements. And they were done years ago, before I really understood what I was doing. Nowadays, I don’t sign them. Not because I want to steal the idea, but because I know there is a 99.9 percent chance that (a) I won’t like it or (b) I will already be working on something similar.

That second situation is quite common. When one person comes up with a clever idea, it’s very likely that other people – often people employed by companies I consult with – have come up with it too.

The reason for these “coincidences” is easy to understand if you’ve read Malcolm Gladwell’s The Tipping Point. Brand-new ideas seldom come to the market sprung from the thigh of Zeus. Usually, they have been percolating around the market’s periphery for years. Gradually, they reform themselves until one particular application of the idea catches fire.

Since the economy began to collapse in the middle of 2008, for example, every smart person in the investment advisory business had been busy thinking about new ways to make money in 2009. These individual thinkers talked to one another and made comments in e-letters and blogs. One specific idea spurred another. And, eventually, there was an outpouring of similar ideas. I saw a half-dozen new products related to income-oriented investment advisories. And another half-dozen for products that focused on short selling.

The people that came up with these ideas were not stealing from one another. They were individually mulling over the same problems. It’s a sort of collective consciousness that results in so many similar ideas, only a handful of which will go on to make money.

And that gets us to the main reason why I don’t sign non-disclosure agreements. Because I know that ideas themselves are not so important. What matters is the way they are articulated.

In How to Get Rich, Felix Dennis puts it like this:

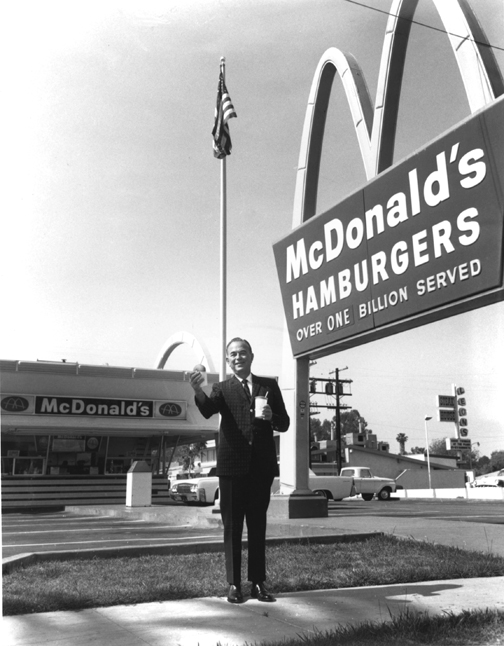

It really does not matter who gives birth to any particular idea. This is borne out by the law relating to patents and inventions. You cannot patent an idea. You can only patent your own method for implementing an idea. …Ray Kroc did not invent the idea of fast food. …There were thousands of ‘fast food’ outlets in the USA at the time. …His genius was merely to recognize this fact and implement a simple five-point plan: Standardize the food and prices, franchise the outlets, produce the food swiftly in clean surroundings, offer value for money, and market the whole shebang relentlessly.

Yes, you need more than an idea to attract money. You need some unique selling proposition and, if possible, proof that the idea will work. You can have both things if – before looking for money – you build yourself a working model.

Let’s look at a few examples that define the difference between an idea and a working model.

Idea: a newsletter on short selling

Working Model: an e-letter that has been published for six months and has 100 paid subscribers

Idea: a retail jewelry store

Working Model: an operating business that has sold jewelry at flea markets profitably for a year

Idea: a musical comedy about Enron

Working Model: a script that has been performed to rave reviews at local theaters

The difference between an idea and a working model is significant – especially to a potential investor. The difference is two-fold:

- Ideas tend to be generalized, whereas working models are specific.

- Ideas are unproven, but working models show the potential for profits.

So that is the first and most important thing to do once you’ve come up with a “great” business idea. Turn it into a working model.

You don’t need to spend much money doing that if you are clever. By taking advantage of the Internet and using direct-marketing techniques, almost any business can be tested without a huge investment.

Almost any. Not every. You can’t create an inexpensive working model of a three-wheeled car, for example. Nor can you test out a new kind of luxury hotel idea on the cheap. But capital-intensive business ideas like those are best left to the larger businesses that occupy already dominant industries. For ordinary entrepreneurs, the good ideas are those that can be modeled cheaply.

Once you have a working model, you have a much better chance of getting the money you want. But where do you look?