The Deportation of Khalil Abrego Garcia: The Facts

The deportation of Khalil Abrego Garcia has surfaced as a major news item, with some politicians and media pundits calling it a “Constitutional crisis.” The Left claims the Trump administration denied him his lawful right to “due process.” Conservatives disagree.

Here is a brief timeline of the events:

Garcia entered the US illegally around 2011.

In 2019, an immigration judge found him to be a member of MS-13 – a criminal gang now designated a terrorist organization. That determination made him legally deportable. Garcia appealed, and the Board of Immigration Appeals upheld the ruling. These two proceedings represent two rounds of due process over the gang affiliation allegation.

Separately, a different immigration judge issued a “withholding of removal” order, finding that while Garcia could be deported, he could not be returned to El Salvador because he had what that judge deemed a “credible fear” of harm from a rival gang. To be clear, that ruling did not prohibit the US from deporting him. It prohibited him from being deported to El Salvador.

Last month, Garcia was among hundreds deported to El Salvador and placed in a high-security prison. When his family presented evidence of the 2019 withholding order, a spokesperson for the Department of Homeland Security (DHS) called his deportation an “administrative error.”

Garcia’s lawyers sued in federal court. Judge Paula Xinis presided and sided with Garcia. She ordered the DHS to “facilitate” and “effectuate” his return to the US.

The administration then appealed to the Supreme Court, arguing that the effectuation requirement exceeded judicial authority. On April 10, 2025, the Supreme Court came to a 9–0 decision. It had two parts. It upheld the “facilitate” portion of the district court’s order. As for the “effectuate” requirement, the court remanded the case to Judge Xinis to clarify what “effectuate” entails, with instructions to respect executive branch authority in foreign affairs.

This distinction matters. “Facilitate” might mean providing transportation if El Salvador chooses to release Garcia. But “effectuate” could imply pressuring or coercing a foreign sovereign – something outside of judicial authority.

Thus far, the administration has not defied the Supreme Court order. It is legally obligated to facilitate Garcia’s return if El Salvador releases him – but it cannot compel El Salvador to act.

Bottom line: There is currently no legal obligation for the administration to force Garcia’s repatriation.

Just the Facts. Briefly…

* Garcia received multiple rounds of due process.

* He was legally found to be a member of MS-13.

* A judge separately ruled that he should not be deported to El Salvador.

* His deportation violated that country-specific withholding order.

* The Supreme Court’s ruling limited judicial authority over executive foreign policy but affirmed the need to facilitate correction of the deportation error.

* The administration’s conduct may be slow or evasive – but it has not (yet) defied the courts.

USAID: Efficient? Mismanaged? Corrupt? The Facts

Of the government agencies DOGE is investigating for waste, mismanagement, and corruption, the attempt to cut in half the budget of the US Agency for International Development (USAID) has upset some Americans and perplexed many.

After, all, compared to all the spending the federal government does on food and drugs and war, the USAID budget, at less than $100 billion a year, is almost de minimis. And isn’t that the government agency that helps poor people all over the world? Isn’t that an intelligent and peaceful form of diplomacy?

Indeed, I can’t remember anyone in the public eye criticizing USAID. Until the Trump administration appointed Jeremy Lewin as the acting head of foreign assistance at the State Department, few, if anyone, thought that DOGE would recommend that the administration should shut it down or, at the very least, drastically cut its budget.

The argument here boils down to a few simple questions:

1. Is USAID running an efficient operation? Are they overstaffed? Are they wasting taxpayer dollars due to typical government bureaucracy?

2. How much of its budget (paid for by tax dollars) ends up in the hands of the truly needy, rather than in the pockets of the intermediaries who facilitate USAID’s spending?

3. What percentage of its projects achieve the humanitarian goals that USAID claims to have in its charter?

Recently, legal challenges have emerged, with federal judges partially blocking attempts to dismantle USAID, emphasizing the potential risks to US national security interests and the well-being of vulnerable populations.

USAID by the Numbers

In fiscal year 2024, USAID spent approximately $21.7 billion – roughly 0.3% of the US federal budget. For FY2025, the agency’s budget has increased to just under $27 billion. USAID remains one of the largest government-funded foreign assistance programs in the world.

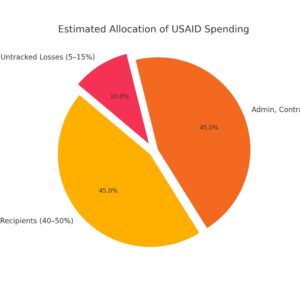

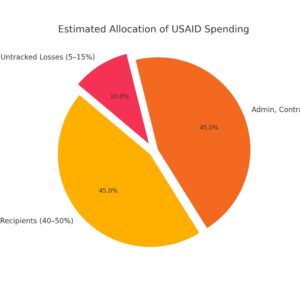

Although many assume that most of this money goes directly to people in need, the actual flow of funds is more complex. Only about 12%–15% of USAID’s funding is allocated directly to local organizations in recipient countries. The remaining 85% is disbursed through US-based intermediaries, including major international contractors and NGOs headquartered in Washington, DC.

