An Excerpt from The 7 Natural Laws of Wealth Building

Friction

Thirty-four years ago, on my 40th birthday and a year into my first attempt at retirement, I decided that K and I should do some estate planning for our family.

I came to that decision because I had recently gotten into the habit of paging through publications like The Robb Report and Forbes issues on the richest men and women in the world, and I was reading the occasional biography or autobiography of great American industrialists like Andrew Carnegie, John D. Rockefeller, Henry Flagler, and Henry Ford.

I was doing this sort of reading because I had, in the span of less than 10 years, brought myself up from humiliating penury to a net worth of more than $10 million, which, in 1990, put me in what I believed was the category of having “great wealth.”

So, I engaged a lawyer I knew to write me up an “estate plan.”

After seeing the size of our financial assets, he assembled a small group of people to provide us with the full spectrum of the legal and accounting services that he told me we needed. The group consisted of my tax accountant, another guy I knew that was an accountant, and a local lawyer who did my real estate closings. At the last minute, on impulse, I asked MN, at that time the CFO of my primary business, to sit in on our first meeting and tell me what he thought.

After the meeting, he pulled me aside and said, “Mark, these guys are clowns. What you need is a company that specializes in this sort of thing.” And he recommended what was perhaps the best estate planning firm in the US. They were way more expensive than I had anticipated, but in retrospect, they were worth every penny of the more than $1 million I have paid them so far.

As it turned out, this was in the middle of my wealth building career. Since then, my net worth has increased by a multiple of 15, which has made their intensive, personalized, state-of-the-art advice worth even more.

A Concern Surfaces

When the plan was in place, K and I felt pretty good – like we had accomplished what responsible people with significant assets should do.

But then I read something that concerned me. Apparently, even the wealthiest people, working with the most sophisticated estate planning professionals, didn’t always get it right. Even with the best technical and legal structures, the most common result of leaving fortunes to their heirs was (A) the destruction of the wealth they left behind within two generations, and (B) the destruction of the family itself.

A few families, however, such as the Cargills and Waltons, had avoided these heartbreaking outcomes. One of the deciding factors was the way they wrote their wills and structured their family businesses. The other one – the more interesting one, it seemed to me – was that the entire family met several times a year to make financial decisions together.

I expressed my concern about the long-term effects of our estate plan to several people whom I’d come to trust at the firm that had put it together. Three of them recommended the same company – a small husband-and-wife team that specialized in what is called the “soft” side of estate planning.

When I contacted them, I explained that K and I weren’t so much interested in growing or even preserving the wealth that we would be leaving to our heirs. “We’re much more concerned,” I said, “that in leaving so much money to them, it could result in resentments, objections, fights, and even worse if things got really out of hand.”

They told me that we were right to be worried. They said that they used to work on the “hard” side of estate planning – asset protection, portfolio management, etc. But because of their own experiences as children of wealthy parents, they had decided, instead, to focus their careers on helping clients like us who were aware of the dangers of giving away a fortune.

The program they laid out sounded very much like the approach I’d read about that was taken by the Cargills and Waltons. They called it “family governance.” We liked the way it sounded, and we signed a contract.

And then, within days – before we could even begin the program – two of our sons got into a tiff about what they should do with our primary residence after our deaths. Sell it and split the proceeds? Or keep it and use it as a beach house for the extended family?

“I hope this ‘family governance’ stuff works,” I thought. “If it doesn’t, K and I might be looking at the beginning of the end of everything we’ve worked so hard to achieve over all these years.”

Introducing Friction

In the science of physics, the word “friction” is used to describe forces that slow forward momentum – more specifically, forces that resist “the relative motion of solid surfaces, fluid layers, and material elements sliding against each other.”

Common examples of physical friction include such things as dryness, roughness, competing currents, and so forth.

In the world of wealth building, “friction” would include countless impediments. For simplicity, I’ve classified them into five categories: external friction, internal friction, economic friction, personal friction, and political friction.

External Friction

In business, external friction includes all the built-in demands and obstacles you can run into that come from outside forces, such as the regulatory agencies of federal, state, and local governments, industry associations, business groups, and basically any outside organization whose requirements get in the way of your efforts to grow your business and your wealth.

Those requirements would include OSHA and ADA rules, SEC and FTC regulations, state and local zoning and building codes, local business regulations, and so on.

Though many of them are necessary to reduce malfeasance and safeguard public interests, they almost always slow down forward momentum.

What to Do About External Friction

I wish I could tell you that I’ve discovered ways to avoid every sort of external friction we experience when we are building businesses and building wealth. Alas, I cannot.

