COVID Part One: The Virus

Chapter 1. Even I Could Tell: The Early Numbers Made No Sense

When the pandemic hit, I wasn’t trying to be a contrarian. I just started paying attention.

Very early on – March 2020 – we were hearing reports from the mainstream media that COVID’s fatality rate was insanely high. Some numbers were as high as 15%. Then 10%. Then 4%.

But even at 4%, it didn’t make sense. We already knew that many people had mild symptoms or none at all. Testing was limited, and the denominator – the total number of infected people – was being ignored. Just using basic logic and arithmetic, I estimated the real number was probably under 1%, and likely closer to 0.5%.

And as it turned out, I was right.

The Early Arithmetic Error: COVID’s Contagiousness vs. Apparent Lethality

In the earliest weeks of 2020, the messaging around COVID-19 was a whiplash mix of alarming figures and scientific uncertainty. I remember reading claims – some of them published in respected journals like The Lancet – that suggested a case fatality rate (CFR) of 10% or more. One study from late February 2020, based on hospitalized patients in Wuhan, reported a death rate of 15% to 28%, depending on how you parsed the data. At the time, I understood that these figures were derived from a limited, severely ill sample – but still, they were appearing in publications that I (and most people) considered reputable. And they were being picked up and echoed by the media with little clarification.

It added to the panic.

Meanwhile, a New England Journal of Medicine editorial around the same time referenced a CFR around 2%. But again, these numbers were being reported at the same time we were hearing that the virus was highly contagious – possibly more so than the seasonal flu.

I remember thinking: These two things can’t both be true. If COVID was as contagious as early modeling suggested, and if the symptomology included a large proportion of mild or asymptomatic cases (which we also knew from early Chinese reports), then millions of people were likely getting infected without being tested – or even knowing it. This meant the denominator in the lethality equation – the number of total infections – was massively understated.

At the time, it was extremely difficult to get tested. Appointments were limited, criteria were strict, and test capacity was low. Combine that with the fact that many people who experienced mild symptoms didn’t even try to get tested, and you had a textbook case of denominator bias.

The math didn’t add up. If you take the number of reported deaths and divide by only the small, sick, and tested portion of the infected population, you get a high fatality rate. But I believed, even then, that actual infections were likely undercounted by a factor of 10 or more.

So I began saying – on phone calls, in emails, in my own head – that COVID’s true infection fatality rate (IFR), the number of deaths divided by the total number of people infected, including the untested and asymptomatic, might end up being less than 0.5%.

And as it turned out, that projection wasn’t far off.

By mid-2021, large-scale seroprevalence studies began to confirm what many outside the panic chorus had suspected. According to the CDC’s estimates, the US infection fatality rate across all age groups was closer to 0.3% to 0.4%, and far lower for healthy individuals under 60.

A Nature review published in late 2022 surveyed IFR estimates from multiple countries and found that most fell between 0.1% and 0.7%, depending on age demographics and healthcare system strength. In many regions, the IFR was closer to that of a bad flu season than a civilization-threatening plague.

It was never about denying that COVID was serious – especially for the elderly and medically vulnerable – but the arithmetic from the start was flawed. We were warned that a wildfire was coming but told to expect a 10% casualty rate. Anyone willing to look past the headlines and apply basic logic could see that the real story was far more complex – and far less catastrophic – than the media made it out to be.

I reached out to a few independent doctors I knew – people I had worked with and respected for years. They were skeptical, too.

I kept digging. I stayed plugged in to alternative media, read summaries of every study I could find, including reports issued by the WHO and the CDC.

I was excited about what I was learning. But many of my friends and family members – well-educated, media-savvy people – did not take my discoveries well.

To them, anyone who questioned the “official” numbers was either a Trump supporter or a conspiracy theorist. I was neither. But nuance didn’t seem to matter.

If the epidemic came up in conversation, it would get heated. And as the months wore on and more evident impossibilities were being “reported” in the mainstream media, these people who liked to think of themselves as pro-science got worse. They abandoned fact-based discourse entirely and reverted to quoting sound bites.

Conversations were no longer strained. They were explosive. Family gatherings could be torn apart by the very mention of the word COVID.

Eventually, I gave up speaking to family and friends about it, which meant that I had to quietly endure hearing them parrot the most absurd government-issued statements.

I love these people. But I knew that if I shared what I was reading, what I was thinking, even what I was noticing with my own eyes, I’d be dismissed as “anti-science,” and the conversation would be over.

Instead, I wrote about it. I published an essay on my blog and got some good response from it from my readers. So I published another. Friends and family members who read them weren’t persuaded. They despaired of my crackpot mission. In person, we limited our conversations to other matters.

Over the next two and a half years, I posted very little about the pandemic on my blog, but I was researching it almost non-stop. Gradually, as I expected it would, the facts were seeping out and making their way into the mainstream discussion. Not in the form of “We were wrong. The conspiracy theorists were right.” More like, “Well, I never disputed that. That was never a question.” (Yeah, right.)

After all the work I had put into it, I wanted to share the research, the facts, the logic – and, yes, the skepticism – that had guided me through those years.

But I kept quiet in public. I wasn’t looking to argue. I didn’t want the eye rolls, the silence, the condescension. So I kept most of what I was discovering to myself or shared it quietly with like-minded people. Working on this monograph became the deeper expression of everything I couldn’t say out loud.

And here’s the thing: I always knew that, eventually, the truth would come out. But I also knew that when that day came, no one would remember where they stood back in 2020. Or what they said. Or what they accused me of.

That, too, is why I’m writing this. To remember. To document. To say to all those who bought all the lies so easily – and with such obvious disdain for those who questioned them – “I told you so.” Not because I’m angry (I’m no longer angry), but because the truth matters.

Chapter 2. The Initial Panic

Uncertainty and worry were rising. News clips from China showed people collapsing in the streets, hospital workers in hazmat suits, entire cities welded shut from the outside. Then Italy got hit hard. Northern hospitals were overwhelmed. ICUs filled up. Patients were being treated in hallways. The same footage played again and again on the news.

The implication was clear: This was coming for all of us.

Governments scrambled. So did public health bureaucracies. But the media? They did what they do best. They turned up the volume.

I remember watching the numbers climb on the Johns Hopkins dashboard. Red dots spreading across continents like a digital plague. Each day brought a new surge – cases, deaths, projections – presented as settled facts. But most of it wasn’t hard science. It was guesswork. Sometimes educated guesswork, but still far from definitive.

