2023 Was a Pretty Good Year for the Global Economy, but…

Despite widespread global inflation, geopolitical problems, and the economic after-effects of COVID and the lockdowns, the global economy in 2023 did a bit better than most economists expected.

However, in 2024, many of these same economists are saying that the US (and most of the rest of the world) will experience a global economy that is less sanguine.

In its semiannual “Global Economic Report,” the World Bank predicted that the growth of the world’s economy would slow to 2.4%.

That’s not good, because despite the improvement experienced in 2023, a 2.4% growth would still be the third consecutive year of economic deceleration. The report cited “continued higher interest rates, anemic global trade, reduced global investing, and rising geopolitical tensions” as the reasons.

If that turns out to be true, this first quarter of 2024 is the time for business leaders and individual investors to make changes. (I will write more about this in future issues.)

The Problem with Minimum Wage Laws

Do minimum wage laws work? Are they helpful in improving the lives of our least-skilled workers? The evidence from a hundred studies over the last 20 years is clear. They do not.

And why would that be?

As I’ve mentioned before, by the time a minimum wage is agreed upon, the market demand for minimum-skilled workers is usually as high as the proposed wage or greater.

As I write this, 22 states are lifting pay floors, but many fast-food cooks and housekeepers are already earning more than minimum wage. And that’s because of free-market competition. The COVID shutdown and the move towards working remotely, have made it increasingly difficult for business owners to attract low-wage workers.

As noted in the WSJ:

“Robust raises in recent years have rendered pay floors largely irrelevant, even in states that aggressively lifted them.”

For example: “To start 2024, Washington State will raise the nation’s highest minimum to $16.28 an hour, from $15.74 in 2023. Washington ties its minimum wage to the consumer-price index, a measure of inflation. Hawaii has the largest planned increase, with its minimum wage rising $2, to $14 an hour, in 2024. That is part of a law that will increase the lowest hourly wages in the Aloha State to $18 by 2028. California, New York, and Illinois are also among the states raising the pay floor.

“Most low-wage workers are making well above those minimums. Through September, the lowest 10% of workers by income in each state earned hourly wages that were on average nearly 50% higher than their state’s minimum wages in 2023, according to a WSJ analysis that compared state minimum wages to income estimates from MIT Sloan School of Management professor Nathan Wilmers.

“That is the largest gap between actual pay and minimum pay in a decade.”

Read more here.

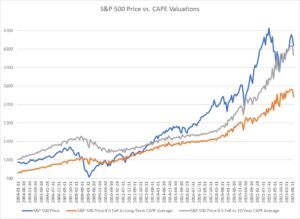

Chart of the Week

This week, Sean MacIntyre talks about the expectation of some economists that we are quickly nearing a worldwide stock market crash. He’s not so sure. And he has another graph with solid analysis and thoughtful explanations to support his thinking.

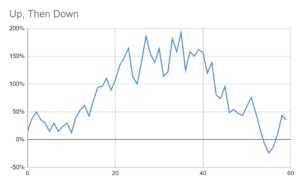

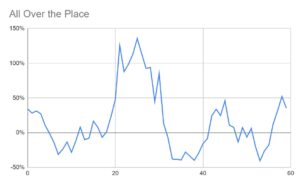

Some new stock market forecasts claim that the S&P 500 could dive as much as -86% in 2024.

The reason given for such a crash is usually overvaluation: Index prices have drifted away from what company profits can reasonably support.

But I question this assumption.

Let’s compare the price of the S&P 500 against the most predictive valuation metric – the Shiller CAPE Ratio.

We’ll compare current prices to both the CAPE’s long-term average and its 10-year average.

As I write, the S&P 500 is trading around 4300.

If it fell until its CAPE valuation returned to long-term averages, the S&P 500 would have to drop to about 2900. That’s a -32% drop from current levels. Cataclysmic, especially for retirees.

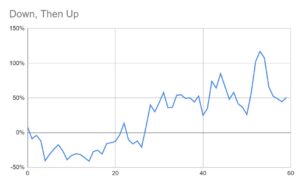

But what if the S&P 500 fell to its 10-year average CAPE?

The S&P 500 would drop to about 4030 – a -6% drop.

Not nearly as scary.

Many doom-and-gloomers balk at the market’s nosebleed-high valuations. But there are many reasons why this should be the norm.

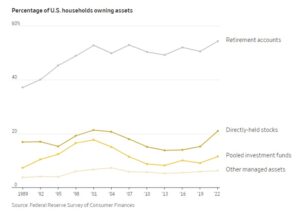

Since the early 1990s, more Americans own stocks than ever before.

And one of the most popular investment strategies is simply to buy and hold the S&P 500.

It stands to reason that if tens of millions of people keep throwing money at one thing, the value of that thing will go up.

Also, retirement accounts and 401(k)s do not offer many alternatives besides stocks and mutual funds that own stocks. Workers have their money shunted automatically into stocks every month, regardless of valuation.

Finally, since the late 1980s, algorithms have accounted for up to 75% of all stock trading volume. Robots routinely scoop up stocks during downturns and drive prices back up. (They cause crashes sometimes, too.)

Simply put: The fundamental calculus of the market has changed. Investor behavior has changed. The world has changed.

So if there’s a cataclysmic crash coming in stocks… it won’t be because the market is “overvalued.”

– Sean MacIntyre

By the way, Sean is working on a free video that teaches stock valuation on his YouTube channel. Click here and subscribe to be notified when it goes live.