External friction comes, as I said, from outside agencies, many of which have enforcement powers. Unless the project you are bringing them is going to add tens or hundreds of millions of dollars in tax revenues to their coffers, any energy you spend on attempting to alleviate the friction by getting them to back down is likely to be wasted. More than likely, you’ll just end up delaying your project and tacking on extra dollars to its cost.

What you can do, however, is keep the friction to a minimum by being stoic about it and not allowing yourself to get upset.

Internal Friction

Internal friction refers to problems that arise from within a business. These would include differing priorities, communication systems, and corporate cultures.

Individual departments, for example, may have different vacation policies, working hours, break times, and so forth. Or one department might use a different meeting and/or notetaking system than another department, which can make it difficult for everyone to be on the same page.

Most irritating can be clashes between individual employees… and you!

What to Do About Internal Friction

You might think, “I can’t believe these people are giving me – the person who pays their salaries – such grief!”

And to be sure, one way you can eliminate that kind of internal friction is to fire the offender.

But although that is sometimes exactly the right thing to do, it’s not always so. Sometimes employees slow you down because they can see that what you want them to do is going to have negative repercussions that you will regret.

That’s the challenge in dealing with internal friction.

What I’ve learned to do is not especially clever. It’s a technique I discovered 40 years ago, and it’s worked so well that I’ve never needed another one. Here it is: When an employee criticizes a plan or project you want to set in motion, instead of discussing it with them to try to win them over to your side (which could take a lot of time and only increase your frustration), say something like, “That’s an interesting point, John. I’d like you to think about it and come back to me tomorrow morning with three suggested solutions.”

The next day, one of three things will happen. John will come back and admit that your idea is good to go. He will come back with a better idea. Or he will come back and tell you, “It’s not my job to find solutions, that’s your job!” – in which case… you fire him.

Economic Friction

Economic friction in business includes macroeconomic factors such as inflation and deflation, industry factors such as material and labor gluts and shortages, supply chain issues, regional and local competition, union demands, and, of course, federal, state, and local taxes.

The big problem with economic friction is that it is often unpredictable and almost always beyond your control. Taxes, of course, are predictable and therefore easy to plan for. But macroeconomic swings cannot reliably be predicted. And even industry trends and responses, which often can be foreseen, will sometimes happen quickly and without warning.

What to Do About Economic Friction

The good news about economic friction is that – although there is almost an infinite number of types – they all have the same solution: insurance.

Insurance was invented to protect individuals and businesses against unpredictable and uncontrollable negative future events. Because insurance programs work with large pools of customers, they can often give you the protection you will need for a price you can comfortably afford.

But is it possible to buy insurance against economic events like inflation or deflation or recession or depression? Not conventionally, as you would against fire or flooding. The way to insure yourself against future economic friction is two-fold: Always keep the spending you do to a minimum. And put a portion of every dollar of profit you get in an “economic emergency fund.”

I have done that with every business I’ve ever owned or run. I do it with my personal income, as well. I do it because I know myself. I know that what I hate much more than saving money for a rainy day is having to come out of pocket to pay for that rainy day.

Personal Friction

Now we come to the sort of friction that every wealth builder and every aspiring wealth builder will inevitably have to deal with. It’s what I call personal friction – meaning it is manifested by your family and friends.

When internal friction in business is manifested personally, it usually comes from partners or colleagues or employees that are not on board with your plans to build the business and are making it more difficult for you to move ahead. And as I explained above, my technique for dealing with it in the case of employees (which is most often the case) is, in my experience, extremely effective.

But here’s the problem with personal friction. If you try to apply that technique to family and friends – as would happen if you tried to apply it to partners or colleagues in business – they won’t likely be willing to come back to you with three solutions to the problem at hand. And if they don’t, you can’t fire them.

What to Do About Personal Friction

The most important thing to know about personal friction problems is that your chances of solving them by persuading the friction-causing friend or family member to see things your way are very, very slim.

When friends and family members question and criticize your ideas, they are rarely doing so because they want to help you avoid making serious mistakes. They’re doing it because of what psychologists would refer to as “relationship dynamics” – patterns of behavior developed over the years by the people in the relationship, for whatever reasons, that affect the way they interact, communicate, and relate to each other.

And this puts you in a very difficult position:

* You can’t change them.

* And you can’t fire them.

So, what do you do?

I have discovered only one thing that works. And even then, it is far from perfect. My solution is to change the only thing I have a chance of changing: the way I react to the friction they are creating.