Efficiency and Impact

Recent estimates suggest that only 40%–50% of USAID’s total funding translates into direct benefits for intended recipients. The remainder is absorbed by administrative overhead, contractor fees, program management costs, and losses due to inefficiencies or fraud. This level of leakage is considered unusually high, especially when compared to top-rated private charities.

Private organizations such as Direct Relief or the Against Malaria Foundation regularly spend 85%–90% or more of their budgets on direct program services. Charity Navigator notes that for most highly efficient nonprofits, a minimum of 75% of funds typically reaches the intended cause. USAID falls short of this benchmark.

Part of this discrepancy can be explained by the regulatory and logistical burdens faced by government agencies. Procurement laws, auditing protocols, and risk-averse contracting rules create structural inefficiencies. Even so, multiple audits and watchdog reports have identified longstanding problems with waste, opaque performance metrics, and instances of outright fraud or corruption.

Spending Breakdown

The chart below summarizes the estimated distribution of USAID’s annual expenditures:

Sources

* USAID FY2024–25 Budget Data – USAspending.gov

* 12%–15% Direct Local Partner Funding – WRAL News Fact Check

* Efficiency Estimates – The Simulacrum (Medium)

* Private Charity Efficiency Benchmarks – Charity Navigator

* Funding Concentration – UnlockAid.org

The Bottom Line

* USAID’s FY2025 budget is approximately $27 billion.

* Only 12%–15% of funds go directly to local organizations in recipient countries.

* Roughly 85% of funds are distributed through large, often US-based, intermediaries.

* Only about 40%–50% of total USAID funds result in direct aid to intended recipients.

* By contrast, many top-rated private charities deliver 75%–90% of donations directly to beneficiaries.

* High administrative costs and regulatory overheads account for much of USAID’s inefficiency.

* Watchdog reports have identified recurring issues with waste, vague reporting, and corruption.

* While some inefficiencies stem from legal and logistical constraints, critics argue that better results are both expected and achievable.

Budgets: California vs. Florida, Round #20: Just the Facts

This is one of many Florida vs. California pieces I’ve written over the years. I jump at any chance I get to compare the two because I live in Florida and am very happy to live here because we do everything right and California does everything wrong. In today’s drubbing of Cali, I’m riffing on the recent news that Gov. Gavin Newsom is now seeking billions in federal assistance because his government has once again failed to balance its budget.

How is that possible? California has a much larger population and a massive Gross Domestic Product – larger than 80% of the countries in the world.

On top of that, the state is a huge tax collector, hitting up its citizens for every sort of tax imaginable. And at high rates. And that’s to say nothing of the Big Tax – the state income tax, which tops out at a breathtaking 13.3%. Between federal taxes and state taxes, a Californian making, say, half a mil a year, would end up paying more than half his income in taxes!

And yet, somehow, California politicians – from both sides of the aisle – can’t balance their budgets. And while they are overspending taxpayer dollars, just about everything they are spending money on gets worse.

For example:

Have you heard of Medi-Cal? It’s the state’s Medicaid program, which was “improved” by Newsom and team to make undocumented immigrants eligible for its services. Medi-Cal accounted for $6.2 billion of the state’s budgetary shortfall.

Worse, California has spent tens of billions trying to address the crisis over the last two decades, yet the problem has only worsened.

Florida, despite far fewer resources, has made more targeted investments and kept its urban centers far more livable.

I won’t mention the coastal fire that caused billions of dollars in property damage, which might have been avoided if the state hadn’t allowed some reservoirs that feed the fire hydrants to go dry.

Anyway, here are the facts:

The Facts, Briefly

* California, which imposes a higher rate of income and other consumer-related taxes, ended 2024 with a $46.8 billion shortfall.

* Florida operates with no state income tax and ended the year 2024 with a $17 billion surplus.

* California has a 68-cent per gallon gas tax and a $2.87 cigarette excise tax. California’s tax system ranks 48th overall on the 2025 State Tax Competitiveness Index.

* Florida has a 37 cent per gallon gas tax, a $0.68 cigarette excise tax, and ranked 4th best in the nation on the same index.

* Florida has maintained a balanced budget every year since Ron DeSantis took office in 2019 without raising taxes.

* California has had a net budgetary shortfall of $140 billion since Gavin Newsom took office (also in 2019) while raising taxes several times – including the State Disability Insurance (SDI) payroll tax, gas taxes, and the state income tax (which went from 13.3% to 14.4% in 2024).

* California’s cost of living is 23.5% higher than Florida’s.

* Florida’s per capita debt is among the lowest in the country.

* Florida’s credit rating remains AAA, indicating strong financial management and low borrowing costs.

* Government agencies in Florida are consistently audited and held to performance standards, reducing corruption and waste.

Final question: Looking at these numbers you might be thinking, “Why would anyone live in California?” I ask myself the same question every time I look at the stats. But every time I go there – which is at least four times a year – I get it. California has the best climate and one of the most beautiful landscapes in the country. Okay. But still…

On to the news…