Chart of the Week: Inflation Cools Again – What’s Next?

I’m halfway through writing an essay about the state of the US economy as I see it, including my analysis of US inflation. Reading Sean’s piece on inflation this morning, I thought it would be a good introduction to my piece, so I’m not going to say anything more here – but I am grateful to him for once again looking at popular economic and financial ideas with a contrarian perspective and then breaking down the myriad details into a few observations and insights that I can understand and agree with. – MF

Back in April, I shared a breakdown of CPI inflation, showing why high inflation remained “sticky” in the first part of this year.

But I also made a prediction:

We should [see] prices level out a bit on their own in the months ahead. Without monetary policy intervention.

So right now, I am still thinking that the Fed might still be on track for at least one rate cut later on in 2024.

My prediction was made based on simple logic and observation. Inflation isn’t magic. It’s just a mathematical model. If you understand how the model works, you can predict what’s coming pretty easily.

But I cannot tell you how many people expressed to me that this prediction was delusional. How many people still expressed concern despite me standing next to the numbers like Vanna White, saying, “Just look!”

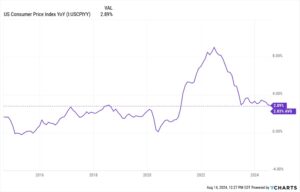

Well, here we are in August, and CPI inflation has fallen below 3% for the first time since 2021.

In fact, average inflation in the US over the last 10, 20, and 30 years is somewhere between 2.5% and 2.8%.

So right now, this month, we are officially in the territory of “normal inflation” for this economy.

Why has inflation calmed a bit?

As I said back in April, the high inflation rate was being caused by supply and demand problems in markets like (for example) used cars, which had knock-on effects to other industries such as auto insurance.

But we’re not out of the woods yet…

We are still seeing some areas of the economy experience really bad inflation: hospital and healthcare services; shelter, rent, and housing; and food (especially restaurants).

Because these areas of the economy are inflating too much and too fast, I’ll bet $8 we’re not going to see an emergency cut from the Fed, as some have called for.

But I also still think we’re going to see at least a few cuts in the coming months.

And it’s going to happen simply because the Fed’s monetary policies don’t have much impact on the portions of the economy that are still experiencing inflation.

What is the Fed going to do? Force hospitals to charge less? Build more apartments and plant more farms?

No. Those prices are affected more by market forces, geopolitics, and fiscal policies (i.e., Congress).

The Fed is going to cut rates because the cost of paying the public debt in the US is getting out of control. They’re also going to do it because banks are currently sitting on hundreds of billions of dollars’ worth of unrealized losses.

(Many of these banks hold massive amounts of long-term treasuries. The price of bonds goes down when interest rates go up. This is why we saw several big banks fail last year.)

So we have to ask what the big takeaway from all this is for investors.

There is a big one: Own bonds in your portfolio 10 months ago, like I recommended then.

Now? It’s getting close to too late for you to capture any meaningful total returns as rate cuts are getting “priced in” to bonds.

So make that move now to get a decent interest rate while you can.

And then prepare to sell those fixed income assets when rate cuts end – possibly a few years from now.

– Sean MacIntyre

Check out Sean’s YouTube channel here.

MarkFord

MarkFord