“My Mom’s Motorcycle”

A sweet and sentimental short film about the past and the future and our connections between objects and people.

“My Mom’s Motorcycle”

A sweet and sentimental short film about the past and the future and our connections between objects and people.

In this, the first monthly “Review” issue of 2025, I’m introducing a new feature – a rating system. It’s something I’ve been cooking up in recent years to explain and justify my judgements on the quality of books and films and other works of art that tell stories. These are obviously abstract notions about subjective experience, but they work for me – and I hope they work for you.

My Rating System for Most Books/Films

* Horizontality: How much and how well did the book/film provide a sense of a particular place, time, community, and/or culture?

* Verticality: How deeply did the book/film go in mining the depths of the human experience?

* Stickiness: How tightly did the book/film keep me glued to the story?

* Literary/Visual Richness: How well did the written descriptions/cinematography enhance the story?

For some non-fiction works that need a slightly different approach – e.g., Stoic Paradoxes and The Last Lecture (reviewed below) – I’ll be using this…

My Rating System for Some Non-Fiction Works

* Vertical Knowledge: How much did the work elucidate what is essential to the human experience?

* Horizontal Knowledge: How much did the work teach about the details of the subject matter investigated (history, science, psychology, etc.)?

* Depth of Thinking: Were the insights and revelations deep? Did the work leave me feeling that I’d learned something important?

* Literary Quality: Was the writing itself engaging and entertaining?

One More Thing

There will be occasions – rare occasions – when I will add a half-point or a point to my rating. When, for example, the book or film changes the way I think or feel about something in some important way (I’m thinking of Schindler’s List or Walter Isaacson’s biography of Elon Musk, which I’m reading now) or when, even though it doesn’t score very well on the analytics, I enjoyed it so much that I still want to recommend it strongly (e.g., my rating today of What We Do in the Shadows).

In this issue, I’ll be applying my new system to three books and four films/TV series that I’ve enjoyed.

The books:

* Stoic Paradoxes by Cicero

* The Blue Hotel by Stephen Crane

* The Last Lecture by Randy Pausch

The films/TV series:

* Maria

* Emilia Pérez

* Conclave

* What We Do in the Shadows

Plus… I’ll be sharing my list of 46 more books that I’m thinking of reading in 2025.

Stoic Paradoxes by Cicero

A New Translation by Quintus Curtius

106 pages

Paperback published 2015

I’ve done what I’d consider the basic requirements of Stoic studies since it became the predominant philosophic perspective of the self-help bloggers about 20 years ago.

I’ve read Marcus Aurelius, Seneca, and bits of Zeno, Epictetus, and Diogenes. But I’d never read Cicero.

I decided to read Paradoxa Stoicorum (Stoic Paradoxes) – written by Cicero sometime in 46 BCE – after reading somewhere that in it “he attempts to explain six famous Stoic sayings that appear to go against common understanding.”

I’ve always had a weak spot for concepts that are contra-intuitive. I like to learn them and then use them as burrs to irritate the minds of those who are confident in their thinking.

There are, admittedly, other explanations. Your average second-year student of psychology would probably (and correctly) diagnose me as (a) rating high on the “disagreeable” scale, and (b) having recurring “narcissistic” tendencies.

Never mind. The point is that I’m glad I read this. Not only is it intellectually challenging, I have gotten a few nuggets from it that will help me sound like I know what I’m talking about in future conversations about Stoicism.

The Six Paradoxes

I’m certainly not an expert in Stoicism. However, I feel confident in saying that it is an ethical philosophy that advocates for the development of character based on reason.

In Paradoxa Stoicorum, Cicero examines these six principles of Stoic thought:

1. Virtue is the sole good.

By this (I think) Cicero is saying that there are some goods (things like pleasure and fortune) that, however satisfying for the moment, cannot give us enduring satisfaction. They merely arouse the desire for more of the same. The goods that can satisfy the soul, he says, are honor, honesty, and virtue. And these can be attained only by disassociating oneself from impulses and desires and committing to the fruits of reason.

2. Virtue is the sole requisite for happiness.

Virtue is all that is needed for happiness. Happiness depends on a possession which cannot be lost, and this only applies to things within our control.

3. All good deeds are equally virtuous and all bad deeds equally vicious.

This one I had problems with. Apparently, the classical Stoic idea is that all vices are equal because they each involve the same decision: to break a moral law. Cicero’s argument seems to be that all vices are the same but only if they are equal in terms of the social statuses of the offender and the offended. A person of lower status offending a person of higher status deserves a considerably harsher punishment than a person of higher status offending a person of lower status.

4. All fools are mad.

This one I didn’t get. Or if I did, it is a specious argument. Cicero seems to be saying that people that are not virtuous are, by definition, mad because any sane person, understanding that the only good is virtue, would act virtuously and therefore be immune to punishment or failure, whereas any person that chooses to be unvirtuous, is, by definition, a fool.

5. Only the wise are free, whereas all fools are enslaved.

Here, Cicero seems to be making the same argument (that all fools are mad) in a different way. Virtuous people are free because they are making choices based on reason, whereas people that act in accordance with their desires are always locked into the tyranny of those desires.

6. Only the wise are rich.

Again, this seems to be a variant of the previous three. On the one hand, since virtue is the only good, seeking other goods – such as fortune, fame, and power – will never produce any lasting good. On the other hand, someone who has an abundance of fortune, fame, and power cannot be said to be rich if he has no virtue.

What I Liked About It

* I believe the subject matter of Stoicism is important because it deals with two of the most important philosophical questions: What is a good and rewarding life? And how does one attain it?

* By finally reading this book, I feel that I now have an understanding (at least a partial and introductory understanding) of Cicero’s contribution to Stoic thinking.

What I Didn’t Like So Much

* Although I now have something to say about Cicero, I don’t have a deeper or even a much broader understanding of the range of Stoic thinking.

