Beta Males

Not surprising: Beta males live longer.

Not surprising: Beta males live longer.

Scientists have long known that alpha males are dominant in the social order of baboons and other primates. They rule the beta males and have their pick of the females.

But a new study at Princeton shows that beta males enjoy plenty of sex … and live longer. The obvious implication: The lives of alpha males are cut short due to the constant stress of defending their position.

Great Truths

The most important things to know in life take a lifetime to learn. Our first lessons come early — but we grasp only the surface. As we gain life experience we gain deeper understanding. All great truths are both simple and complex, easy to understand yet difficult to master.

Forgiving

The universe is eternally and instantly forgiving. The moment you forgive yourself, you are forgiven. Others may not forgive you, but you can ignore them. Only your own conscience has the power to haunt you. The only people who don’t need to forgive themselves are psychopaths. They don’t need to forgive themselves because they don’t feel guilty. They don’t feel guilty because they don’t feel responsibility. The point is: To live a guilt free life you have to forgive yourself and not worry about what anyone else thinks. Easier said than done. Still.

Investing, Speculating and Gambling: Let’s Get the Terms Straight

One sensible way to acquire wealth is to buy shares of large, stable, cash-rich companies that pay dividends and hold them for a long time. (I am talking about investing in companies like Hershey’s and Coca Cola.)

This is called investing.

Most people do something else. They buy stocks of large, solid companies whose share prices they hope will increase for some reason. They buy them with the intention of selling them at a profit when they do.

This is called speculating.

Most people would not agree with that last statement. Most people – including most of the professional investment community – prefer to call this second type of financial activity investing too. They don’t like the negative connotation of speculating because it implies undue risk.

Ninety five percent of the investment activity in the world falls into this second category. Even the major media, on which the public relies for common sense, calls this type of transaction investing.

So what is the difference?

Any paperback dictionary will tell you that speculation is characterized by the fact that it is based on incomplete information. And when you buy a stock on the assumption that its share price will rise due to some anticipated short-term event, you are definitely relying on incomplete information.

For one thing, unless you have true inside information, you really have no idea that the event you are counting on will materialize. For another thing – and this is actually more important – you have no certain knowledge that the marketplace of investors will respond to that event by buying up the stock.

So this is one thing that every investor must understand: the difference between true investing, which is largely independent of specific future outcomes, and speculation, which is dependent on them.

If your broker or financial advisor is giving you this second kind of recommendation you must learn to recognize it as a speculation. Then, if you want to speculate, you can.

I am not saying that one should never speculate. (Although I should say this.) But I do think that if you are going to speculate you should not delude yourself by thinking you are making a sound investment.

There is a third way people buy stocks that deserves another name. I’m talking about investing in companies that are neither large nor well known but have the potential to enjoy large increases in their stock prices (which are generally cheap) due to some foreseen event.

The market calls such activities speculation but we should, to be honest, call this by another name. We should call it gambling. Gambling is defined as the purchase of an unlikely chance to profit. Any stock you buy whose chances of having its share prices go up over the long term (and virtually every cheap stock fits into this category) is a form of gambling.

Again, I am not saying that you should never gamble (though I should). I am just saying that you should know you are gambling when you do. Gambling – whether it is playing the slots or Keno, may be a fun way to spend your money. But only a fool would think that it is a way to increase one’s wealth.

Americans are getting smarter?

Americans are getting financially smarter. They are spending less and saving more. This is something that our leaders should be praising. But they are doing just the opposite. They are trying to encourage us to spend more. Why would they do that? Because of an economic fallacy. Their thinking is this: Since such a large part of our economy is based on spending, the way to have a stronger economy is to encourage more spending. But this makes as much sense as advising a junkie to take more drugs because so much of his biochemistry is dependent on drugs.

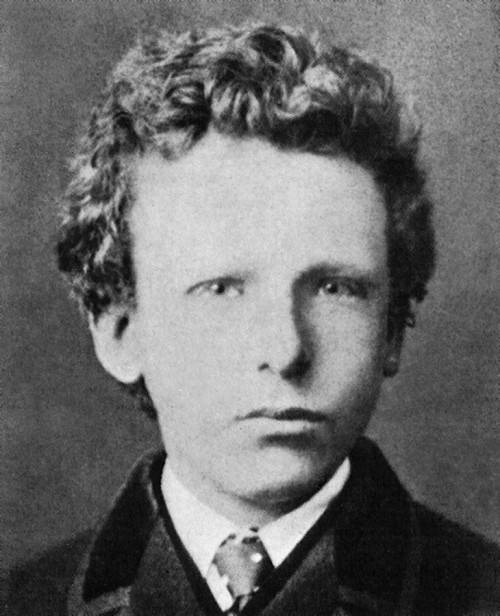

Van Gogh and the Protestant Reformation

Van Gogh would never have been the unique genius he was, Rene Huyghe argues in Van Gogh (a monograph in the Crown Art Library series), were it not for the Protestant Reformation.

