What Is the Future for Stocks Over the Next Five Years?

Just before publication, I asked Sean MacIntyre, who, along with my broker Dominick, has been managing the stock portfolio I set up ten years ago, if he could tell us what he foresees for stock investing in the near future. This is what he had to say…

For one of my recent video posts, I wanted to answer a simple question: “What does the economic data suggest the S&P 500 will do over the next five years?”

I did a regression analysis of the five econometrics most highly correlated with future returns. Here’s how they’re suggest the S&P 500 will perform in the next five years based on past trends:

* US Housing Starts: 8.5% per year

* Fed Interest Rates: 8.9% per year

* Delinquent Auto Loans: 14.1% per year

* 10-year Treasury Yields: 6.7% per year

* Shiller Excess CAPE Yields: 8% per year

Average it all up and you get what the market has just about always done: 9.2% per year.

Honestly, this finding was a little frustrating. I wanted something more definitive so I could declare that we “BUY NOW” or “CRASH INCOMING.”

But all these data suggest things will be as they have always been. And “average returns” has always been a mixed bag.

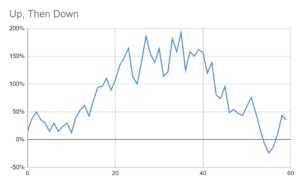

The market could climb from here and then fall, as it did for folks who bought in 1998 or 2020.

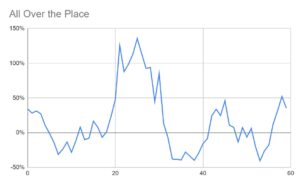

The market could go all over the place, as it did in the 70s.

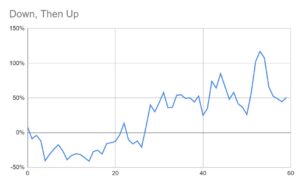

Or the market can drop for years before climbing again, which seems most likely at the moment.

Each of these scenarios ends with people achieving “average returns.” They are mathematically the same.

But they are psychologically very different. After all, how excited will you be about buying more stocks if they fall for the next two years?

The point is, we can’t know what the future holds. Given enough time, things tend to average out to what they’ve done historically.

It’s just a matter of investing with the right mindset, patience, and an understanding of everything that might happen along the way so that you don’t make emotional decisions that destroy your wealth.

If you want some more investing tips, economic insights, and findings both exciting and disappointing, check out my YouTube channel here.