* Since the book is a translation of a translation (Cicero translated the Stoic arguments from the Greek), it was pretty much impossible to get a sense of how close the ideas were to the original.

About the Author

Marcus Tullius Cicero (106 – 43 BCE) was a Roman statesman, lawyer, scholar, and philosopher. He is considered a key figure in Roman intellectual history.

About the Translator

Quintus Curtius is the pen name of writer and translator George J. Thomas, who has written extensively on moral philosophy, ethics, and historical subjects.

My Rating

I found this to be a good book, but hardly a great one. I would recommend it if you read it as I did: with the purpose of understanding Cicero’s role in Stoic philosophy. If you have little to no interest in that, I wouldn’t bother.

* Vertical Knowledge: 3.5

* Horizontal Knowledge: 2.5

* Depth of Thinking: 3.0

* Literary Quality: 3.0

* Overall: 3.0 out of 4.0

The Blue Hotel

A short novel by Stephen Crane

40 pages

First published in 1898

This was an off-the-shelf read for me. An off-the-shelf read is a book that has been sitting alone and untended for years on one of the many bookshelves in one of five locations that, for whatever reason, calls out to me for attention.

I was drawn to it because of the color of the cover, the title (modest but also promising), the author (by whom I’ve only read one other book, The Red Badge of Courage, and yet I know he is considered a great American novelist), and the small size of it (a book I could read during a busy business weekend in Baltimore).

The Story

Five strangers, each on his own journey, de-board a train in Fort Romper, Nebraska, a small town at the edge of the wilderness of the American West, for a night’s rest at the Palace Hotel. Pat Scully, the hotel proprietor, persuades them to book rooms and offers them dinner.

At dinner, the men engage in small talk. Afterwards, Scully invites them to play cards, which they agree to. One of the five, referred to only as “the Swede,” is brooding and quiet at dinner, and during the card game predicts that he will die in the hotel that night.

The game resumes. But before the night is over, the Swede is indeed killed.

The rest of the story is about the fairness of the murder trial and the verdict.

What I Liked About It

I liked the story itself – the simplicity of its structure, the directness of the plot (chronological), the plainness of the prose, and the mood (brooding).

I loved the irony – the fact that the Swede comes to Fort Romper expecting to be killed because of the image he had about the violence of the Wild West, which came from reading dime-novels written by hacks who know nothing about the real West.

And I liked the way the story was written. Crane tells his stories like Hemingway does: straightforward and without sentiment or embellishment. I’ve always felt there is an inverse relationship between the sparseness of the prose and the emotional power that can come from it.

What I Didn’t Like

Nothing.

Interesting

The Blue Hotel was published in 1898 in two installments in Collier’s Weekly and has subsequently been republished in many collections. In 1977, it was made into a TV movie directed by Ján Kadár. In 1999, David Grubbs did a musical adaptation – a folk-rock album titled “The Coxcomb.”

About the Author

Stephen Crane (1871-1900) was an American poet, novelist, and short story writer. Prolific throughout his short life, he wrote notable works in the Realist tradition as well as early examples of American Naturalism and Impressionism. He is recognized by modern critics as one of the most innovative writers of his generation.

I haven’t read his poetry yet, but I’m going to.

Critical Reception

The Blue Hotel is considered to be a masterpiece – one of Crane’s finest short novels, along with Open Boat and The Bride Comes to Yellow Sky.

My Rating

* Horizontality: 3.5

* Verticality: 3.75

* Stickiness: 3.5

* Literary Richness: 4.0

* Overall: 3.75 out of 4.0

You can read the full text here – for free – on the Washington State University website.

The Last Lecture

By Randy Pausch

106 pages

Published April 2008

The title intrigued me. I looked it up and found this:

The Last Lecture by Randy Pausch, a computer science professor at Carnegie Mellon University, is a distillation of his life lessons and experiences. Written with reporter Jeffrey Zaslow, the book is an expanded version of a lecture Pausch gave in 2007 (when he was 47) after being diagnosed with pancreatic cancer.

JSN, one of the great mentors in my life, died from pancreatic cancer.

The book (and Pausch’s lecture) has two parts. The first is a lighthearted explanation of how he achieved six of his childhood dreams: experiencing zero gravity, playing in the NFL, authoring an entry in an encyclopedia, being Captain Kirk, winning stuffed animals in amusement parks, and becoming a Disney Imagineer. The second part, which is more substantial, is about how he used his experience to help others achieve their childhood dreams.

What I Liked About It

His positive attitude and upbeat energy is infectious. Most of the ideas, however mundane, are nevertheless true and important.

For example:

* We cannot change the cards we are dealt, just how we play the hand.

* How do you get people to help you? By telling the truth and being earnest.

* Apologize when you screw up and focus on other people, not on yourself.

* Remember: Brick walls exist to separate us from the people who don’t really want to achieve their dreams. Don’t bail.

* Show gratitude. (When he got tenure, he took his research team to Disney World for a week. “These people just busted their ass and got me the best job in the world for life,” he said when asked why he did it. “How could I not?”)

* Work hard. (He got tenure a year early. When asked what his secret was, he said, “It’s pretty simple. Call me any Friday night in my office at 10 o’clock and I’ll tell you.”)

* Find the best in everybody. You might have to wait a long time, but people will show you their good side. Just keep waiting, it will come out. And be prepared. Luck is truly where preparation meets opportunity.”

About the Author

Randy Pausch was a Professor of Computer Science, Human-Computer Interaction, and Design at Carnegie Mellon, where he was the co-founder of Carnegie Mellon’s Entertainment Technology Center (ETC). He was a National Science Foundation Presidential Young Investigator and a Lilly Foundation Teaching Fellow. He had sabbaticals at Walt Disney Imagineering and Electronic Arts (EA), and consulted with Google on user interface design.

Critical Reception

The book was a bestseller. The lecture, which went viral, has been viewed by millions. You can watch it here.