This is a stretch but it is not absurd. I’m talking about the effect of the Protestant Reformation in secular terms. We normally think of the Protestant Reformation as a religious movement – an effort to reform the bad practices of the Roman Catholic Church and/or break away from the dominance of the papacy. But it also gave people the idea that they could think for themselves.

One of the primary issues on the reformist agenda was the “right” of individuals to be able to read and interpret the Bible. Until then, church ceremonies were conducted in Latin and, except for songs, recited silently by priests. Churchgoers had no idea what was being said. This suited the clergy since their knowledge of the Bible gave them power.

One of the great ideas of Luther and his fellow revolutionaries was that every man had the God-given right to draw his own meaning from the Bible. By seeking to put Bibles into the hands of ordinary people and eventually have the Bible translated into English, the reformists were providing an extraordinary tool for individual liberty and creativity.

Three Rules of Wealth Distribution

Three rules of wealth that everyone should memorize:

1. You cannot legislate the poor into prosperity by legislating the wealthy out of prosperity.

2. The government cannot give to anybody anything that the government does not first take from somebody else.

3. You cannot multiply wealth by dividing it.

Sweet and Savory

I’ve heard it said that the best way to classify wines is to put them in one of two categories: sweet or savory.

California Pinot Noirs, because of their fruitiness, are sweet.

Old school Bordeaux and Barolos are savory because of their earthy flavors. So are Rieslings.

California Chardonnays and dessert wines are sweet.

When Great Men Lie

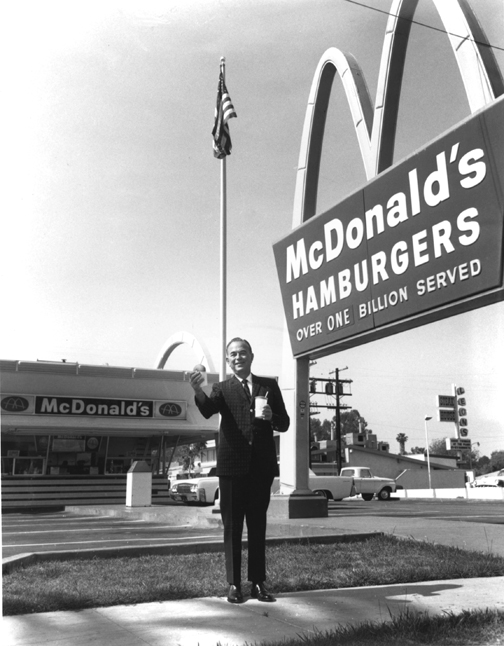

When entrepreneurs reach the pinnacle of success, they are often asked to explain how they got there. When they do, they usually lie. They attribute their success to luck and the people around them. They pretend they were simply along for the ride.

They lie in order to appear humble. But there is no virtue in modesty when it is misleading. The truth is that, with rare exceptions, entrepreneurs do not believe in luck. Luck, they know, is what gamblers count on. And entrepreneurs do not gamble. Instead, they take calculated risks. They are always looking for the best risk/reward equation. If they had their druthers, they would take no risk at all. But they know that their job is to create newness and newness brings with it some risk. Most of their thinking is devoted to reducing risk, not gearing themselves up to take more of it.

Some quotable mendacities:

- “I attribute my success to two things. I am not afraid of taking risks – big risks. I prefer to take big risks because that’s the only way to score big returns.” (David Paschal, president of Paschal Petroleum Inc.)

- “Every time we’ve moved ahead in IBM, it was because someone was willing to take a chance.” (Thomas Watson, CEO of IBM)

- “Risk is the force of entrepreneurship – because where there’s risk there’s also a reward.” (Karl D. Bays, chairman of Baxter Travenol Laboratories.)

- “Entrepreneurs are risk takers, willing to roll the dice with their money or reputation on the line in support of an idea or enterprise.” (Victor Kiam, president and CEO of Remington Products)

- “If you’re not a risk taker, you should get the hell out of business.” (Ray Kroc, McDonald’s mastermind)

The other way entrepreneurs lie is to pretend that they were motivated by noble thoughts and never compromised their ethics.