The Recession of 2022: How Bad and Long Will It Get

It’s official. The US is in a recession. According to a report issued last week by the Bureau of Economic Analysis, the real GDP (gross domestic product) decreased in the second quarter of the year by 0.9%. It decreased in the first quarter by 1.6%. (The Bureau of Economic Analysis, an agency of the US Department of Commerce, has been the government’s official tracker of GDP and other economic indicators since 1972.)

You can read the report here.

Biden officials and most of the mainstream economic experts, including Treasury Secretary Janet Yellen, have been telling us for six months that there wasn’t going to be a recession, and that the spike of inflation we saw earlier this year was only temporary. They were wrong. But they were also wrong about the Great Recession that followed the 2007/2008 real estate meltdown. And every other economic downturn, big and small, for the last 50 years.

This should not surprise you. High profile and highly paid economists, whether they work for the mainstream media, Wall Street, Big Tech, or big government, are essentially paid to ignore or deny bad economic news – to promote optimism and push federal spending, in hopes of pumping up the economy and thus keeping incumbents in office and encouraging business borrowing, consumer and business spending, and sales.

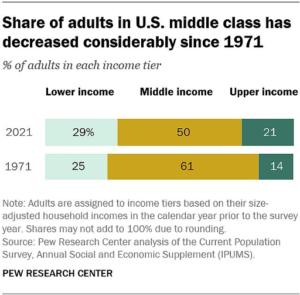

Right now, in a desperate attempt to keep the American working- and middle-classes from despairing our country’s economic future, they are denying the fact that we are in a recession by redefining the term.

Until now, economists agreed on a simple criterion. Two consecutive quarters of negative GDP growth = a recession. And that, as I said above, is what we have had this year. I won’t bother you with their argument. It’s laughably wrong. And it’s not fooling anybody – at least not anyone that has noticed the rising cost of milk, bread, dishwashers, cars, diapers, and gasoline. Or anyone that works in manufacturing, housing, or construction that has noticed that iron and steel and shingles and plywood are more expensive than they’ve ever been. They are fooling only the portion of the population that is too wealthy to be affected by these 10% to 30% price increases. Including the mainstream media pundits that repeat their talking points. (And also including RF, my brother-in-law, who has bet me that the recession will be over in a matter of months.)

I’m going with the Bureau of Economic Analysis’s 50-year-old definition of recession. And my prediction is that it will get worse, and stay worse, for at least the next few years.

One reason I feel that way is based on my personal experience in my current business. That business – publishing information and advice about investing – has traditionally been a bellwether of economic trends. Months before folks pull back on buying cars and TVs because of economic uncertainty, they pull back on buying investment advice. This has happened prior to every recession, big and small, since I’ve been in this business. That’s 40 years. And something like 16 quarterly downturns and a half dozen serious recessions.

About 18 months ago, we began to see a slowdown in our industry. Prospective customers and even existing customers were reluctant to buy more investment services. Since the beginning of the year, our sales are down by more than a third. That means cutbacks and layoffs and, most importantly, reduced spending on recruiting new readers and subscribers.

The principal talking point of those that are predicting a quick return to positive growth has been the unemployment statistics, which were at all-time lows a few months ago. You couldn’t find a restaurant or grocery store that didn’t have a help-wanted sign in their window. But if our industry is once again indicative of the future economy, we’ll be seeing unemployment surging in the next six to 12 months.

It will happen because of the “wage-price spiral” I mentioned in Saturday’s issue. The higher wages that companies are paying now will become more difficult to support as inflation ratchets up every other cost of business. That means thousands, maybe tens of thousands, of businesses, large and small, will be laying off employees and, in some cases, shutting down.

So, that’s what I’m going to be looking at in the coming months. In the meantime, I’m recommending significant cutbacks to the companies I own and/or consult with. Fewer products, simpler systems, and fewer (but better) employees.

I’m also making a few changes in my investment portfolio. (More on that in a coming issue.)

This Doesn’t Bode Well for My Brother-in-Law

The Bureau of Economic Analysis’s bad news about the GDP (above) came a day after the Federal Reserve raised interest rates by 0.75 percentage points, the fourth raise this year. The goal, of course, is to try to stop any further inflation, which is, at 9.1%, at a 40-year high. (You can check out our annual inflation rate here.)

What does this mean? It means that it will cost businesses and consumers more to borrow more. There will be deflation in some areas of the economy – industries that sell optional products for middle- and working-class people. But inflation for everything else. And “everything else” is the lion’s share of the economy. That’s not good.

And It’s Not Just Here…

I’ve been reporting on America’s economic troubles regularly. Inflation, runaway government spending, and the Cold War with Russia have significantly curtailed US GDP and made middle-class Americans poorer. But things are just as bad for China and Russia and most of our European allies. It’s no surprise, then, that the International Monetary Fund lowered its growth projections for the world economy to 3.2% for this year and going down to 2.9% next year.

Click here.

Need a Low Paying Job? Walmart Wants You!

Because of the particular nature of the economy today, the general rise in unemployment that I’m predicting is likely to hit hardest among the higher paying jobs. But if you are willing to work for minimum-wage (or thereabouts), there will be opportunities. Walmart, for example, is looking to hire. Click here.