My Rating

* Horizontality: 2.0

* Verticality: 3.0

* Depth of Thinking: 2.5

* Literary Richness: 2.5

* Overall: 2.5 out of 4.0

Maria

A biopic about the last years of Maria Callas in Paris in the 1970s

Directed by Pablo Larraín

Starring Angelina Jolie

Released Aug. 2024

Watch Time: about 2 hrs.

It had been weeks since I had found the time to watch a movie, but on Saturday, the 14th, K and I needed a break before getting back to our holiday chores and my work. I was hoping for a Christmas movie. Strolling through Netflix, however, K chose Maria. She said she’d heard it was good. And it was good. Not amazingly good, perhaps, but good enough to leave me thinking about Maria Callas for weeks afterwards.

What I Liked About It

* Angelina Jolie in the leading role. Her expression was significantly restricted by the mise en scene, with the lion’s share of the footage of her being close shots of her face. Notwithstanding that limitation, Jolie was able to project a strong, complicated, and deeply sympathetic character almost entirely with her eyes. That’s no small accomplishment. In fact, considering the role and her performance, she is surely on the short list for at least one major award.

* The two secondary leads. Pierfrancesco Favino as Callas’s loyal butler and Alba Rohrwacher as her loyal housekeeper.Without their good acting, the drama would have been less intense and the pathos of Callas’s character weaker.

* Pablo Larraín’s decision to present Callas’s story through the perspective of someone suffering from depression and drug-induced hallucinations.

* The cinematography. The lush but still moods of the interiors, the sad grays of the exteriors, the camera angles, and the graininess throughout.

* The stories behind it. In just 124 minutes, Maria tells at least four compelling stories: one of Callas in her prime, another of Callas in her last act, another of Jackie Kennedy, and still another of Aristotle Onassis. It provoked a lot of questions about them that I’d like to answer one day if I can find the time to do the reading.

* The way the film portrayed the loneliness, self-doubt, and despair not only of Callas, but of other world-renowned artists. It had me thinking about the last days of Elvis Presley, Michael Jackson, and Jim Morrison, but also of the likes of Robin Williams, John Belushi, and Philip Seymour Hoffman.

What I Didn’t Like So Much

The pace of the movie was slow – at times uncomfortably slow. But in defense of Larraín, the slowness was effective in allowing me to feel the hopelessness and ennui that Callas must have felt after her great gift and enormous stardom was gone.

Interesting

I was shocked to learn that some portion of the singing was performed by Angelina Jolie herself. I read that the parts she sang were the “not-so-good” pieces from the end of Callas’s career – although I couldn’t tell the difference. I also read that in preparation for the role, Jolie took months of training under Eric Vetro, the same voice coach that worked with Timothée Chalamet as the young Bob Dylan in I’m Not There.

About the Director

Pablo Larraín Matte is a Chilean filmmaker. He and his brother Juan de Dios co-produced Sebastián Lelio’s A Fantastic Woman, the first Chilean film to win the Academy Award for Best Foreign Language Film.

Critical Reception

Maria got mixed reviews from the critics, though Angelina Jolie’s performance was generally praised. It did very poorly at the box office, taking in less than $140,000 in the first week.

* “La Diva Eterna lives in Jolie, with a performance as towering as it is understated: sad and soulful and heartbreaking. She has never been better. Brava!” – John Nugent, Empire Magazine

* “Pablo Larraín’s latest biopic drowns in melodrama but dazzles with visuals, leaving Angelina Jolie to rescue what she can of Maria Callas’s legendary life.” – Rex Reed, Observer

* “As a movie, Maria is just okay. As a calling card for the next phase of Jolie’s career, however, it sings to the rafters.” – Caroline Siede, Girl Culture (Substack)

My Rating

* Horizontality: 3.0

* Verticality: 3.5

* Stickiness: 2.0

* Visual Richness: 2.5

* Overall: 3.25 out of 4.0

You can watch the trailer here.

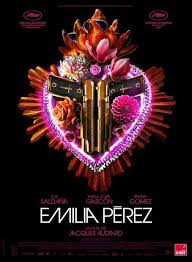

Emilia Pérez

Directed and co-written by Jacques Audiard

Starring Karla Sofía Gascón, Zoe Saldana, and Selena Gomez

Released Nov. 2024

Watch Time: 2 hrs. 12 min.

MM recommended it. He said, “I can’t tell you why without giving too much of it away, but I’m pretty sure you’ll like it.”

He was right. And I know why he didn’t want to explain it to me. Had he done so, I might have refused to see it.

One could say that the movie is about a Mexican cartel leader that decided to get out of the business and evade capture in the future by going through “gender affirmation” surgery. Had that been the core of the story, I would not have liked it. But it was much more.

I don’t know how to sum it up. It is unlike any film I’ve ever seen.

I can’t even nail down the genre. It’s part a gangster story. Part a story about guilt and redemption. Part a story about female empowerment. But it is also an action movie and a thriller. And a love story. Actually, several. All that would not have surprised me. I’ve seen movies (not many) that successfully spanned that many boundaries before. But this one is also a theatrical production – part Evita and part Slumdog Millionaire!

What I Liked About It

* What I just said: that it managed to do so many different and diverse things successfully at the same time. When it was a cartel movie, I was frightened. When it was an action movie, I was gripping my seat. The love stories pulled at my heartstrings. The redemption story was inspiring.

* Everything it took to pull it off: great acting, directing, editing, cinematography, music, make up, colorization, costuming, and scenery.

* It had me thinking about it days after I saw it. That happens only with films that are very good.

What I Didn’t Like

As Kamala Harris said when asked if she’d do anything that Joe Biden did differently, “Nothing comes to mind.”

Interesting

* The woman that plays the male gangster turned female philanthropist (both roles – amazingly) is Karla Sofía Gascón, a Spanish trans actress who found success in Mexican films and soap operas long before transitioning.

