What I Believe: About Investing

To be successful at anything, we must begin with the ancient Greek aphorism, “Know thyself.”

With respect to investing, that means understanding your instincts and emotions with regard to fear and greed. Here’s an easy-to-answer question that can shed light on those characteristics right away:

What is more important to you? Becoming richer? Or being sure you won’t become poorer?

If, like me, your fear of getting poorer is greater than your desire to get richer, you must do three things:

* Diversify the assets you invest in.

* Establish a “sell point” when you first invest, in case things go south.

* And size your positions – i.e., regulate how much money you put into each asset class and each particular investment within each asset class.

Alex Green on Making Money in the Stock Market…

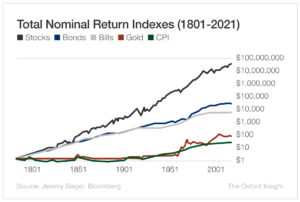

“Jeremy Siegel – a professor of finance at the Wharton School of the University of Pennsylvania and author of Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies – has done a thorough historical study of the returns of different types of assets over the past couple hundred years.

“What he discovered is dramatic: $1 invested in gold in 1802 would have been worth $90.05 at the end of 2021. The same dollar invested in T-bills would have grown to $4,437. A $1 investment in bonds would have been worth $36,390.

“And a single dollar invested in common stocks with dividends reinvested – drumroll, please – would have been worth over $45 million.

“Just look at the massive moves in the graph below…

“Look back through history and start whenever you choose. You’ll find the rolling returns for different asset classes are remarkably consistent.

“And equities win in a landslide. Since 1926, the stock market has generated a positive return in 71 out of 96 years.

“Historically, the odds of making money in the US stock market are 50-50 in one-day periods, 68% in one-year periods, 88% in 10-year periods, and 100% in 20-year periods.

“(That’s something to remember whenever stock prices start wilting like last week’s roses, as they have lately.)”