Chart of the Week: Small Caps Rebound?

I’m halfway through a piece I’m writing on what I’m calling “the state of the US economy.” I’m looking at it from the perspective of what I see happening among my friends and acquaintances – those that have small companies (with revenues of less than $500 million) and those in the real estate business as well as the luxury goods and fine art markets. The outlook, as you will see when the piece is published, is not positive. But history tells us that the ups and downs of the stock market are not always corelated to the economy, including the market for low cap stocks, as Sean explains in his column this week. – MF

Individual stocks typically swing up and down with unpredictable caprice.

But in aggregate, when you divide them up into industries or sort them by factors, stocks do seem to obey the simple physics of a pendulum swing.

We’re seeing that right now with small cap stocks. That is, shares of smaller companies with market capitalization of between $250 million and $1 billion.

While the major stock indices like the S&P 500 and Dow recovered from the 2022 bear market, small cap stocks, like those in the Russell 2000 (the purple line in the chart above), did not.

And that’s despite the fact that, historically, small caps tend to offer better long-term returns than the market overall.

Forbes, in June, even pointed to this as evidence of “extreme divergence” in the stock market, which can be an early sign of a faltering market.

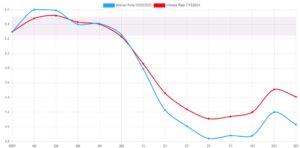

The wealth management firm Pathstone points out that small caps had “their worst first half of the year compared to the S&P 500 on record. As interest rates have remained higher for longer, earnings for smaller and less growth-oriented businesses have been more heavily impacted.”

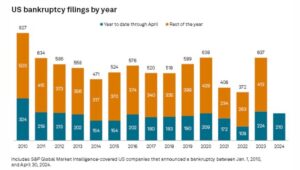

However, we’ve finally seen this start to change with the Russell 2000’s 3-year returns finally breaking positive. Even though the rate of corporate bankruptcies has been high and rising since 2023 as the cost of debt has exploded.

This raises an important question: Why? What’s leading small cap stocks higher?

Surprisingly enough, the answer is small regional banks, which have just spiked in a big way over the last few weeks.

Small regional banks have dragged down the performance of small cap indices since (1) interest rates spiked and the yield curve inverted, (2) the failures of Silicon Valley Bank, Signature Bank, First Republic Bank, Heartland Tri-State Bank, and Citizens Bank in 2023, and (3) Fed Chairman Jerome Powell’s assertion that “There will be bank failures” caused by exposure to commercial real estate loans.

But now that interest rate decreases are increasingly likely and the yield curve is looking just slightly less inverted compared to where it was at the start of the year, the future prospects for smaller banks are looking a little brighter.

Does that mean one should rush out to buy small caps or regional bank stocks right now?

No. The time to do that was December 2023, when these stocks were still cheap, hated, and at the beginning of an uptrend. And with all the other potential problems facing small banks right now, we don’t yet know if this growth is sustainable.

But if we take this data and combine it with the recent selloff in large growth stocks, we seem to be at the beginning of a big “churn” in the markets.

Money is on the move.

And I think this is foreshadowing quite a bit of volatility in August and September.

I have my trailing stops set for some of my positions that I don’t want to hold forever. I’m also amassing a war chest of cash and bonds to take advantage of any big opportunities that come up in the coming months.

I suggest you consider doing the same. Stay safe out there.

– Sean MacIntyre

Check out Sean’s YouTube channel here.

MarkFord

MarkFord