* The film was shot almost entirely on Parisian soundstages, where the streets of Mexico City were recreated for scenes with an international cast.

About the Director

Jacques Audiard is a French film director, producer, and screenwriter. Over the course of his career, he has received numerous accolades, including two British Academy Film Awards, three Golden Globes, 10 Cesar Awards, and four prizes from the Cannes Film Festival.

Critical Reception

* “Phrases like ‘game-changer’ and ‘cutting-edge’ can’t capture just how audacious and original Emilia Pérez is. It’s a knockout.” – Leonard Maltin

* “Audiard has created Emilia to startle and divert, but it’s Gascón’s performance that centers and grounds the story, and it’s the actress who finally gives the movie real stakes. She is its heart and soul both.” – Manohla Dargis, The New York Times

* “By making Emilia Pérez a quasi-musical, Mr. Audiard cranks up the campiness; by making it a parable about one’s own past being inescapable, he makes it profound.” – John Anderson, Wall Street Journal

My Rating

* Horizontality: 3.75

* Verticality: 3.75

* Stickiness: 3.75

* Visual Richness: 4.0

* Overall: 3.8 out of 4.0

You can watch the trailer here.

Conclave

Directed by Edward Berger

Starring Ralph Fiennes, Stanley Tucci, John Lithgow, and Isabella Rossellini

Released Oct. 2024

Watch Time: 2 hrs.

The plot of Conclave follows one of the world’s most secretive and ancient events – selecting a new Pope. Cardinal Lawrence (Ralph Fiennes) is tasked with running this covert process after the unexpected death of the beloved current Pope. Once the Catholic Church’s most powerful leaders have gathered from around the world and are locked together in the Vatican halls, Lawrence uncovers a trail of deep secrets left in the dead Pope’s wake, secrets which could shake the foundations of the Church.

What I Liked About It

Most of all, the directing, editing, cinematography, and the acting. But it was also a beautifully designed film, with visually arresting attention to light and color. The music and sound effects were perfect for the emotional atmosphere the film needed. In other words, it had all the components a film needs to be very good.

I also liked the information the film presented about the Vatican and its rules, written and unwritten.

What I Didn’t Like

* The ideas behind the movie were clichés.

* The resolution of the mystery was implausible. Actually, it was absurd.

* It showed me nothing truthful about the human condition.

Interesting

* The word “conclave” – referring to a room that can be locked for privacy – was derived from the Latin phrase cum clave (“with a key”).

* This is the fourth time a Sistine Chapel set has been built at Cinecittà Studios for a feature film, following The Agony and the Ecstasy (1965), The Shoes of the Fisherman (1968), and The Two Popes (2019).

Critical Reception

* “You may think that being locked in a room with a bunch of pompous elderly men deviously attempting to shaft each other wouldn’t be a lot of fun. But trust me on this: Conclave is a blast.” – Wendy Ide, Observer (UK)

* “There is much to admire about Conclave, but in the end, all of its lofty aspirations come tumbling down due to that poorly constructed Jenga tower of a plot.” – Richard Roeper, Chicago Sun-Times

* “It’s possible that the film takes itself entirely too seriously. Fortunately, the viewer is under no such obligation and may have a good time as a result.” – Matthew Lickona, San Diego Reader

My Rating

* Horizontality: 3.0

* Verticality: 1.5

* Stickiness: 3.25

* Visual Richness: 4.0

* Overall: 2.93 out of 4.0

You can watch the trailer here.

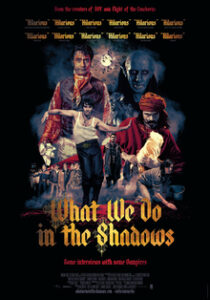

What We Do in the Shadows

Written and directed by (and starring) Jermaine Clement and Taika Waititi

Released 2014

Watch Time: 1 hr. 26 min.

Like Emilia Pérez, this was a strong recommendation from a friend. “This is right up your alley,” he said.

I didn’t doubt I’d like it because it was the creation of Jermaine Clement and Taiki Waititi. I’ve been a huge fan of Clement ever since watching Flight of the Conchords about five years ago. And I knew Waititi from JoJo Rabbit, which I thought was brilliant.

The Plot

What We Do in the Shadows is a mockumentary that follows four vampires who share an apartment in a New Zealand suburb. They have most of the expected habits and superpowers of vampires, such as sleeping in the daytime, sucking blood for sustenance, and hypnosis. But some have additional skills, like levitation and morphing into animal forms.

They also have wonderful backstories. Viago, for instance, is a 17th century dandy who originally traveled to New Zealand in the 1940s in search of Katherine, the love of his life. Vladislav is a 12th century former tyrant known as “Vladislav the Poker,” who is haunted by memories of his nemesis “The Beast.” And Deacon is a 19th century former peddler who was turned into a vampire by the fourth roommate, Petyr, a reclusive ancient that looks and acts like Nosferatu.

I don’t think I need to tell you more. By now, you are either dying to see it or have zero interest. As for me, I loved it!

What I Liked About It

* The idea of it – doing it as a fake documentary. It adds a layer of humor that gives it extra comic power.

* The sense of humor: This is New Zealand humor. If you liked Flight of the Conchords or JoJo Rabbit, you’ll like this.

* The quirks and idiosyncrasies of each of the vampires were very smart.

* The way the movie plays against vampire movie tropes.

* The acting – especially Clement’s.

Interesting

* What We Do in the Shadows is based on a 2005 short film – What We Do in the Shadows: Interviews with Some Vampires – written and directed by Waititi and Clement.

* Genre movies that are heavily quoted or referenced in the film include The Lost Boys, Bram Stoker’s Dracula, Interview with the Vampire, Blade, Twilight, and Buffy the Vampire Slayer.

* $447,000 was raised for the film from over 7,000 supporters via the crowdfunding website Kickstarter.