Early modeling from Imperial College London became the foundation for global policy. Their March 2020 report warned of over 500,000 deaths in the UK and 2.2 million in the US without strict intervention. Governments used that report to justify lockdowns, school closures, and sweeping restrictions. But the assumptions were based on high fatality estimates and models that quickly turned out to be flawed.

And yet, fear took hold. Once it did, it was hard to shake.

Even then, if you were paying attention, there were signs the virus wasn’t as deadly as advertised.

Cruise ships gave us early test cases. The Diamond Princess, for example, had more than 3,700 passengers and crew, many of them elderly. After a full outbreak, 712 people tested positive and 14 died – a fatality rate of just under 2%. And that was before any standardized treatment. Still, instead of updating the narrative, officials and the media pushed the same dire warnings.

That’s when I started to question what we were being told.

It wasn’t just the science that was unsettled. It was the messaging. The tone. The posture. The insistence. Institutions seemed to be aligning around a single story. Whether by coordination or inertia, it didn’t matter. The effect was the same: Fear took center stage.

And that fear became the filter through which everything else would be seen – data, policies, even other people. Once fear became the driver, reason moved to the back seat.

Panic Sells

February 28, 2020 – The New York Times: “Coronavirus Could Kill Millions If Spread in US”

March 16, 2020 – Imperial College London: Model predicts 2.2 million US deaths without intervention.

April 7, 2020 – Dr. Deborah Birx: “If someone dies with COVID-19, we are counting that as a COVID-19 death.”

March/April 2020: Toilet paper vanishes from shelves – not from supply breakdowns, but from fear-fueled hoarding.

Fear wasn’t incidental. It was the strategy. And it worked.

Chapter 3: Testing and the Case Count Game

From the beginning, I never doubted that COVID-19 was highly contagious. It spread quickly and efficiently through households, workplaces, and communities. But to understand the real-world implications of that contagiousness – and how it shaped our response – we have to put it in context.

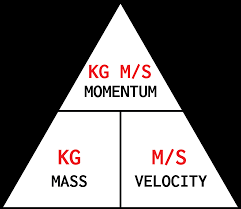

COVID-19’s basic reproduction number, or R0 (pronounced “R naught”), measures how many people, on average, an infected person will spread the virus to. For the original SARS-CoV-2 strain, early estimates placed the R0 between 2 and 3. That meant each infected person would, on average, transmit the virus to two or three others. Seasonal influenza, by contrast, has an R0 between 1.1 and 1.8. So, yes – COVID-19 was significantly more contagious than the flu, roughly twice as transmissible in its original form.

But that doesn’t make it uniquely contagious. For comparison, measles has an R0 between 12 and 18. Chickenpox ranges from 10 to 12. Norovirus and rotavirus (common stomach bugs) can also spread with extreme speed in enclosed spaces. So while COVID-19 clearly warranted caution, it wasn’t outside the boundaries of what we’d seen before.

And yet it was presented as if it were.

Testing, Visibility, and the Numbers Game

One of the most significant differences between COVID-19 and influenza wasn’t the virus itself, but the scale of testing. Prior to 2020, influenza testing in the United States was limited. Most people with flu-like symptoms weren’t tested unless they were at high risk or required hospitalization. According to the CDC, during the entire 2020–2021 flu season, US clinical laboratories tested around 818,939 specimens for influenza.

By contrast, in the first three months of the COVID-19 pandemic alone, more than 1 million COVID-19 tests had already been administered in the US. And that number exploded over time. According to the COVID Tracking Project, by mid-2021 the United States was performing an average of 1.5 to 2 million tests per day. In total, more than 900 million tests were performed in the US over the course of the pandemic.

That disparity – several orders of magnitude – is key to understanding why COVID case numbers appeared so shockingly high. If you test a thousand people and find 10 positives, you get one kind of data. If you test a hundred million people, even with the same infection rate, you’ll get a number that looks overwhelming. The volume changes the scale.

The public was told that this mass testing was a crucial part of controlling the pandemic. And on one level, that made sense. More testing meant better visibility into where outbreaks were happening. It helped allocate resources, protect vulnerable populations, and inform decision-making. But it also created a major distortion in public perception.

When you test tens of millions more people than you ever did for flu – and include people with no symptoms or known exposures – you will detect far more infections. This doesn’t necessarily mean the virus is more prevalent or more dangerous. It just means you’re looking harder.

If we had conducted flu testing on the same scale as COVID-19, especially with the same definition of a “case,” it’s likely the seasonal flu would have appeared far more widespread and serious than we’ve ever thought.

The Case Count Conundrum

That brings us to the term “case.”

In pre-COVID medicine, a “case” meant someone who was sick – someone with symptoms. If a person had strep throat or pneumonia or the flu, they were counted as a case when they sought care and tested positive. The concept of a “case” was synonymous with illness.

During COVID, that definition changed. A “case” became any positive PCR test, regardless of symptoms, severity, or context. You could be asymptomatic. You could be post-infectious. You could be recovering. You could test positive weeks after your immune system had already done its job. None of that mattered. If your swab lit up in the lab, you were a case.

This was a fundamental shift in the way disease was tracked and understood – and the consequences were enormous. Daily “case counts” became the lead story on every news broadcast. Public dashboards tracked these numbers like stock tickers. Politicians used them to make policy decisions. And the public absorbed them as a real-time barometer of danger.

But those numbers didn’t distinguish between a child who briefly carried the virus without symptoms and an elderly patient on a ventilator. They were all counted the same.

Sensitivity and the PCR Problem

Then there’s the issue of testing sensitivity. PCR (polymerase chain reaction) tests are designed to detect even the smallest fragments of viral RNA. To do that, they run amplification cycles – each cycle doubling the genetic material in the sample. The higher the number of cycles needed to detect a signal, the lower the amount of virus in the sample.

Many COVID-19 PCR tests were run at 37 to 40 cycles. At those levels, the tests can detect minute traces of non-viable viral particles – debris from past infections that pose no threat of transmission. Dr. Anthony Fauci, in a July 2020 interview, acknowledged that a cycle threshold above 35 is likely to be detecting “dead nucleotides” – viral remnants that do not indicate live, infectious virus.

Despite this, positive tests at those high cycle thresholds were still being counted as new cases. They inflated the numbers. And since the public was never told what the cycle threshold was – or what it meant – they assumed each “case” was a sick, contagious person.

