Garrett Baldwin on the Global Shift to Gold

As a consultant to Agora, the largest publisher of financial advice in the world, I read a lot of economic and investment commentary every month. Below, I’m reprinting a good part of an essay published in the 10/18 issue of Postcards from the Republic by one of Agora’s best writers.

Should You Be Buying Gold?

The world has changed how it handles money. Gold now stands at the center of the global system.

For decades, the US dollar has been king. Countries needed dollars to buy oil, making the dollar powerful due to the demand to fulfill transactions. This system was initially called the petrodollar. It was the backbone of America’s economic power from 1971 to the early 1990s.

Following the first Gulf War, the US government expanded its focus. The Treasury quickly got nations (that weren’t so involved in the global oil trade) hooked on US dollar-denominated debt. After roughly 30 more years of additional dollar domination, things are shifting abroad.

We can pinpoint the day that the world shifted under our feet. The West put sanctions on Russia in late February 2022. Western leaders thought they’d cripple Russia’s economy.

Instead, it backfired. Now, the world is engulfed not only in physical wars across the Middle East and in Ukraine but in a quiet economic war that threatens everything we own.

Following the 2022 sanctions and ensuing price caps on Russian oil prices, the West hoped Vladimir Putin’s nation would be unable to engage in global trade. Instead, Russia and China saw an opportunity. They started working together to bypass the dollar.

Here’s how:

1. China created the petro-yuan. It’s a way to buy oil with Chinese money backed by gold.

2. Russia began selling its oil and gas in currencies other than the dollar.

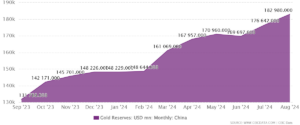

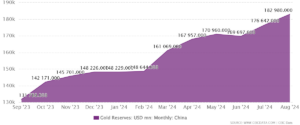

3. Both countries started buying massive amounts of gold. In 2023, central banks worldwide added over 1,000 tons of gold to their reserves. We witnessed the largest purchases of gold by central banks since Richard Nixon took the US off the gold standard.

Why are all these central banks buying gold? Because it’s trustworthy. Countries don’t fully trust China’s money yet. But they trust gold. So, China needed a lot of gold to back up its currency….

Plus, as more countries move away from the dollar, the US might struggle to pay its debts. This could change the value of everything – stocks, bonds, and savings. But gold? It’ll likely keep going up.

So, what should you do?

1. Consider buying gold. Not just coins or bars, but also take a look at gold mining stocks and royalty companies. We have long advocated for the Sprott Physical Gold Trust (PHYS) as a simple, more liquid way to increase gold exposure.

2. Keep an eye on what big banks and countries do with their money.

3. Pay attention to international trade deals, especially those involving China and oil-producing nations. This election could lead to two very different outcomes, but regardless of who wins, the long-term trend is de-dollarization.

This change won’t happen overnight. The US dollar will remain the primary instrument of trade over the next decade. But we see this process accelerating at the moment.

In a world where paper money is getting shakier, gold is becoming the real deal again.

It’s not just shiny metal – it’s a way to protect your wealth and purchasing power in uncertain times.

Stay positive,

Garrett Baldwin

Millionaires Who Can’t Afford to Buy Their Dream Homes

And Why They’re Renting Instead!

Before I took an interest in wealth and wealth building, I took for granted that it is always better to own a home rather than rent one. The logic seemed irrefutable: The dollars you spend on rent are gone forever. They are not “invested,” they are “spent.” But when you own a home, you own a piece of its price appreciation over the years. As the house becomes worth more, so do you.

I held on to this belief longer than I should have. But when I began investing in rental real estate, and had the opportunity to see how that industry works from the inside out, I soon realized that ownership only trumps renting in certain economic situations. And today, in many areas of the world and for many sorts of housing units, it is largely smarter to rent than to buy.

Here’s a piece from the WSJ on this point.

Has California Had Enough of George Soros’s DAs?

In 2014, California launched a grand experiment in progressive criminal justice, appointing George Soros-backed DAs that believed the way to reduce the disproportionate number of African Americans in California jails was to refrain from jailing them for a slew of crimes, including drug possession, resisting arrest, and theft of merchandise whose retail value was less than $1,000.

Advocates, including Gov. Gavin Newsom, said this would save money for taxpayers. What happened, however, was that the social costs have far exceeded any savings. And now California voters are rethinking that initiative.

Click here.

Niall Ferguson: My Journey from a Jerusalem of Ghosts to the Living Jerusalem

“To make proper sense of the bloody events of the past 12 months in the Middle East, I had to go to Vilnius,” writes Niall Ferguson in The Free Press.

“That may strike you as bizarre, as Vilnius is the capital of Lithuania and roughly 1,600 miles from Tel Aviv. But Vilnius was once ‘the Jerusalem of the North’ – that’s what Napoleon called it when he passed through in 1812.”

Read more here.

The Debanking of America

We’ve all read plenty about social media and government-imposed censorship, including demonetizing, deplatforming, and doxxing. Now there is a new way to make your political opponents disappear: debanking.

Click here.

Can the “Good Guys” Save America from Bankruptcy?

David Stockman on Why Trump and Harris Are Dangerous

“When in the course of history’s twists and turns dire necessity becomes the mother of invention,” writes David Stockman in this essay, “it’s usually too late. That’s the case with America’s fiscal derangement at the present time. There is simply not a snowball’s chance in the hot place that either the Trumpified GOP or the beltway blog-controlled Democrats will lift a finger to deflect America’s fiscal doomsday machine from its appointed rendezvous with disaster.”

Read more here.

Freddie deBoer on “Deference Politics”

Why Woke Largesse Doesn’t Help Those It Pretends To

“When I talk about deference politics,” writes Freddie deBoer, “I’m referring to the tendency of left-leaning people to substitute interpersonal obsequiousness towards ‘marginalized groups’ for the actual material change those groups demand.”

Read more here.