* In 2019, What We Do in the Shadows was made into a TV series. The 6th (final) season ended in 2024. I haven’t seen it yet, but based on the movie, I’m going to give it a try.

Critical Reception

* “An irrepressibly charming B-movie that never over-stays its welcome, and is both conceptually clever and admirably well-executed.” – Simon Abrams on the Roger Ebert website.

* “At a brisk 86 minutes, What We Do in the Shadows never sags or drags, delivering its comic punches with surgical precision and then getting off the stage.” – Alonso Duralde, The Wrap

* “It’s a cheerfully horrific affair, a sanguine comedy that feels more than a bit like a Christopher Guest farce or an elaborate Monty Python sketch, imprinted with the Kiwi comic sensibilities of [Clement and Waititi].” – Stephen Rea, Philadelphia Inquirer

My Rating

* Horizontality: 0

* Verticality: 2.0

* Stickiness: 3.8

* Visual Richness: 3.8

* Overall: 2.4 out of 4.0

But I’m also giving it…

* 1.5 Extra Points for New Zealand Humor

* So Overall: 3.9 out of 4.0!

You can watch the trailer here.

46 More Books I Might Read in 2025

Since I began writing Early to Rise in 2000, I’ve challenged myself to read at least 50 books a year. For a fast reader like my parents, who could easily consume books of 350 pages in a single evening, reading a book a week is par for the course. But for someone who has diagnosed himself with ADD and dyslexia, it’s an ambitious goal.

I don’t think there has been a year that I haven’t hit my mark. But I succeed by taking shortcuts and (some would say) cheating. I can skim through non-fiction books at a rate of about 600 to 800 words a minute by using a speed-reading method I invented years ago.

Since I read fiction primarily to enjoy the literary skillfulness of the authors, I don’t have the option of skimming. I must read every word. Consequently, I prefer short novels (200 to 250 pages).

At the beginning of each year, I usually spend an hour or so looking up the books that have been nominated for and/or won some of the major literary awards in order to put a few dozen prize-winning titles in my head. This year, I also looked at “best of 2024” recommendations from the newspapers I read (the NYT, the WSJ, The Guardian, the Washington Post, and The Times of India (Don’t ask!), as well as a few blogs I follow to get a gut feeling for new books that might be up my alley.

One thing I noticed: A large percentage of the books that won multiple prizes were authored by women or men of color – another example of what I would call the current “affirmative action award culture.” You may say, “It’s about time.” But it’s not a new trend. It’s been going on for decades, though it may have peaked in 2024. At least I hope so.

That said, here are 46 books (24 fiction and 22 non-fiction) that are on my list to “maybe” read in 2025. What you will find is the title and the author, followed by a brief comment on or critique of the book from one of the sources I consulted. (I’m sure that some of them will turn out to be dreadful. I apologize in advance.)

Non-Fiction

1. King: A Life by Jonathan Eig

A revelatory portrait of Martin Luther King, Jr. that draws on new sources to enrich our understanding of each stage of the civil rights leader’s life, exploring his strengths and weaknesses, including the self-questioning and depression that accompanied his determination.

2. Postwar: A History of Europe Since 1945 by Tony Judt

Both intellectually ambitious and compelling to read, Postwar is thrilling in its scope and delightful in its small details.

3. An Unchosen People: Jewish Political Reckoning in Interwar Poland by Kenneth Moss

As a chronicle of how an embedded minority, buffeted by strengthening winds beyond its control, is forced to confront questions of belonging, identity, and illiberalism, the book has a disturbingly acute relevance for our current moment.

4. Say Nothing: A True Story of Murder and Memory in Northern Ireland by Patrick Radden Keefe

Easily the most compulsively readable entryway into Northern Ireland’s “Troubles” – an endlessly fascinating, and terrible, episode in 20th century conflict.

5. Blind Spots: When Medicine Gets It Wrong and What It Means for Our Health by Dr. Marty Makary

A high-profile specialist at Johns Hopkins University, Makary shows how the medical establishment promoted misinformation on a range of topics, ranging from childhood peanut allergies and hormone replacement therapy for menopausal women to a cavalier attitude toward antibiotics and the damage of excessive antibiotic use.

6. Building a Story Brand: Clarify Your Message So Customers Will Listen by Donald Miller

Whether you are trying to persuade a lawmaker to adopt your policy proposal or inspire donors to give to your local conservative club, compelling storytelling is essential to communicating conservative ideas effectively.

7. Hero of Two Worlds: The Marquis de Lafayette in the Age of Revolution by Mike Duncan

A nobleman, motivated by the ideals of freedom and democracy in the time of the American Revolution, in search of adventure. Although the book is nonfiction, Duncan’s prose is easy to read with interesting facts and good pacing to move Lafayette’s story along.

8. Marlborough: His Life and Times by Winston Churchill

George Washington once advised his friend James Madison that when the country faces storms, what it chiefly needs are “wisdom and good examples.” Marlborough provides both. More than that, it provides both twice-over, because in retelling the remarkable life of one of the greatest statesmen and generals in Western history, Churchill tells us a great deal about himself.

9. Nuclear Revolution: Powering the Next Generation by Jack Spencer

The good life means clean air and affordable, reliable resilient energy. Spencer explains how to get there through nuclear power.

10. Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts by Annie Duke

Written by a cognitive psychology graduate student turned one of the most successful female poker players of all time, Thinking in Bets examines the process of human decision-making and suggests ways to optimize it to achieve better results in all facets of everyday life.

11. Detrans: True Stories of Escaping the Gender Ideology Cult by Mary Margaret Olohan

What happens when a young person “changes” her gender – and then realizes she made a mistake? Olohan tells stories the legacy media has largely ignored, describing exactly what happens in these experimental medical procedures and the effects they can have.