The CDC and FDA later issued guidance to reduce the amplification cycles for diagnostic relevance. But that guidance came long after the narrative had been set. And even then, many labs and hospitals continued using the higher cycle thresholds.

The Psychology of Numbers

One of the things I noticed early in the pandemic was how the daily drumbeat of “cases” created a psychological environment of crisis. It wasn’t just about raw numbers. It was about momentum. A sense that things were spiraling.

You’d hear: “Yesterday, we had 50,000 new cases. Today, it’s 70,000. Tomorrow it could be 100,000.” That kind of framing creates a mental model of exponential threat. And it drives behavior – emotional, political, economic.

But these numbers were being generated not by hospitalizations or deaths, but by the sheer scale of testing. You could double the number of tests and double the number of positive results, even if the actual risk of severe illness hadn’t changed at all.

In hindsight, it’s clear that some public health officials encouraged this momentum deliberately. Not necessarily out of malice, but out of strategy. There was a belief, sometimes stated outright, that fear was necessary to drive compliance. If the public wasn’t scared, they wouldn’t wear masks, or stay home, or agree to shut schools.

Government Messaging and the Role of Fauci

Dr. Fauci became the face of the government’s COVID response. He was everywhere – TV interviews, press briefings, podcasts. And to his credit, he often tried to be measured. But the messaging from the institutions he led wasn’t always so balanced.

The NIH, CDC, and FDA all leaned heavily on case counts in their public communications. They emphasized rising numbers without explaining the role of testing scale or test sensitivity. There was little distinction made between being infected and being sick. That subtlety got lost in the charts.

Why didn’t public health agencies emphasize hospitalization and mortality rates more clearly? Why didn’t they communicate that many “cases” were mild or asymptomatic?

One answer is bureaucratic inertia. Once a metric becomes the focus, it tends to stay that way. But another possibility is strategic: Fear worked. It increased compliance. It made people take the virus seriously. And from a public health perspective, that was the priority.

But that choice came at a cost: Clarity. Trust. Long-term credibility.

When people eventually learned that many “cases” were not serious – or not even symptomatic – they felt misled. That erosion of trust continues to this day.

A Manufactured Sense of Scale

Looking back, it’s clear that the enormous COVID case numbers were partly a product of the virus’s contagiousness – but also a function of how we chose to count. We tested more people, more often, with more sensitive tools. We redefined what counted as a “case.” We erased distinctions that used to matter: symptomatic vs. asymptomatic, contagious vs. post-infectious, serious vs. mild.

These choices made COVID look – and feel – unprecedented. But much of what was new wasn’t the virus. It was the system we used to track it.

That system wasn’t neutral. It created a narrative. It created a climate. And in doing so, it changed everything – from how we responded to how we remember.

Chapter 4. Lockdowns

“Two weeks to flatten the curve.”

That phrase became the rallying cry of early 2020. We were told that by staying home for a couple of weeks, we could slow the spread, preserve hospital capacity, and buy time for the system to prepare. It sounded reasonable. And for the most part, people complied.

But two weeks turned into months. Then into an indefinite suspension of normal life.

Schools were closed. Businesses shuttered. Playgrounds were taped off. Weddings were canceled. Funerals were restricted. Church services went online. And in some states, even walking on the beach was forbidden.

There was never a clearly defined exit plan. Instead, there were shifting metrics and vague targets. First it was hospital capacity. Then it was positivity rates. Then it was daily case counts. And each time one benchmark was reached, another was introduced. The goalposts moved, but the restrictions stayed.

In theory, lockdowns were supposed to be targeted and temporary. In practice, they became blunt instruments – broad policies imposed at the state or national level, often with little regard for local conditions or real-time risk assessments. And very little public discussion was allowed about the cost.

And the costs were massive.

Mental health deteriorated across all age groups. According to CDC data, symptoms of anxiety and depression tripled among US adults during the pandemic. Domestic violence incidents rose. Drug overdoses spiked. Small businesses – especially restaurants, salons, and retail shops – were devastated, while big-box stores and online giants consolidated market share. Students lost critical instructional time. Seniors were isolated and, in some cases, died alone. The social and economic fabric of everyday life frayed.

I remember reading the justifications in real time. Governors and public health officials repeatedly cited “the science” as their guiding star. But more often than not, they were selectively referencing data or models that supported continued restrictions. And when friends and family members parroted the talking points – “lockdowns save lives,” “it’s just temporary,” “we can’t be too careful” – I found myself wondering if anyone was actually looking at the numbers.

Because the numbers didn’t justify the scale of the lockdowns.

Florida, which ended its lockdown early and resisted future closures, saw health outcomes that were no worse – and often better – than places like California and New York, which imposed some of the longest and strictest restrictions in the country. Sweden, which never instituted a full lockdown, recorded COVID death rates comparable to or lower than many European countries that did. And yet, these outcomes were often ignored or downplayed.

The lockdown debate quickly became moralized. Questioning the efficacy or cost of restrictions was framed as selfish, anti-science, or even dangerous. It was no longer about what worked – it was about what was acceptable to say.

Meanwhile, some of the rules defied basic logic. Liquor stores stayed open while schools remained closed. Casinos reopened before churches. Big-box retailers packed with shoppers were deemed safer than playgrounds or park benches. Protests for approved causes were allowed. Outdoor gatherings with family were not.

The media played its part. Case counts were presented without context. Death tolls scrolled across the bottom of screens. There was little appetite for nuance. Anyone who raised questions was labeled a conspiracy theorist or an irresponsible contrarian. The psychological effect was cumulative: Fear became habitual, and compliance became normalized.

Policymakers showed little interest in cost-benefit analysis. Economic losses were assumed to be recoverable. Psychological distress was labeled an unfortunate side effect. School closures were justified indefinitely despite mounting evidence of harm to students. Even as studies began to show that the most aggressive lockdowns didn’t correlate with significantly better health outcomes, many leaders chose to double down rather than pivot.

And then came the hypocrisy.

Officials who imposed the strictest rules were often the first to break them. California’s governor attended a private indoor dinner. The mayor of Chicago got a haircut after banning them for everyone else. British officials, including the prime minister, attended parties during national lockdowns. These incidents weren’t just bad optics. They undermined the legitimacy of the restrictions themselves. If those in charge didn’t take the rules seriously, why should anyone else?

Still, millions complied. Not everyone, of course, but enough to give the appearance of consensus. And once the norms were established – masking, distancing, stay-at-home orders – it became socially risky to question them. It didn’t take a police state. It just took social pressure and a culture of conformity.