I convince myself that, however much it irritates me, they are doing what they are doing out of love. And then I imagine myself – I actually visualize myself – receiving their criticism calmly and even gratefully. I imagine myself thanking them for their caring thoughts. And then I imagine myself ignoring everything they’d said.

It may be hard to believe, but you really can, through purposeful thinking, meditation, and visualization, do this.

Because this kind of friction is a part of you, you have the power to control it.

Political Friction

There is one final sort of friction you may encounter – especially when you’re trying to build a family-owned business.

In terms of a category, I’d call it half personal and half internal. What makes it especially difficult to handle is that it is invisible. Which means that it can fester and grow without you even being aware that it is happening. And its potential for destroying a strong and profitable business is great.

This kind of friction exists in almost every medium- to large-sized business. And yet it is almost never addressed in business classes or talked about among businesspeople.

I call it political friction.

What to Do About Political Friction

The fundamental currency of business – the metric one uses to measure the financial health of a business – is profit. Honest, sustainable, enduring profit. Which means that whether you’re the CEO or an employee working on the clock, the obvious way to advance your career is to continually contribute to the long-term profits of the business you’re in.

Politics is nearly the obverse. The currency of politics is power. All politicians understand that advancing their careers is about acquiring more and more power. Although having wealth can sometimes help a politician advance, wealth is not, in and of itself, a reliable way to acquire power. In politics, it’s all about making connections and making deals and making promises to colleagues and constituents.

The problem with power as a currency is that it operates in a zero-sum universe. Gaining more power means, by definition, taking power away from others.

In business, on the other hand, the potential for profit is unlimited. A business can (and often does) continually grow its profits by, for example, continually expanding the market for its products.

There are, however, more than a few smart and ambitious people in every industry who take the political approach to advancing their careers. Rather than focusing their time and intelligence on improving the profit potential of the businesses they work for, they apply their energy to acquiring personal power within the organization – which usually means pandering to their superiors.

Politically minded executives breed political underlings because they are not seeking to hire people to help them improve the profits of the business. They hire people like themselves – people who they know will do whatever it takes to please their boss. And that often includes executing projects and policies that make the customers unhappy and the business weaker.

If you have someone like that working for you, it may be difficult to spot them. That’s because political employees are especially skilled at making you believe they have your back and will help you move up the corporate ladder. And they will do so, so long as it helps them in their own climb. But since their loyalty is only to themselves (and the power they hope to acquire), they will throw you under the bus the moment it is helpful to them.

You’ve been warned. So be wary.

When I mentor young executives, I explain to them that, in rising to the top of any business, they will encounter all sorts of challenges and problems. I tell them that they will be able to handle many of them by analyzing data and using logic to find solutions. But when they get involved in people problems – either individual personalities that aren’t committed to the company mission or political personalities who think only in terms of acquiring power – they are getting themselves into corporate quicksand.

There is one more type of friction that has a significant impact on slowing down the natural wealth accumulation curves. It applies to not just business building but to individual investing – and if not identified and remedied, will eventually erode any progress you’ve made over the years by hard work and smart thinking.

I’m talking about…

Friction in Finance and Investing

The most common and most serious friction you will encounter as an investor is expenses – often hidden expenses – that you will be asked to pay.

I’m thinking about such impediments to wealth building as brokerage commissions and fees, transaction costs, taxes, and more.

Benjamin Obi Tayo, Professor of Engineering & Physics at the University of Central Oklahoma, talks about this sort of financial friction using the metaphor of a rocket:

When a rocket is launched into orbit, the rocket has to generate enough thrust to compensate for the incessant gravity [friction] produced by Earth. As a matter of fact, rockets burn about 95% of their fuel to escape Earth’s soupy atmosphere.

When the rocket is in orbit, it becomes the master of space – covering thousands of miles with just a touch of propulsion.

The Earth’s atmosphere and incessant gravity are your investment costs and fees. These fees and costs can greatly slow down your wealth building process.

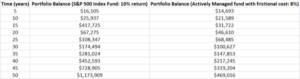

To illustrate, Tayo offers this hypothetical study of two investment strategies.

Case 1: An investment in an S&P 500 index fund with an annualized average return of 10%.

Case 2: An investment in an actively managed fund that produces an annualized return of 11% but charges 3% for management fees and costs.

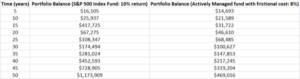

The table below shows the portfolio balances for the two cases.

“We observe from the table above,” says Tayo, “that over a 50-year period, a portfolio that is passively managed with less frictional costs produces a return of over $1,100,000, while the portfolio with more frictional costs produces a return of about $500,000 over same period, a difference of over $600,000.”

