Chart of the Week: Presidential Elections and the Stock Market

How will the election affect the stock market? As Sean points out, there is no reliable correlation, from any number of perspectives, between election results and subsequent stock market performance. One reason is that the stock market is responsive to many factors that are mostly economic rather than political. And even if a conservative, pro-business, tax-reducing candidate wins, experienced stock market pros know that any substantial legislation enacted in one term of office tends to have its impact four to seven years later. So we might see an upward bump if Trump wins – or a downward move if Harris wins. But those will be temporary. Enough, perhaps, to trade on (although the odds are so obvious, the gains won’t be great). But in my own portfolio – the one that Dominick and Sean manage – there will be no changes made as a result of what happens in November. – MF

During my recent trip to Japan, I received one question repeatedly: How will the US presidential election affect the stock market?

Now that Kamala Harris is the presumptive Democratic nominee, I want to revisit this question and offer what I hope will be received as a healthy, nonpartisan dose of “perspective.”

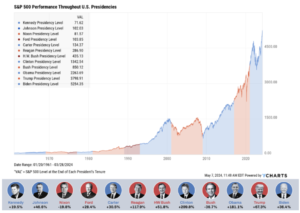

Take a look at this chart showing how the markets performed under every presidency for the last 60 years:

Under both Democratic and Republican presidents, the stock market generally trends up long term.

Why?

Because presidents have little to no control over the things that affect stock prices.

For example, George W. Bush’s presidency was marked by the September 11 attacks on the World Trade Center, the Enron Scandal, and the 2008 Great Financial Crisis.

The market went down, of course. As it would have regardless of party, policy, or person.

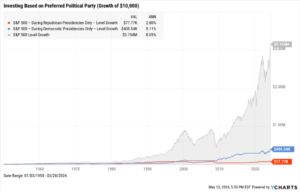

To further emphasize this point, take a look at this chart that shows the growth of a $10,000 investment if you only invested during Republican presidencies (the red line), Democratic presidencies (the blue line), or just bought and held the market the whole time (gray).

Choosing to invest in the S&P 500 only during Democratic presidencies since 1950 and sticking to cash otherwise resulted in a 5.11% annualized return. Similarly, a strategy of investing exclusively during Republican presidencies generated an even smaller 2.8% annualized return.

Though there have been several peaks and valleys along the way, the S&P 500 has grown in value over the long term regardless of who’s in office.

While elections may create some short-term uncertainty, simply “staying the course” produces the best results for investors.

Let me put this as bluntly as I can…

Through wars, recessions, inflation, onerous regulation, deregulation, high taxes, low taxes, welfare, housing crises, hyper-socialist policies, hyper-capitalist policies, liberals, conservatives, moderates…

The market has trended up.

The only guaranteed way to lose out on money is to make major investment decisions based on a president’s political party.

So don’t do it.

– Sean MacIntyre

Check out Sean’s YouTube channel here.

MarkFord

MarkFord