In retrospect, lockdowns began to look less like emergency public health measures and more like an experiment in behavioral compliance. The tradeoff wasn’t just economic. It was civic. People gave up their autonomy in exchange for the promise of protection.

But for some of us, the longer it went on, the more it felt like a test – of independence, of critical thinking, of how far people would go to avoid being seen as selfish.

And the policies left scars. Many students are still catching up from months – or years – of interrupted education. Mental health systems are overwhelmed. Small businesses haven’t come back. Entire industries have changed. And low-income families, elderly residents, and people with disabilities paid the steepest price.

Even more troubling is what remains. The legal frameworks that allowed emergency powers to bypass normal checks and balances are still on the books. The belief that government can – and should – suspend basic freedoms during a crisis has become embedded in the public imagination.

Some politicians and pundits have since admitted that the most aggressive lockdown policies weren’t really about stopping the virus. They were about “showing leadership,” “sending a message,” and “signaling seriousness.” The optics took priority over the evidence. It was policy as performance.

Parents were left in impossible situations. Work or care for your kids? Trust the officials or go your own way? Voice your concerns or stay silent? People were caught between public messaging and private intuition – and punished for not picking the right side.

What’s most alarming, in hindsight, was the silence. Leaders rarely admitted mistakes. They rarely updated guidance in light of new evidence. Instead, the narrative was maintained, and dissent was treated as deviant.

In a supposedly open society, the space for genuine debate disappeared. Experts who questioned the wisdom of lockdowns – many of them credentialed epidemiologists – were smeared, deplatformed, or ignored. The public heard from one kind of expert. And that’s the story that stuck.

Meanwhile, the long-term damage mounted. And it’s still mounting. Learning loss, mental health deterioration, business closures, civic distrust. The ripple effects continue – and they will for years.

Lockdowns weren’t just a response to a virus. They were a stress test for democratic norms. And it’s not clear how well we passed.

Chapter 5. Early Treatments and the War on Cheap Drugs

From the beginning, it was clear that finding effective treatments for COVID-19 would be critical. The virus was here, it was spreading, and people were getting sick. Most of us understood that we needed options – fast. Anything that could reduce the severity of illness or keep people out of the hospital wasn’t just nice to have – it was urgent.

But instead of pursuing every promising lead, the medical establishment – backed by public health agencies and echoed by the media – quickly narrowed the field. The message was clear: Wait for the vaccine.

Now, I understand the appeal of a vaccine. It offered the promise of a long-term solution. But the idea that we should put all our eggs in that one basket – and ignore or even suppress every other possibility in the meantime – never made sense to me.

Safe, affordable medications like hydroxychloroquine (HCQ) and ivermectin had long histories of use. HCQ was widely prescribed for malaria and autoimmune diseases. Ivermectin had been used globally to treat parasitic infections. Both drugs were familiar to doctors and known to be safe when used properly. So when some clinicians started reporting success using them for early-stage COVID – often alongside zinc, vitamin D, and other supportive therapies – I thought, “Why not give it a closer look?”

Instead, those doctors were met with suspicion and, in many cases, outright hostility. Some were mocked. Others were censored or threatened with losing their licenses. Platforms like YouTube and Twitter banned discussions about these treatments. It wasn’t just caution. It felt like a coordinated effort to shut down the conversation.

I watched it unfold in disbelief. These weren’t quacks. Many of the doctors advocating for early treatment were well-respected, with decades of experience. They weren’t saying they had a magic bullet. They were saying, “This seems to be helping our patients – can we talk about it?” And for that, they were labeled dangerous.

Dr. Pierre Kory and the FLCCC (Front Line COVID-19 Critical Care Alliance) come to mind. I remember watching his testimony before the US Senate in December 2020. He laid out the case for ivermectin, citing clinical results and published data. The video went viral – and then it vanished. YouTube removed it. No rebuttal. No counterargument. Just deleted.

Later, when Joe Rogan said he used ivermectin after testing positive, the media pounced. “Horse dewormer,” they said. Never mind that ivermectin is an FDA-approved drug for humans and had won the Nobel Prize. Never mind that Rogan’s approach seemed to work. The important thing, apparently, was making him look ridiculous.

In my opinion, a big part of this backlash had nothing to do with science. It was political. Trump had mentioned HCQ early in the pandemic. He wasn’t nuanced about it – but once he said it, the issue was poisoned. Suddenly, supporting or even investigating these treatments meant you were “on Trump’s side.” That’s all it took.

What followed felt like a nationwide effort to discredit – not just the drugs, but anyone who talked about them. Social media platforms cracked down. Major outlets ran headlines mocking “Trump’s miracle cure.” Friends of mine who relied on mainstream media still believe that HCQ and ivermectin are essentially snake oil. They think people were drinking bleach. And it’s not their fault. That’s what they were told.

The tragedy is, the science wasn’t on the side of the smear campaigns. Both drugs had safety profiles established over decades. There were studies – some flawed, yes, but others that showed promise. More importantly, there were doctors on the ground saying they were seeing real results.

But instead of debating the evidence, the conversation turned into a culture war. You were either “pro-science” or “pro-conspiracy.” There was no middle ground.

One reason for this, I’ve come to believe, is the way Emergency Use Authorization (EUA) laws work. In order to issue an EUA for a vaccine, there can’t be any “adequate, approved, and available” alternative treatments. So acknowledging that HCQ or ivermectin might work – even a little – could have complicated the regulatory path for the vaccines. And that was a risk no one seemed willing to take.

There was also the optics. Leaders needed to project strength and competence. They needed a clear solution to point toward. Vaccines were simple. Scalable. Easy to market. A patchwork of early treatment protocols? Not so much.

And then, of course, there’s the simple momentum of narrative. Once the media framed these treatments as fringe, it became difficult to walk that back. Doing so would require admitting they’d been wrong – or worse, that they’d misled the public. That kind of institutional humility is rare.

To be clear, I’m not saying ivermectin or HCQ were miracle cures. Not every study was positive. Some trials were small or poorly designed. But some weren’t. Some showed real benefit. And at the very least, these treatments deserved a fair hearing.

Instead, we got silence, smears, and suppression. Many doctors fell in line. Others stayed quiet, afraid of losing their jobs or licenses. A few spoke out – and paid the price.

Looking back, the war on early treatment wasn’t about keeping people safe. It was about maintaining control over the narrative. If people could manage COVID at home, the fear would drop. The urgency for mass vaccination might slow. The sense of emergency might fade. That couldn’t happen.