In a recent issue of Legacy Wealth Monthly, Sean had this to say about the friction caused by financial fees:

The financial industry has been under a lot of pressure recently to lower fees, and it’s all thanks to low-fee or no-fee competition.

In the past, stock brokerages made most of their money from commissions and trading fees. It used to be the case that stockbrokers would charge 2% fees for the amount traded.

That’s buying and selling.

Meaning: When you purchased, you were immediately 2% in the negative. And when you sold, you lost 2% of your total stake.

Now we’re entering an era where trading fees are almost non-existent for the vast majority of self-directed online brokerages. (This hasn’t begun happening all over the world. But in America? It is now almost impossible to find a brokerage that has trading fees.)

However, wealth managers will still charge up to 1% of your assets that they manage per year.

And many mutual funds, closed-end funds, and ETFs will charge management fees and expense ratios.

Consider something like the Invesco KBW High Dividend Yield Financial ETF (KBWD), which lures investors in with its 12%+ dividend yield.

What most investors fail to notice is the fund’s 3.84% expense ratio!

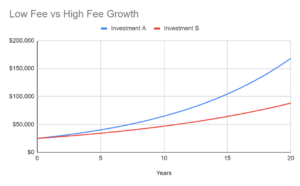

Just to illustrate the comparison, let me show you how this can impact your wealth.

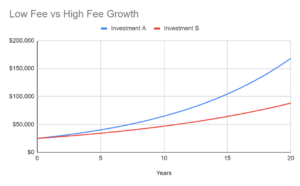

The chart above shows how much $25,000 would grow to if you achieved a 10% return for 20 years with no fees. That’s investment A.

But investment B shows you the same investment, the same returns, but with a 3.84% fee.

As you can see, adviser and fund fees are a major drag on the performance of your portfolio. And it only gets worse over time.

So not only is it important to avoid trade commissions and wealth management fees, it’s also important to avoid mutual fund expense ratios – especially if they’re greater than 0.6%.

Back to the Idea of Estate Planning…

I began this chapter by telling you what I learned about the dangers of dumping a ton of money on your family after you die and hoping it will make everyone happy.

When the wife-and-husband team we hired to help us avoid a trap that so many other wealthy families had fallen into joined us in our first official family meeting, they arrived with countless stories and facts confirming our worry that leaving our heirs lots of money would only create anger and family fragmentation.

And they arrived with at least a half-dozen techniques that they said they had used with other families with good results.

The first was a test designed to identify our individual work or “leadership” styles – to match each of us with one of four profiles: directors, persuaders, counselors, or analysts.

You should understand that neither side of our family – neither the Fords nor the Fitzgeralds – are comprised of people that would be comfortable with these sorts of psychological assessments. Especially any that sought to suggest that our individual personalities could fit into some sort of universal type. Speaking for myself, I would say that the test seemed more akin to astrology than to science.

Nevertheless, we all agreed to suspend our suspicions for the moment and take it.

Each of the leadership types, we were told, tends to approach decision-making in different ways.

Directors are quick to take the lead, suggest solutions, and are impatient to see their solutions carried out.

Analysts are uncomfortable with quick decisions, preferring to mull over questions and opportunities, considering what might go awry before coming to a conclusion.

Like directors, persuaders are quick to come up with solutions. But unlike directors, they are not necessarily impatient when it comes to implementing them. They prefer, as their title suggests, to first achieve consensus through persuasion.

As for counselors, they are not much interested in solutions per se. Their main interest is in keeping the group dynamics pleasant.

None of us was particularly optimistic that this test would be at all applicable to us. But when we saw the results, we were surprised.

I was identified as being strongly in the “director” corner. And everyone agreed that “director” matched very well with my actual work style.

K and our first two boys were labeled “analysts,” and our third son was somewhere between “persuader” and “counselor.” Again, we all agreed that the test’s conclusions were right.

The next step was about recognizing the challenges that each personality type has in communicating effectively with the other three.

We learned that of the four types, the greatest natural conflict tends to be between directors and analysts. And it was clear to all of us that if we wanted to succeed as a family unit, our director and our three analysts had to learn how to get along with one another, without the constant squabbling and subsequent bad feelings.

Which brings me back to the reason we got involved in this program in the first place…

Overcoming Friction to Make Good Financial Decisions

I eventually realized that what we were dealing with here – the tension caused by a clash of personalities within the family – was a form of friction that would inevitably thwart the estate planning I was trying to put in place to benefit them. To overcome it, the group came up with several suggestions.