12. Two Years Before the Mast: A Sailor’s Life at Sea by Richard Henry Dana Jr.

In 1834, Richard Henry Dana Jr. dropped out of Harvard to sail on a small trading brig bound for California. Two Years Before the Mast recounts his time at sea, including themes of courage in the face of danger, the consequences of poor leadership, and the thrill of diving headfirst into a new way of life.

13. The Woketopus: The Dark Money Cabal Manipulating the Federal Government by Tyler O’Neil

A very accessible read despite the fact that it deals with an enormous number of facts.

14. Uncanny Valley: A Memoir by Anna Wiener

An aspiring writer making her way up the publishing hierarchy of the New York book scene, Anna Wiener suddenly decides to travel west and settle in the Bay Area, where she will enter the Silicon Vally culture and report back to us.

15. A History of Money and Banking in the United States by Murray Rothbard

An interesting account of how government and the large financial institutions have been manipulating the economy by manipulating money.

16. Soldiers and Kings: Survival and Hope in the World of Human Smuggling by Jason De León

An intense, intimate and first-of-its-kind look at the world of human smuggling in Latin America by a MacArthur “genius” grant winner and anthropologist with unprecedented access.

17. Circle of Hope: A Reckoning with Love, Power, and Justice in an American Church by Eliza Griswold

Part of a little-known yet influential movement at the edge of American evangelicalism, Philadelphia’s Circle of Hope grew for 40 years, planted four congregations, and then found itself in crisis. The story that follows is an American allegory full of questions with relevance for many of us, not just the faithful.

18. Unshrinking: How to Face Fatphobia by Kate Manne

Manne examines how anti-fatness operates – how it leads us to make devastating assumptions about a person’s attractiveness, fortitude, and intellect, and how it intersects with other systems of oppression.

19. Knife: Meditations After an Attempted Murder by Salman Rushdie

A deeply moving reminder of literature’s capacity to make sense of the unthinkable, an intimate and life-affirming meditation on life, loss, love, art – and finding the strength to stand up again.

20. Whiskey Tender: A Memoir by Deborah Jackson Taffa

Whiskey Tender traces how a mixed-tribe native girl – born on the California Yuma reservation and raised in Navajo territory in New Mexico – comes to her own interpretation of identity.

21. The Return: Fathers, Sons, and the Land in Between by Hisham Matar

Transforming his personal quest for answers into a brilliantly told universal tale of hope and resilience, Matar has given us an unforgettable autobiography with a powerful human question at its core: How does one go on living in the face of unthinkable loss?

22. Serendipity: The Unexpected in Science by Telmo Pievani

Pievani, a biology professor at the University of Padua in Italy, provides a catalog of serendipitous discoveries. For example, in 1941 the Swiss engineer George de Mestral was vacationing in the Alps and noticed that burdock seeds stuck annoyingly to his clothes and to his dog’s fur. Examining the culprits under a microscope, he saw many tiny hooks, whereupon he got the idea for… Velcro!

Fiction

1. The Book of Love by Kelly Link

The prose is diamond-sharp. It’s hard to imagine Link ever writing a clunky sentence or a bad description. Her characters are all brilliantly fast-talking and fast-thinking, their conversations full of wordplay and in-jokes. As people, they are multi-faceted – charming and understandable and tragic, as well as a bit obnoxious.

2. A Dove of the East: And Other Stories by Mark Helprin

The 20 stories here, many of which first appeared in The New Yorker and have since been anthologized throughout the world, are strikingly beautiful essays on enduring and universal questions. Pick this up, crease the binding, turn the page. You’ve never known anything like it. It has the benefit of being true.

3. Creation Lake by Rachel Kushner

You know from this book’s opening paragraphs that you are in the hands of a major writer, one who processes experience on a deep level. Kushner has a gift for almost effortless intellectual penetration.

4. Beautyland by Marie-Helene Bertino

Through friendships, hardships, adolescence, adulthood, celebrations of life, death, and the publication of an alien’s musings on humanity, Beautyland is not only a story of remembering the difficulties and beauties of being different, but one of discovering life as a person every day.

5. The Scarlet Pimpernel by Baroness Orczy

If you are looking to reengage with classic fiction but want something not too long or daunting, The Scarlet Pimpernel is a delightfully fun adventure. Set during the French Revolution, it introduces readers to a mysterious hero in disguise who rescues families from the daily executions by guillotine. There is mystery, intrigue, daring escapes, and just a little romance.

6. Night Watch by Jayne Anne Phillips

A beautifully rendered novel set in West Virginia’s Trans-Allegheny Lunatic Asylum in the aftermath of the Civil War where a severely wounded Union veteran, a 12-year-old girl, and her mother, long abused by a Confederate soldier, struggle to heal.

7. I, Robot by Isaac Asimov

Asimov’s short stories about the challenges of programming robots are extremely interesting in light of today’s AI policy debates. While this collection was written in the 1940s and 1950s, it offers surprisingly timely food for thought.

8. Long Way from Home by Frederick Busch

Responding to a magazine ad that may have been placed by her biological mother, Sarah Barrett abandons her Bucks County family and runs slowly to disaster in this sedate, ruminative thriller.

9. Red Cavalry by Isaac Babel

A group of related short stories about Russia’s (the Red Army’s) war against Poland. It is considered one of the great masterpieces of Russian literature.

10. Dirty Snow by Georges Simenon

A strongly written, darkly viewed novel about a young man who decides to live a life of crime. Simenon is not well known, but he may be the granddaddy of this sort of noire fiction.

11. Stone Yard Devotional by Charlotte Wood

Charlotte Wood has been described as one of Australia’s most original and provocative writers. This novel, set in a convent in rural Australia, follows a woman who is feeling despair over climate change.

12. The Doomed City by Arkady and Boris Strugatsky

An absolutely unique, unaccountably under-rated gem: Soviet-era science fiction written “for the drawer” (in the assumption that nothing so daring could be published in the USSR) by a wildly inventive pair of brothers who claim they wrote every single sentence collaboratively.

