* I have only two book reviews for you this month. I’ve had to suspend my goal of reading a book a week while I’m dealing with other matters that have greater priority. I’ve also reduced the number of movies I’m reviewing, for the same reason. The good news is that the two books I’m reviewing below are very good ones, and very much worth reading.

* I also have eight essays and articles for you… again, very much worth reading – and you can zip through all of them in about an hour.

* Plus, as always, there’s something extra at the end.

The Blind Watchmaker

By Richard Dawkins

496 pages

Published 1986

This was the first Richard Dawkins book I’ve read, but it won’t be the last. It was suggested by my book app, probably because of the three Steven Pinker books I’ve read in the past 18 months – Enlightenment Now, Rationality, and How the Mind Works – all of which I rated very highly.

Pinker is, among other things, an evolutionary biologist who has made a name for himself in the past two decades through his books and Harvard lectures on language, culture, history, and brain science. Dawkins, too, is an evolutionary biologist. He became a noted public intellectual in the 1980s as a result of this book (published in 1986) and The Selfish Gene(published in 1989), as well as his subsequent public debates on religion and atheism.

The fact that this book was written 40 years ago made me that much more eager to read it.

What It’s About

At its simplest level, The Blind Watchmaker is about Darwin’s theory of evolution through natural selection. You might wonder why such a book needed to be written 100 years after Darwin’s death. The answer would be that during the 1970s and 1980s, an anti-evolutionary theory made its way into public prominence that sounded not just plausible but the equal of Darwin’s explanation of how and when Homo sapiens became Homo sapiens. And it restored to Creationism the respectability that so many religious believers had long desired.

The counter-argument to natural selection, simply put, is this: When you consider the immense biological complexity of the human being, it is impossible to believe that it could have come into existence by accident. It must have been created by an even more complex divine intelligence.

To counter the counter-argument, Dawkins uses the example of the human eye. He begins by noting that there are simple organisms that are capable only of distinguishing between light and dark, and then only barely. He then leads the reader through a series of thousands of minor modifications, which could easily be explained by minor mutations to those organisms, that could have ended up as something as elegant and complex as the eye. In leading the reader through this trail of logic and probability, he supplements his argument by pointing to several creatures whose various seeing apparatuses are living examples of intermediate levels of complexity.

Later in the book, he expands on his argument by describing how randomness coupled with cumulative selection can easily explain the complexity of the human eye. In fact, he proves, quite convincingly to me, that it is mathematically impossible for the human eye, or something equivalently utile, not to have arrived through natural selection.

What I Liked About It

* The Blind Watchmaker is intelligent, intellectually stimulating, and immensely edifying. As I often felt reading Steven Pinker’s books, it gave me the feeling that I was learning something both fascinating and important, and from someone I would like to have in my circle of friends.

* I very much liked the fact that, in addition to learning about natural selection at a deeper level than I’d ever understood it, I was seeing Dawkins exercise a deeply contrarian impulse with a brilliant, cutting, sometimes searing wit that I’d describe as Steven Pinker crossed with Oscar Wilde.

* Another big plus for me was the chapters in which he makes the effort to make his argument mathematically. So much of modern science and philosophy has been given over to mathematicians whose theorems and calculus are far beyond my level of comprehension that I often give up on reading their books after a chapter or two. Somehow, thankfully, Dawkins kept his math to a level that I could follow.

Critical Reception

* “Dawkins restrains his combative secular humanism here to write a patient, often beautiful book… that begins in a generous mood and sustains its generosity to the end…. It is one of the best books ever to address, patiently and persuasively, the question that has baffled bishops and disconcerted dissenters alike: How did nature achieve its astonishing complexity and variety?” – Tim Radford, The Guardian

* Dawkins “succeeds admirably in showing how natural selection allows biologists to dispense with such notions as purpose and design,” and is “not content with rebutting creationists” but goes on to press home his arguments against alternative theories to neo-Darwinism. – Michael T. Ghiselin, The New York Times

Interesting

* The title of the book refers to the watchmaker analogy made famous by William Paley in his 1802 book Natural Theology or Evidences of the Existence and Attributes of a Deity.

* In an appendix to the 1996 edition of the book, Dawkins explains how his experiences with computer models led him to a greater appreciation of the role of embryological constraints on natural selection.

* In the preface, Dawkins states that he wrote the book “to persuade the reader, not just that the Darwinian worldview happens to be true, but that it is the only known theory that could, in principle, solve the mystery of our existence.”

About the Author

Richard Dawkins is a British evolutionary biologist, zoologist, science communicator, and author. He is an emeritus fellow of New College, Oxford, and was Professor for Public Understanding of Science in the University of Oxford from 1995 to 2008. He set up the Richard Dawkins Foundation in 2006 to promote the cause of removing religion from science.

I both listened to the book when I was driving and read it in book form when I was relaxing at home. That allowed me to digest the content in two voices: that of Richard Dawkins (who narrated the audiobook) and the one in my head, which, I think, allowed me to get into it with a greater level of interest and comprehension.

That said, I gave The Blind Watchmaker an average score of 4.5, plus bonus points for the sheer number of novel insights and smart observations it provided on almost every page.

My Rating

* Verticality: 4.5 – The subject was covered well and broadly.

* Horizontality: 4.5 – The subject is important.

* Literary Richness: 4.5 – The writing was smart and sassy.

* Bonus Points: 0.4

* Overall Score: 4.9 out of 5.0 – A great book. Highly recommended.

