What We Can Learn from the Bond Rate

Anyone whose financial comfort is dependent to some degree on the US economy (i.e., everyone in the world) should be praying that the Federal Reserve is making the right moves to keep it from slipping off the rails.

It’s a big, complicated job. With dozens of external forces at work. The problem: The Fed has a tool kit with only three tools:

- It can buy US Treasury bonds.

- It can sell US Treasury bonds.

- It can raise or lower the interest rate on them.

When the dollar was pegged to the price of gold, the interest rate was set automatically and the buying and selling happened naturally. But since President Nixon untied the dollar from the value of gold in 1971, managing the economy has been increasingly difficult. For the last three presidencies, the Fed has added to its burden by trying to keep the economy afloat through stimulation – i.e., borrowing and spending trillions of dollars the government doesn’t have. This worked – sort of – by transferring middle-class wealth to Wall Street. But borrowed money must be repaid, either through recession, inflation, or both.

And that is what we have today.

Here’s a concise and clear summary of the situation from Bonner Private Research:

700-Year Drop

Bonds – and the interest rates they reveal – tell us which way the strong undercurrents are running. They measure (indirectly) how much capital is available and (directly) how much it costs. A place like Switzerland, with abundant savings and reliable borrowers, typically enjoys low interest rates. A West Baltimore “payday loan” joint or a poor country such as Haiti or Burkina Faso will have much higher rates, because there is less capital available… and borrowers might not pay it back. And generally, as the world grew richer, interest rates went down….

But the Fed got up to mischief 20 years ago – dropping its key rate from above 6% to below 1%. Was the country suddenly richer? Were savings more abundant?

Of course not. The Fed was giving out a lie. What is important about interest rates is not that they are high or low, but that they are honest. And the Fed was manipulating credit prices in order to give the impression that we were richer than we really were. The idea was to boost stock prices, increase spending, and stimulate the economy. Then in 2008, it repeated the scam, this time pushing rates down to “effectively zero.” In real terms, adjusted for inflation, the Fed Funds rate stayed below zero for more than a decade – where it remains still.

No wonder speculators acted as though money had no value – bidding up prices of meme stocks and cryptos to preposterous levels. No wonder businesses borrowed to buy back their overpriced shares. And no wonder the US government spent trillions on unwinnable wars abroad and jackass boondoggles at home.

And no wonder the country now has $90 trillion of debt – public and private… so much that the pain of reducing inflation will now be likely more than the elite can stand. In order to stop inflation, the Fed must raise interest rates. And every 1% increase – if applied to the whole debt load – would add $900 billion in extra expense annually.

What to do?

Yeah. It’s bad. Our debt has never been this high. And now we have energy shortages, rising inflation, and more government spending on the horizon. The Fed has the power to put a halt to extreme inflation if it is willing to continue to raise interest rates. But when it raises interest rates, the economy stalls and begins to shrink. And we experience recession.

Whenever I find myself between a rock and a hard place, I do something I call “making friends with the enemy.” The enemy is the worst-case scenario. “Making friends” means finding a way to imagine myself being “okay” with that scenario. Or even benefitting from it.

So, what are the bad- and worse-case scenarios for the US economy.

There are three:

- More inflation – getting poorer due to the loss of purchasing power.

- A deepening recession – getting poorer because the value of assets is going down (i.e., asset deflation).

- Both – getting poorer because the value of our financial wealth is shrinking at the same time as the purchasing power of our cash.

Of the three, inflation is probably the scariest. Because inflation can lead to hyperinflation. And hyperinflation will destroy the economy completely. Jerome Powell understands this. That’s why he just increased the Fed interest rate by 75 basis points. And it’s why he’s talking tough about another increase.

If he hangs tough, he can fend off higher inflation. But he knows that doing so will put the economy into a deeper recession. The Democrats and the Biden administration don’t want that to happen, because it will mean all the economic numbers (besides inflation) will be getting worse fast. So, to keep the effects of our shrinking economy to an amount they can explain away or blame on other factors, they will put pressure on Powell to ease off.