So the system turned its fire not on the virus, but on the people trying to treat it differently.

And the cost? We’ll never know for sure. But it’s hard not to believe that lives were lost – not just to COVID, but to the suppression of ideas that could have helped.

Chapter 6. Masks, Distancing, and Behavioral Control

In early 2020, public health officials gave conflicting advice about masks. Dr. Anthony Fauci and then US Surgeon General Jerome Adams both advised against the public wearing them. The World Health Organization echoed that message. At the time, the rationale given was that masks should be reserved for health workers and that they offered limited protection to the general public.

Then the message changed. Virtually overnight, masks went from being discouraged to mandatory. Fauci explained the shift by saying the original advice was intended to preserve supplies for hospitals. Whether that’s true or not, the public takeaway was simple: We were being asked to believe one thing, then the opposite, with very little acknowledgment that the original message had been wrong.

And here’s the part that bothered me most: Fauci later admitted that his initial guidance was strategic. He didn’t say that the science changed. He said that the message was tailored to preserve masks for frontline workers. In other words, it was a lie. A purposeful one. And once someone admits they lied to you for strategic reasons, why would you believe the next thing they say? This became, in my view, a pattern throughout the pandemic. Many of the government’s pronouncements – whether about masks, distancing, school closures, or early treatment – turned out not just to be wrong, but deliberately misleading. Officials admitted they said things not because they were true, but because they wanted to influence public behavior.

They may have believed they were lying for the greater good. Or maybe not. Either way, they were lying. And they admitted it.

Soon, cloth masks became required in nearly every public setting, even though the data supporting their effectiveness was limited. And as time went on, the narrative hardened. Masks weren’t just helpful – they were essential. If you doubted their usefulness, you were accused of being anti-science.

But there were reasons to doubt. Even the CDC and WHO eventually admitted that cloth masks, especially the kind most people were using – homemade, loose-fitting, poorly maintained – offered minimal protection. A 2020 CDC journal article reviewing existing studies found that cloth masks were far less effective than medical-grade masks, and that many performed no better than wearing nothing at all.

A 2023 Cochrane Review – widely regarded as one of the gold standards of evidence synthesis in medicine – looked at randomized controlled trials (RCTs) on masking. The conclusion? There was little to no evidence that wearing masks, especially in community settings, made a meaningful difference in the spread of respiratory viruses like COVID-19.

In other words, the gold-standard scientific data did not support the sweeping mask mandates that were imposed across the country.

That didn’t stop the mandates. And it didn’t stop the social pressure. Masks quickly took on symbolic meaning. Wearing one meant you were a good person. Not wearing one meant you were reckless, selfish, or “one of those Trump people.”

And yes, the division fell along political lines. If you were skeptical of masks, you were viewed as anti-Biden, pro-Trump, or worse. In Biden’s own words during the 2020 campaign: “Be a patriot – wear a mask.” The implication was clear: Patriots mask up. Rebels don’t.

But COVID isn’t a political virus. It doesn’t care who you voted for. Still, I saw the effects firsthand. Friends refused to enter rooms where someone was unmasked. Others wore masks jogging alone, outdoors. I saw parents mask their toddlers at the beach. These weren’t based on any actual science. They were fear responses – or worse, rituals of obedience.

Let’s be clear: Respiratory viruses like SARS-CoV-2 are transmitted primarily through aerosols – tiny particles that linger in the air. While N95 masks, when properly fitted and used consistently, can filter these particles to some extent, cloth masks and even surgical masks fall short. A 2021 MIT study concluded that in poorly ventilated spaces, six feet of distance and a cloth mask would not protect you from airborne transmission over time.

That six-foot rule? It turns out it wasn’t based on solid evidence either. Dr. Scott Gottlieb, former FDA Commissioner, later admitted the six-foot guideline was “a perfect example of the lack of rigor” behind many COVID-era policies. “Nobody knows where it came from,” he said. Yet schools rearranged desks, stores marked floors, and people were shamed for standing too close – all to maintain a distance that may have had little practical benefit.

Still, the mandates continued. Some airlines removed families from flights because their toddlers wouldn’t wear masks. Restaurants asked patrons to “mask between bites.” In cities like New York and Los Angeles, people were fined for not wearing masks in outdoor spaces – despite very limited evidence of outdoor transmission.

Meanwhile, many of the leaders pushing these rules broke them openly. California Governor Gavin Newsom dined indoors, maskless, at the French Laundry. Washington, DC Mayor Muriel Bowser went maskless at a wedding hours after reinstating a mandate. These incidents sent a message: The rules are for you, not for us.

That hypocrisy wasn’t lost on people. But instead of fostering skepticism of the rules, it often just made people double down on their own adherence. I saw people cling even harder to their rituals – masks on while driving alone, pulling them up between sips of coffee, avoiding eye contact with the unmasked in line.

And the social tensions were real. According to FAA reports, more than 6,000 incidents of unruly passengers were reported in 2021 alone, and roughly 72% of them were related to mask disputes. Passengers were removed from planes for not masking toddlers. Flights were delayed because of fights over face coverings. Some of these incidents turned violent. There were altercations on buses, in grocery stores, even in elevators. People threw punches, screamed at strangers, called the police over bare faces.

The Washington Post documented more than 200 reports of confrontations in retail and restaurant settings in just the first year of the pandemic – many of them involving threats, physical violence, or arrests. And for what? A mask that, in most cases, offered limited to no protection in real-world settings.

It didn’t stop at airports. Across the country, stores posted signs warning patrons to mask up or leave. Police were called on unmasked customers. Videos went viral of shouting matches in grocery stores, of employees being berated, of neighbors reporting each other to hotlines set up for “COVID violations.” It created a culture of surveillance and suspicion.

And one of the strangest and most harmful chapters was the masking of children. For years, we’ve known that children are far less vulnerable to severe illness from respiratory viruses like COVID-19. Studies published in journals like Pediatrics and JAMA confirmed again and again that children, especially those under 10, were both less likely to transmit and far less likely to suffer from the disease.

And yet, toddlers were forced to mask up in schools and daycare centers. In some places, children were expected to wear masks for seven or eight hours a day – even during recess. There was no consistent logic. States like Florida never imposed child mask mandates and saw no worse outcomes than those that did. In fact, CDC data showed that infection trends in schools did not correlate clearly with mask rules at all.