13. Zero K by Don DeLillo

DeLillo is best known for his sprawling Cold War epic Underworld (1997), but this shorter novel feels more eerily relevant today. An emotionally stunted billionaire and his wife have locked themselves away in a state-of-the-art facility beneath Kyrgyzstan. Their goal is to be cryogenically frozen until technology has developed enough to enable them to forestall death.

14. Ghostroots: Stories by Pemi Aguda

A debut collection of stories set in a hauntingly reimagined Lagos where characters vie for freedom from ancestral ties.

15. My Friends by Hisham Matar

A devastating meditation on friendship and family and the ways in which time tests – and frays – those bonds, My Friends is an achingly beautiful work of literature by an author working at the peak of his powers.

16. Martyr! by Kaveh Akbar

Cyrus Shams, an Iranian American aspiring poet and recovering drug addict, wallows in a post-college malaise in a fictional Midwestern town. He’s working dead-end jobs and halfheartedly attending A.A. while grieving his parents’ deaths and, increasingly, fantasizing about his own. Cyrus is lost and sad, but this captivating first novel, by an author who is himself a poet, is anything but.

17. You Dreamed of Empires by Alvaro Enrigue

Hernán Cortés and his men have arrived at Moctezuma’s palace for a diplomatic – if tense and comically imbalanced – meeting of cultures and empires. In this telling, it’s Moctezuma’s people who have the upper hand, though the emperor himself is inconveniently prone to hallucinogenic reveries and domestic threats. The carnage here is devilishly brazen, the humor ample and bone-dry.

18. Havoc by Christopher Bollen

This abidingly wicked novel of suspense and one-upmanship is narrated by an 81-year-old American widow permanently installed in a hotel on the Nile catering to moneyed vacationers. The widow is driven to “sow chaos” by what she calls her “compulsion.” “I liberate people who don’t know they’re stuck,” she claims. But her routine is disrupted when an eight-year-old American boy arrives at the hotel and becomes wise to her machinations.

19. The Storm We Made by Vanessa Chang

Ambitious” would be a trite term for Vanessa Chan’s outstanding debut, a historical novel that thrums with the commingling tensions of its backdrop: the lead-up to the WWII Japanese invasion of what is now Malaysia. Chan writes her characters with a precision that neither flinches from the brutality of war nor ignores the humanity within.

20. Wandering Stars by Tommy Orange

Stories about the ancestors of characters from Orange’s celebrated first novel There There. Extending his constellation of narratives into the past and future, he traces the legacies of the Sand Creek Massacre of 1864 and the Carlisle Indian Industrial School through three generations of a family in a story that is by turns shattering and wondrous.

21. All the World Beside by Garrard Conley

As Conley himself has described it, All the World Beside is a pioneering “queer Scarlet Letter,” revisiting the Puritan New England we remember from Nathaniel Hawthorne’s classic with a new cast of conflicted lovers.

22. Trust by Hernan Diaz

At once an immersive story and a brilliant literary puzzle, Trust engages the reader in a quest for the truth while confronting the deceptions that often live at the heart of personal relationships, the reality-warping force of capital, and the ease with which power can manipulate facts.

23. The Land in Winter by Andrew Miller

A study of two young marriages during England’s 1962-63 Big Freeze, The Land in Winter is a page-turning examination of the minutiae of life.

24. Lies and Weddings by Kevin Kwan

In a globetrotting tale that takes us from the black sand beaches of Hawaii to the skies of Marrakech, from the glitzy bachelor pads of Los Angeles to the inner sanctums of England’s oldest family estates, Kevin Kwan unfurls a juicy, hilarious, sophisticated, and thrillingly plotted story of love, money, murder, sex, and the lies we tell about them all.

From KW re my article about “Growers and Tenders” in last week’s issue:

“Growers and Tenders… interesting concept. I have always considered myself an efficiency guy (Tender). I realized early on in my corporate career that I am not the visionary type. However, if you want to turn around your unprofitable company/division, I am your guy. That’s the way I always thought of this concept. Thanks for sharing your thoughts!”

My Response: I agree. If you are an “efficiency guy,” I’d say you are a Tender. And as you say, as someone who thinks (and prioritizes your work) as a Tender, you can contribute to the business by paying attention to how all the many parts of your business are running – repairing broken parts; streamlining protocols, processes, and procedures that are no longer running as well as they once did; eliminating processes, protocols, and procedures and firing or establishing different objectives for employees who are no longer contributing positively to the bottom line.

Growers can sometimes get obsessed with growing revenues. And when they do, they need a Tender around to take care of the bottom line, which is ultimately more important to the future of the company.

A Question from KJ, a fellow BJJ enthusiast:

“What made you start your martial arts journey in 1998 in BJJ? Was it UFC 1 winner Royce Gracie? For me, it was the podcasters ex-Navy Seal Jocko Willink and Joe Rogan.”

My Response: My father, who was a literature professor and had no interest in sports, once told me that a good grappler will beat a good boxer. That stuck with me. When my boys were old enough to wrestle, I began looking for places they could do that. (Their school didn’t have a wrestling team.) One day I was driving down Federal Highway in Boca Raton and noticed a new storefront business: “Reylson Gracie Jiu Jitsu.” I knew that Jiu Jitsu was largely a grappling art and that the Gracie family had somehow brought it to a new level down in Brazil.

I enrolled my three boys, and the owner, Reylson Gracie, persuaded me to take lessons, too. I did. And I fell in love with it. My boys eventually dropped it, but I’m still practicing nearly 30 years later.

I agree with you about UFC 1. Nobody outside of the BJJ and UFC world today knows who Royce Gracie is. The name Jocko Willink is known to at least a million people. Joe Rogan? Half a billion?

The “Works in Progress” issue of the week.