It will be interesting to see what the Fed does in the coming year. And by the way, there’s no guarantee that if the Republicans gain control of the House and Senate in the midterms, they will be brave enough to do what we should have done in the first place: Stop spending money we don’t have and balance the budget.

What to expect?

As I said, I like to hope for the best but make friends with the worst.

The worst of the scenarios would be hyperinflation. I think it’s highly unlikely, given the fact that the Fed is independent and our politicians, however economically ignorant some of them are, won’t be able to take over the Fed and start reinflating the economy. Nevertheless, if hyperinflation happens, the only defense one can have against it is real property and hard assets like gold and silver. I have enough of that to become my own warlord in the post-Apocalyptic version of Armageddon that runs through my mind.

The other two scenarios are considerably less terrible, but they are, nevertheless, bad. And they are, in my opinion, very likely.

A sustained period of moderate inflation of 8% to 15% is possible. So is a sustained period of lower inflation (trending down from 8% to a healthy 2%) but with a considerable shrinkage of the US economy.

How do you prepare for these two scenarios?

To offset the damage of 8% to 15% inflation over the next so many years, you should own assets that do well during inflationary periods.

Gold and Other Precious Metals: The most obvious of these is gold and silver. About 4% of my net worth is in bullion and rare coins. It’s not a large percentage, but it’s enough to keep my family afloat if the economy goes to hell.

Stocks: You might not think of stocks as an asset class that is resistant to inflation. And that’s because many of them are not. But there are some companies that are able to sustain themselves during inflationary periods because they can increase their prices along with inflation. Traditional brand name consumer companies like Nestle and Coca-Cola are examples. And new ones like Apple and Amazon should be okay. My stock portfolio is made up of businesses like these that have the size and strength to endure through recessions and even depressions. (I call them Legacy companies.) So, if the stock market continues to go down – and even if it crashes – I’m not going to be selling. I’m not worried about what the share value is right now, but whether the business itself can stay profitable until the market recovers.

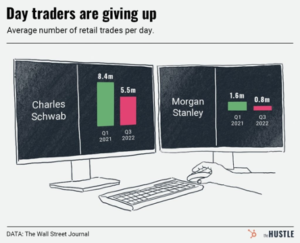

If I had another sort of stock portfolio – one that was heavy in speculative and/or growth stocks – I would make a change. Likewise, if I were making money trading stocks, I’d stop and wait till the smoke clears.

Debt Instruments: I still have a stash of longer-term municipal bonds that are paying between 3% and 4% tax free. (That’s about 5% to 6%.) I’ve been selling them as they come due, and then putting the money into other debt instruments – mostly private mortgages and loans. These have been giving me decent returns over the years, about 8% on average. But now that inflation is at 8%, I will have to charge interest, which I may be able to do. If not, I’ll move my money into the asset class where I have the largest percentage of my wealth: income-producing real estate.

Real Estate: Real estate has always been the largest part of my portfolio. And it will continue to be so in the coming years. When you invest in rental properties, you get richer two ways: from the rental income and from the appreciation in value. Given the economic situation we find ourselves in now, I’m feeling cautious about building rental apartments. But I’m still in the market for properties that can give me a cash-on-cash return of 8% to 10%, which means a return of 12% to 16% with a bank loan.

I also have a fair amount of raw land that I’ve been holding for years. Some is here in the States, and some of is overseas. Prices are very high right now. And since I’m pretty sure things will get worse before they get better, I’m selling off some of these properties and putting the money into endowing my non-profit projects.

Other Hard Assets: I have about 6% of my net worth in art and other collectibles. About two-thirds of that is designated for a museum I’m developing, so I won’t be selling any of it. The other third I will hold onto as a sort of emergency fund. If, for whatever reason, I need extra cash, I can sell off pieces one at a time.

That’s it. As you can see, I’m not making any big changes. If I had my wealth in other, more speculative asset classes, I’d be thinking seriously about rebalancing my portfolio. I hope this helps with your own planning.