Doctors, including those at UCSF and Stanford, publicly questioned the wisdom of masking young children. “The benefits are minimal, the harms are real,” said Dr. Jay Bhattacharya. “We are teaching children to fear one another, and for no good reason.”

It reminded me of a term from psychology: learned helplessness. When people are subjected to inconsistent, confusing, or irrational rules long enough, they stop asking questions. They adapt. They internalize the fear. They comply.

By 2021, there were dozens of studies showing that school masking – especially for young children – had limited benefit. European countries like Sweden never mandated masks for kids in schools. Their health outcomes were no worse. But in states like Illinois and California, kids were forced to mask through most of 2022. Some schools punished children who removed their masks even briefly. Again, the data didn’t seem to matter.

When I pointed this out, I wasn’t trying to be defiant. I wasn’t trying to make a political statement. I just wanted honesty. I wanted leaders to acknowledge that some of the rules didn’t make sense. But instead, dissent was framed as dangerous. Questioning the efficacy of a policy meant you didn’t care about other people. That kind of framing shuts down conversation.

I’ve said it before: The real damage wasn’t just from the virus. It was from the loss of critical thinking. The social silencing. The replacement of science with slogans.

Most people don’t wear masks during flu season. And flu, as we now know, has a similar infection fatality rate (IFR) as COVID for most healthy individuals under 65. Yet we were told that masks were essential – not just recommended but mandated – for years. What changed? The politics. The media coverage. The fear. But not the virus.

COVID was serious. But the response to it was sometimes performative. And masking became the most visible expression of that performance. It became a social uniform. A political litmus test. A test of obedience.

We’re now three years past the height of the pandemic. But many people still walk around with masks. They’re not doing it because the data supports it. They’re doing it because they were conditioned to. Because once fear takes root, it’s hard to uproot.

I don’t fault individuals for being afraid. I fault the people who weaponized that fear. Who confused the public. Who punished questions instead of answering them.

Masks may have helped a little. In specific settings, with proper use, they may still help. But they were never the magic shield we were promised. And pretending otherwise did more to divide us than protect us.

It’s time we admit that.

Chapter 7. The Experts and Their Power

At the start of the pandemic, most people were looking for answers. For leadership. For someone to explain what was happening and what to do about it.

That void was quickly filled by the experts.

We were told to trust them. Not question them. Just follow the science. But it didn’t take long to realize: What we were being asked to follow wasn’t science. It was authority.

The Rise of Fauci

No one embodied this more than Dr. Anthony Fauci.

He became the face of the pandemic response. He appeared on 60 Minutes, Meet the Press, CNN, The Daily Show. He threw out the first pitch at a Nationals game. He graced the covers of InStyle and Time. For a period, you could even buy prayer candles with his face on them. Fauci told the public that criticizing him was equivalent to criticizing science itself. A direct quote: “Attacks on me, quite frankly, are attacks on science.”

Early on, like most Americans, I found Fauci reassuring. He sounded confident. His comments thoughtful and carefully considered. But as time went on, and I paid closer attention to what he was saying – and how often it changed – I started to lose confidence.

* Masks were unnecessary. Then they were essential. Then maybe double up.

* Shaking hands might be gone forever. Then it was fine.

* He dismissed the lab-leak theory as fringe. Then admitted it was plausible.

Each reversal was wrapped in confidence. No apologies. No humility. Just a new directive.

The Technocracy Problem

COVID revealed something deeper than just bad policy. It exposed a quiet technocracy that had been building for years.

Unelected bureaucrats – CDC directors, FDA administrators, NIH advisors – suddenly had the power to shut down businesses, override governors, censor dissent, and reshape daily life. The CDC extended eviction moratoriums, issued mask mandates for air travel, and provided school reopening guidelines that were reportedly edited in consultation with teachers unions.

Even the WHO, while often deferential to China and late to acknowledge human-to-human transmission, positioned itself as the global referee of truth. Its early January 2020 tweet claimed there was “no clear evidence of human-to-human transmission” – a position that cost the world precious time.

These were not people you voted for. But they had more power than most of the people you did.

Conflicts of Interest, Everywhere

The “experts” weren’t always independent. In many cases, they were up to their necks in conflicts of interest.

* Fauci’s NIAID had helped fund gain-of-function research at the Wuhan Institute of Virology.

* Many public health officials, including NIH scientists, received royalty payments from pharmaceutical companies developing COVID-related treatments and vaccines. Between 2010 and 2021, Fauci and former NIH Director Dr. Francis Collins received 37 and 21 royalty payments, respectively – some of which were collected during the pandemic.

* A 2005 Associated Press investigation revealed that 916 NIH scientists received royalties for products they helped develop, with individual payments as high as $150,000.

* Members of the CDC’s Advisory Committee on Immunization Practices (ACIP) had prior financial ties to Pfizer, Moderna, and J&J, raising concerns about impartiality.

* The CDC Foundation, which funds public health campaigns, accepted over $161 million in corporate donations – including from pharmaceutical firms like Roche, which donated $193,000 to support a CDC flu campaign.

None of this was illegal. But it mattered.

It raised the question: Were decisions being made for public health, or for profit? And when the answer wasn’t clear, trust began to break down.

Dissent Was Not Allowed

It wasn’t just that the experts got things wrong. It was that anyone who pointed it out was censored, fired, or blacklisted.

* Dr. Jay Bhattacharya, Dr. Sunetra Gupta, and Dr. Martin Kulldorff – authors of the Great Barrington Declaration – argued for focused protection rather than blanket lockdowns. Emails later revealed that Francis Collins, then head of the NIH, called for a “devastating takedown” of their ideas.

* Dr. Scott Atlas, briefly a White House COVID advisor, opposed school closures and lockdowns. He was denounced by Stanford faculty in an open letter.

* Dr. Robert Malone, a scientist involved in early mRNA research, raised concerns about vaccine side effects and was suspended from Twitter.

* Dr. Pierre Kory’s testimony before the Senate on early treatment was removed from YouTube.

This wasn’t just a scientific debate. It was an information war.

Big Tech, Big Media, Big Government

The alliance was clear: Government agencies shaped the narrative, and Big Tech enforced it. Twitter, Facebook, YouTube – each played their part.

In the Missouri v. Biden case, emails revealed that White House officials and the CDC regularly flagged posts for removal or suppression. “This is exactly the kind of content we’re concerned about,” read one email from the White House to Facebook in July 2021, referring to vaccine skepticism.