* Crazy busy, overtipping & other clippings from my Journal

* News you should have seen but didn’t & five stories I (almost) missed

* The Good, Bad, and Ugly – my January report on the state of the US economy

* Five edifying and unsettling essays I wanted to share with you

* Interesting, Serious, and Fun – 13 video clips I think you’ll appreciate

* A quiz on the “weird science” of 2024

And finally…

* Ten quotes to lift you up and get you going in 2025

My Mad December

December was another month of full-speed-ahead, bookended with two trips to Baltimore to meet and work with board members and senior executives of the business that’s been my primary source of income and satisfaction for the last 35 years.

In between were yearly board meetings with two of the family’s nonprofits: FunLimón, a community development center in Nicaragua, and Paradise Palms Botanical & Sculpture Gardens in Delray Beach… two development meetings with the CEO of Rancho Santana… an advisory board meeting with the English Department of a local university… a meeting with SS and Number Three Son to review the status of our collection of Central American art… a yearly review and planning session led by Number Two Son on the family’s business and real estate assets… a very encouraging marketing meeting with the creative team that publishes my books and courses in Japan… a meeting with Palm Beach County about zoning issues for our property in West Delray Beach… a Zoom meeting with a nonprofit that is working to support entrepreneurial ventures for veterans and ex-Peace Corps volunteers… an introductory meeting with RR about working with him on his business mentorship nonprofit… and a happily productive meeting with MC, the agent heading the six-year audit the IRS hit me with last year.

Not to mention the always engaging discussion/argument about a book selected by the Mules, the book club I belong to… the Monday afternoon lecture/discussions on political and economic freedom hosted by a secret cabal of writers, professors, and economists I was recently honored to join… two doctor appointments… three breakfast meetings… and my meager efforts to assist K in her month-long preparation for the last two weeks of the year when our house is happily filled with our kids and their wives and kids and at least a dozen friends and additional family members that drop by to celebrate the holidays.

Mad. And that’s how December has been for K and me and for the Ford/Fitzgerald clan for the 30+ years that we’ve been living in Florida, and I hope it continues until K and I drop dead from exhaustion!

Working with Your Hands, Tipping with Your Heart

There are people in my circle of family and friends that occasionally accuse me of being overgenerous in how much I pay and/or tip manual laborers. Their attitude seems to be: “What’s wrong with you? Are you feeling guilty about or trying to compensate for something?”

I find these interactions puzzling. These are people who know me as someone who once cut grass, shoveled snow, washed cars, built pools, painted houses, tarred roofs, worked in warehouses, bartended, babysat, and cleaned toilets pretty much non-stop from the age of 12 until I was old enough to draw a paycheck. Don’t they trust my judgment about how I should pay the people that do these sorts of jobs for me now?

Have you noticed that…

* People that have worked as servers are generally better tippers than those that haven’t?

* Managers that have never done manual labor tend to be the most demanding of laborers?

* Kids that never had to shovel snow or mow lawns or babysit grow up to be adults that are stingy when it comes to paying kids to mow their lawns, shovel their driveways, and babysit their kids?

And tell me this…

* On a restaurant bill, what percent do you normally pay?

* Do you base the tip on the entire amount or just on the food?

* Do you tip when you order food from a counter?

* Have you ever stiffed a server? If so, why?

* What was the biggest tip you ever gave and why?

How I Lost My Self-Esteem to ChatGPT

In response to reader questions, I’ve been making notes for a longish essay on the technology of robotics and AI and how it will impact the job market. My general view is that (A) the effect will be massive, and (B) it will come much faster than nearly everyone expects.

As you’ll see when I publish this piece (soon!), I’m predicting that we’ll see huge changes in the next three to five years. My advice for dealing with it will be my go-to position for all possible future upheavals: “Hope for the best, but prepare for the worst!”

I should have followed my own advice. Because just before Christmas, I discovered that AI had replaced me in doing a job that wasn’t even on my radar screen. I’m thinking of my role as chief card and letter writer for K.

It happened quite suddenly and unexpectedly. K had mentioned when I left for work that she was counting on me to write the note to our nieces and nephews that would be attached to their Christmas presents.

So that evening, I sat down and began writing while she was dishing out our dinner.

“Oh, you don’t have to bother with that,” she said. “It’s done.”

“What? How could…?”

“I asked ChatBox to write it for me this afternoon.”

“You did? And you were happy with the result?”

She handed it to me. I was, I’m embarrassed to admit, quite good. Perhaps not as good as the best ones I’ve written. But as good as most, and better than a few.

A bittersweet moment, to be sure. Something won in terms of time. Something lost in terms of pride.

Semaglutide Experiment Update

I’m down to 196 pounds – 30 pounds from my peak.

My strength is down, too. Mostly, I think, due to a significant loss in fast-twitch muscle fiber. I’m working on reclaiming some of that by eating more protein (shooting for 100+ grams daily), resistance exercises, and five-minute sprints two or three times a day, trying to get my heart rate to its max. (It was up to 178. Now it’s about 20 beats less.)

My blood pressure is back to very good. It’s been at about 110/70 for the past 30 days. I’ve stopped taking the medication my VIP doctor prescribed. I’m awaiting blood test results to see what other old-man drugs I can trash.

According to the medical literature I’ve dug into the past month (NIH, the Mayo Clinic), the drug poses a small risk of three potentially serious negative side effects – pancreatitis, thyroid tumors, and kidney injury – although “the risk of these complications is considered low and primarily arises in individuals with pre-existing conditions or family history of these issues.”

On the positive side, I found a report on a large (86,000 subjects) study that found that participants taking semaglutide had more than a 50% lower risk of abusing alcohol – a benefit that people taking other weight-loss drugs, such as naltrexone or topiramate, didn’t experience.

I have noticed that since I’ve been on the juice, I rarely drink more than a single glass of wine or beer. That’s a third of what I commonly drank. So that’s good. But my capacity for tequila – which is almost unlimited – remains the same. I presume it’s a matter of viscosity – that wine and beer take up more space in the digestive system. But I’ve not found any research to support that.