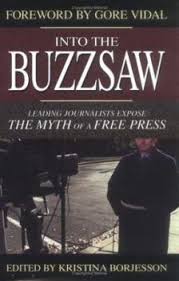

Into the Buzzsaw:

The Myth of the Free Press

Edited by Kristina Borjesson

462 pages

Published 2002

A paperback copy of the book was on a shelf of books in the bedroom of our little cottage at the botanical gardens. I had no recollection of buying it. Nor of reading about it. Had I picked it up at a yard sale? Could it have been left by a visitor or one of the kids?

I liked the subtitle: The Myth of the Free Press. For a moment, I assumed it had been written and published recently, since the world went Woke and decided that censorship was not only a reasonable response to hate speech but to any sort of information that could be inconvenient to the Big Government, Big War, Big Food, and Big Sickness industrial complexes.

I had read plenty on that subject over the past six to eight years in the alternative press. But a brief description of this book on its back cover promised a different perspective: It was a collection of essays from 18 professional journalists (mostly from the Legacy Media, such as the BBC, ABC News, The New York Times, the Associated Press, The New York Observer) who had confronted the threat of censorship firsthand.

But then I looked at the copyright page and discovered that it was published in 2002 – 14 years before I began researching the censorship industry. What sort of censorship was going on then? And from whom?

As soon as I began reading Into the Buzzsaw, I was embarrassed to have asked such questions. It presents personal accounts of stories I had remembered reading about decades earlier – from police brutality, to investigations of toxic dump sites, to reportage of civilian casualties in Afghanistan, to exposés of hospitals that were killing some of their patients.

What I Liked About It

Kristina Borjesson, who compiled and edited the book, must have encouraged her fellow contributors to eschew any inclinations they might have had about sounding balanced. The stories read the way you might imagine they’d be told by salty old reporters talking shop to one another at a local watering hole. I liked that approach. It made for lots of very direct and often amusing characterizations of prominent individuals. (Such as when one described Tom Brokaw as “a professional hair-do.”)

The through theme is a concern for the erosion of integrity in the media – most aggressively in local television, but well embedded in network TV, cable TV, and even mainstream newspapers. In 2002, this was not common knowledge. The public’s trust in the news media was, in percentage terms, high (in the 60s and even the 70s, depending on which poll I looked at). Today, it is at an all-time low, hovering in the low 30s. Reading Into the Buzzsaw gave me, at times, the chills, thinking about how close we came to the collusion of Big Business and Big Media during the last four years of the Biden administration. And wondering whether it could happen again in the next four years.

What Concerned Me a Bit

What bothered me about the stories in the book arose from the same casual approach that pleased me. There were a number of facts stated that seemed questionable and an equal number of complaints made about being treated poorly that didn’t seem reasonable. But of course, if you get a seat at a table where conversations like these are taking place, you have to expect a certain amount of exaggeration to enrich the drama.

Critical Reception

Into the Buzzsaw won the National Press Club’s Arthur Rowse Award for Media Criticism and the Independent Publishers Award. I don’t think the book got a lot of publicity. I found almost nothing about it on the internet, and only two comments that I would characterize as “criticism.”

* From Publisher’s Weekly: “If members of the general public read this book, or even portions of it, they will be appalled. To the uninitiated reader, the accounts of what goes on behind the scenes at major news organizations are shocking. Executives regularly squelch legitimate stories that will lower their ratings, upset their advertisers or miff their investors. Unfortunately, this dirt is unlikely to reach unknowing news audiences, as this volume’s likely readership is already familiar with the current state of journalism.”

* “One recurring theme in Into the Buzzsaw is the claim that the leading lights of television and print journalism are sheep when it comes to relying on government sources, even though these sources are often interested parties in the stories. If a top reporter’s source in the White House, CIA, Pentagon, etc., denies a story, that seems to satisfy most of our major media outlets.”

Interesting

The impetus for the book arose when Kristina Borjesson found herself in the middle of an investigation of the 1996 TWA flight 800 crash off the coast of Long Island.

Assigned to cover the story for CBS, she stumbled upon a series of red flags that should have tipped off any curious reporter. The fact that the military wouldn’t allow the NYPD dive team access to the area for almost three days after the crash – and when they did, only allowed them to search certain areas for remains. Or the so-called “30-knot clip” – a blip on recorded images of radar screens that shows a large surface vessel moving at a high rate of speed away from the area right after the plane erupted in a ball of flames. In addition, numerous credible witnesses from the Long Island shore who went un-interviewed (or were dismissed when interviewed) claim to have seen something rise from the surface of the ocean and explode just before they saw the plane come apart and plunge into the water. Finally, the bullying tactics, ever-changing stories, and outright lies offered by the government’s lead investigator (who landed a plum job at CBS right after the investigation) all led her to chase the story of a government cover-up with regard to the possibility that the US Navy accidentally shot down flight 800 during a training exercise.

The final straw came one evening when Borjesson and fellow investigator Kelly O’Meara left some crucial evidence in the trunk of Borjesson’s car overnight in front of the building in which they were staying. What happened next is the stuff of pulp spy-thriller fare: “The next morning, we went to the car, and O’Meara opened the trunk. Everything was there, except for the TWA 800 documents and O’Meara’s computer. The trunk lock itself looked untouched and worked perfectly. Yes, ladies and gentlemen, these things do happen in the United States of America. I would never have believed it if I hadn’t experienced it myself.”

About the Editor

Born in Washington, DC, Kristina Borjesson grew up in Port-au-Prince Haiti, the daughter of a civil engineer and a businesswoman. An Emmy and Murrow Award-winning investigative reporter, she published her first book, Into the Buzzsaw, in response to being censored herself while working on a story. (See “Interesting,” above.)

My Rating

* Verticality: 4.0 – The subject was covered satisfactorily.

* Horizontality: 4.9 – The subject is very important.

* Literary Richness: 4.0 – The writing was efficient.

* Overall Score: 4.3 out of 5.0 – Worth reading.