You didn’t need to post misinformation to get silenced. All you had to do was ask the wrong question. Raise the wrong doubt. Share a study that didn’t support the official line.

What We Lost

When trust is broken, it doesn’t return easily. The COVID era didn’t just damage public health – it damaged the idea of expertise itself.

People learned that “following the science” could mean following someone with power, not someone with proof. That’s a dangerous lesson, and one we’ll be living with for a long time.

It’s also a lesson that has left us unsure of where to turn. For decades, institutions like the CDC, the FDA, and NIH were seen – however imperfect – as sources of credibility. Now, it’s not so clear. When people hear official guidance, the default reaction isn’t compliance. It’s suspicion.

Surveys bear this out. According to Statista, only 20% of Americans in 2024 said they had a “great deal” of trust in the CDC’s recommendations. That’s down substantially from pre-pandemic norms. And vaccine willingness is falling, too – just 44% said they would get an annual COVID booster if recommended. Mask compliance has also dropped sharply.

I remember talking to a longtime friend – a lifelong Democrat, someone I’ve always respected. When I asked if he still trusted Fauci, he hesitated. “I did at first,” he said. “But I don’t know anymore. Too many reversals. Too many headlines. I feel like I was manipulated.” That pause said everything.

Fauci, Trump, and Biden

Fauci’s relationship with the presidents he served under was complex – and in my view, not at all what it appeared to be. With Trump, there was always tension. Trump never fully trusted Fauci or the things Fauci was saying. He had a gut instinct that something was off. He didn’t have the expertise or the right people around him to back up those instincts, so instead of confronting Fauci outright, he pretended to trust him. And Fauci played the same game in reverse – pretending to support the president while clearly working around him.

But Fauci didn’t like Trump. I believe he feared that Trump would eventually uncover something – whether about gain-of-function research, early treatments, or the shifting advice on masks and lockdowns. He saw Trump as a threat. Biden, on the other hand, posed no such risk. Fauci said he felt “liberated” working under Biden, and that makes sense. With Biden, he knew his narrative would be protected. He wouldn’t be second-guessed, and he wouldn’t be challenged. That may have made things more comfortable for him – but it also removed the one thing science requires most: skepticism.

We now live in an era where AI can generate fake videos, where deepfakes can put words in anyone’s mouth, and where social media can amplify lies faster than facts. The only way through that kind of chaos is trust. And we’ve lost it.

For a while, I held out hope that someone – maybe someone like RFK Jr., who has openly challenged the pharmaceutical industry and government overreach – could help rebuild that trust. But even that hope feels fragile. Because once people stop believing in institutions, they don’t usually come back. Not without real transparency. Not without real accountability.

And we haven’t seen much of either.

Voices of Authority – and Dissent

“There’s no reason to be walking around with a mask.” – Dr. Anthony Fauci, March 2020

(And later: “I wear a mask not only to protect myself but also to protect others.”)

“Attacks on me are, quite frankly, attacks on science.” – Dr. Anthony Fauci, June 2021

“Cloth masks are little more than facial decorations.” – Dr. Leana Wen, CNN, December 2021

“We knew early on that young people were at minimal risk. Yet we closed schools anyway.” – Dr. Scott Atlas

“If you’re vaccinated, you’re not going to get COVID.” – President Joe Biden, July 2021

“We have trained an entire generation to be afraid of each other.” – Dr. Jay Bhattacharya

“Science isn’t about consensus. It’s about debate.” – Dr. Martin Kulldorff

“YouTube deleted my Senate testimony on early treatment. That should scare everyone.” – Dr. Pierre Kory

Chapter 8. The Financial Toll of COVID-19

Attempting to quantify the total financial cost of the COVID-19 pandemic is an immense challenge. The ramifications have touched every sector of the global economy – from emergency medical spending and stimulus packages to the ripple effects of lockdowns and long-term shifts in labor, productivity, and public health. The direct costs are staggering, but the indirect consequences are even harder to tally.

The $20 Trillion Disruption

Globally, COVID-19 is estimated to have cost the world more than $20 trillion as of early 2024. That figure includes lost economic output, government spending, healthcare costs, and future productivity losses. Some estimates are even higher, projecting a cumulative global cost approaching $30 trillion by the end of the decade.

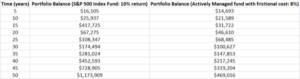

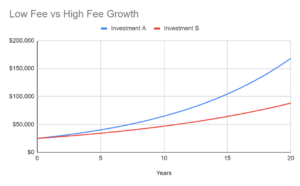

In the US alone, the financial toll may have exceeded $14 trillion, according to research published by the USC Schaeffer Center. That includes direct spending on healthcare, vaccine development and distribution, federal stimulus packages, and the economic impact of deaths, disability, and missed education.

Massive Government Spending and Record Debt

To avoid total economic collapse, governments around the world opened their fiscal floodgates. The US government passed multiple stimulus bills, totaling more than $6 trillion in spending. Programs like the CARES Act, the American Rescue Plan, and Paycheck Protection loans poured billions into the economy. The federal deficit ballooned to over $3.1 trillion in 2020 alone – more than double the 2009 deficit at the height of the Great Recession.

Meanwhile, US national debt soared past $34 trillion by early 2025, a nearly 30% increase from pre-pandemic levels. Many economists warn that the interest payments alone – already exceeding $1 trillion annually – are unsustainable in the long term.

The Great Economic Pause

At the peak of the crisis in 2020, global GDP contracted by 3.4%. The US economy shrank by 3.5%, its worst year since 1946. Tens of millions lost their jobs. Entire industries – especially hospitality, travel, and entertainment – were brought to a standstill. In April 2020, the US unemployment rate hit 14.7%, the highest since the Great Depression.

Small businesses were among the hardest hit. By the end of 2021, an estimated 200,000 US small businesses had closed permanently due to the pandemic. Minority-owned and low-income businesses were disproportionately affected.

Remote Work: Boon or Burden?

One of the lasting shifts has been the normalization of remote work. Before the pandemic, only about 5% of US workdays were conducted from home. At the height of the pandemic, that number rose to more than 60%. As of 2024, it’s stabilized at around 25% to 30%, depending on the sector.

The economic implications of this shift are massive:

* Commercial real estate values have dropped significantly in major urban centers.

* Local economies built around office life – restaurants, dry cleaners, retail – have struggled to adapt.

* Some studies estimate long-term productivity losses of 5% to 10% in industries not well suited for remote work.

On the flip side, remote work has reduced commuting, lowered carbon emissions, and given some workers greater flexibility. But the broader economic impact is still being sorted out – and likely will be for years.

Education and Future Earnings

School closures had a devastating effect on learning. According to the McKinsey Global Institute, US students lost an average of six months of learning during the 2020-2021 school year, with low-income and minority students disproportionately affected.

The long-term economic consequence of this educational disruption is estimated at $2 trillion in future earnings losses due to lower academic achievement, diminished job prospects, and reduced overall productivity.

Healthcare Spending and Long-Term Costs

Direct COVID-19 healthcare costs are estimated to have exceeded $1 trillion in the US alone. That includes hospitalizations, testing, vaccines, PPE, and emergency care. But the indirect costs are mounting, too:

* Long COVID, affecting an estimated 10% to 15% of infected individuals, has reduced productivity and increased disability claims.

* Delayed care for non-COVID illnesses has contributed to a surge in preventable deaths and chronic disease complications.

* Mental health-related costs have soared, with anxiety, depression, and substance abuse diagnoses all spiking.

The Cost of Fear and Misinformation

The pandemic didn’t just damage economies – it changed behavior. Fear, uncertainty, and mixed messaging led to:

* A surge in mental health costs, now estimated at over $280 billion annually in the US.

* An erosion of trust in public institutions, impacting future crisis response.

* A rise in public sector inefficiencies and fraud. For example, the Department of Labor estimates that over $191 billion in unemployment benefits were improperly paid during the pandemic, much of it due to fraud.

A Reckoning Still to Come

While the world has largely moved on from the immediate crisis, the financial legacy of COVID is still unfolding. Inflation, supply chain instability, labor shortages, and massive deficits are all downstream effects.

Some costs will never be fully known. Others – like the debt, the interest, the lost lives and livelihoods – will linger for decades.

If there is one thing the numbers make clear, it’s this: The COVID-19 pandemic wasn’t just a public health crisis. It was one of the most expensive mistakes in modern history.

And if, as increasing evidence suggests, it originated from a lab accident enabled by careless research and lax oversight – then that cost is not just tragic. It’s infuriating.

Chapter 9. The Legacy of the Virus

Now that the dust has started to settle, the headlines have faded and the emergency declarations have mostly expired. But the effects of the COVID-19 pandemic – especially the way governments, institutions, and media responded – are still with us. Some of the damage is visible. Some of it will take years to fully understand.

What’s certain is this: The virus changed more than our health. It changed our world.

Trust Was the First Casualty

One of the defining features of the early pandemic was the appeal to trust. Trust the experts. Trust the models. Trust the government.

That trust is gone now. And for good reason.

* We were told the virus couldn’t spread human to human. It could.

* We were told lockdowns were temporary. They weren’t.

* We were told school closures were necessary. They weren’t.

* We were told early treatments didn’t work. Some did.

* We were told the unvaccinated were driving the pandemic. That wasn’t true either.

Every time the narrative shifted, those in charge pretended nothing had happened. No apologies. No accountability. Just a new set of rules.

It wasn’t just the facts that kept changing. It was the tone. The certainty. The moral pressure to fall in line. Those who asked questions were labeled selfish or reckless or anti-science. But in hindsight, many of those questions were not only reasonable – they were right.

A New Normal – or a New Problem?

People talk about “getting back to normal.” But normal has a new definition now.

* Remote work is here to stay – but so is increased surveillance.

* Schools and businesses are more reliant than ever on digital infrastructure.

* Travel still carries the faint scent of biosecurity theater.

* “Emergency powers” became a routine political tool.

In the name of public health, we saw the normalization of censorship, lockdowns, and the idea that basic rights could be suspended indefinitely for “safety.”

Governments learned how quickly people would comply. That might be the most important – and unsettling – lesson of all.

And the tools created to track and control a virus haven’t gone away. They’ve simply been repurposed. Digital vaccine passports. Contact tracing apps. Emergency-use authorizations. All remain on the table for the next crisis – whatever it may be.

Winners and Losers

Not everyone suffered. Some profited handsomely.

* Tech companies – Zoom, Amazon, Google – posted record-breaking earnings.

* Pharmaceutical companies banked tens of billions in vaccine sales and saw their influence expand globally.

* Media outlets enjoyed record traffic and advertising revenue during peak fear cycles.

Meanwhile:

* Small businesses were decimated.

* Children’s education was set back by years.

* Mental health plummeted.

* Medical trust – once the bedrock of public health – was deeply eroded.

The people who paid the highest price were often the ones with the least to give: the working class, children, and the elderly isolated in nursing homes.

In many cases, those who made the rules were exempt from them. Politicians attended parties and galas. Public health officials dined indoors while telling others to stay home. The hypocrisy was blatant – and corrosive.

We Were Gaslit in Real Time

Perhaps the most unsettling part of the COVID response was how easily reality was rewritten – sometimes overnight.

What was a “conspiracy theory” one week became official guidance the next. What was “misinformation” turned out to be true. But the labels stuck. People were banned, silenced, fired, or mocked – not for being wrong, but for being early.

You didn’t need to be a scientist to see the contradictions. You just needed to pay attention. Masks were first declared useless, then mandatory. Natural immunity was dismissed, then quietly acknowledged. The lab-leak theory was censored, then investigated.

Truth became secondary to optics. And fear became the ultimate justification.

And when public figures were caught in contradictions – Fauci’s shifting statements, CDC reversals, WHO denials – there were no consequences. Just another press conference. Another tweak to the guidelines. Another plea for trust.

Closing the Curtain on Part One

COVID was never just about a virus. It was a stress test for society – and for liberty. It revealed the fault lines, the pressure points, and the playbook.

That playbook included:

* Emergency declarations that rewrote the rules

* A compliant media class that reinforced panic

* Tech platforms acting as censors

* Experts elevated to infallibility

* Citizens conditioned to obey first, ask later

And maybe most important: a total realignment of who we trust, and why. For many people, the pandemic ended any illusion that our institutions – medical, media, governmental – were operating objectively. That damage is lasting. And it matters.

Even now, years later, public confidence has not rebounded. Polls show deep skepticism toward public health authorities. Vaccine uptake is down. Mask mandates are mostly ignored. And people are far more cautious – not about germs, but about the credibility of the people issuing the warnings.

This wasn’t just a moment. It was a transformation.

All of it set the stage for what came next: the vaccine era – a campaign more aggressive, more polarizing, and arguably more consequential than anything that came before.

That’s where we go next.