One example: When I have an idea about something we should or shouldn’t do as a family, instead of simply stating it as a “done deal” (which is what I usually did) and then being forced to defend it against the barrage of criticisms that would always follow, they told me to present the idea as soon as I come up with it, and then give them some time to consider it.

At first blush, this seemed unnecessary and artificial. But when we put it into practice, it worked very well.

I didn’t feel attacked. And they didn’t feel pressured to have an immediate opinion. They could go home and take a day or two to do the analytical thinking they liked to do.

The net result was that decisions involving the family were made with more cooperation and less stress. Better yet, we learned that when decisions were made by consensus, it immeasurably improved the likelihood that they would work long-term.

The Takeaway

Almost everything you do to build wealth – either by starting or investing in active businesses or by investing – is going to meet with some sort of resistance or “friction.” It’s The Third Natural Law of Wealth Building. And like Newton’s Laws of Motion, it is governed by internal and external forces.

You can’t avoid it, but you can overcome it.

It will be challenging, but that’s a good thing. The fact is that the universe is designed in such a way that nothing worth having is easy to get.

An Excerpt from The Art of Collecting Art

Introduction

I fell in love with art when I was twelve.

That’s not exactly right. I fell in love with Gabriella, a petulant 14-year-old beauty.

She was the daughter of German aristocrats – Jewish intellectuals who had emigrated to America before World War II. Our parents knew one another through part-time teaching jobs they had at St. John’s University on Long Island, New York.

Gabriella’s father was an art critic and historian, and both of her parents were collectors of art. Their home was a museum of paintings and drawings and sculptures – much of it done by (I now know) early 20th century modernists – as well as curiosities and collectibles of every possible kind.

They lived in a neighboring town, and once a month or so, our family would spend a day visiting them. I loved being there, mostly to be in the Gabriella’s aura. But my love was not requited. She was more interested in spending time with my elder sister. And so, I spent a fair amount of time in that house by myself, looking at all the art.

Thinking back now, I don’t know if Gabriella’s family was wealthy or merely upper-middle class. But their house, with all its art, felt like wealth to me. Later, in my teens and twenties, whenever I would dream about becoming “rich,” the image that would come to mind was always some version of that house.

And that may be why, as soon as I could afford to, I began collecting art.

At first, I bought from street fairs and flea markets – whatever I could afford that pleased me. And what I could afford back then wasn’t much. As the years passed and my income rose, what I was willing and able to spend on art rose along with it.

Eventually, I experimented with buying art at auctions. That was an entirely different experience. Very fast. Very exciting. And, usually, a lot of fun. Auctions are tailormade to appeal to buyers like I was then: enthusiastic, overconfident, and ignorant.

But there was an upside to buying at auctions – at least at the bigger auction houses like Christie’s and Sotheby’s. They were public. That meant there were published evaluations of the art they were selling. And those estimates could be validated by the bidding. So long as I didn’t let myself get carried away and kept my bids at or below the estimated ranges, I could feel reasonably confident that what I was buying had some legitimate market value. So long as I didn’t chase any piece too far into the bidding, I could feel comfortable knowing that, if I won it, the price I paid was realistic.

That was my thinking. And in retrospect, it was mostly correct. Later in my collecting career, I came to understand more about how art is priced from the inside. And how much auction houses make on selling it. And how they participate in buttressing certain artists and types of art.

Still, buying at auction the way I was doing it then was giving me some protection against being swindled. That was something that surely happened to me time and again when I did all my buying at street fairs and flea markets, with no understanding of what I was buying and no idea how to determine its actual worth.

I have come a long way since then. And, based on my experience, I believe that it is possible for anyone, even a rank amateur like I was, to assemble, over time, a first-class collection that will not only provide decades of enjoyment, but also an appreciating store of wealth and a lasting legacy for their heirs.

It can be used to balance a conventional portfolio of stocks, bonds, and real estate, help protect that conventional portfolio from inflation, insure against economic or political instability, and even contribute to a retirement income.

I did it, and you can, too.

Let’s get started…

Part I: I Dip My Toe into the Art Business and End Up with My First Collection… and Then Another One… and Another One

In 1989, I bought a half-interest in an art gallery in my hometown of Delray Beach, Florida. It was a way for me to live out a fantasy that had been materializing in my imagination for many years. I had this image of myself owning a boutique gallery and spending many happy hours there surrounded by beautiful things, reading books, and occasionally chatting about art with potential customers that would stop by. I thought of it as something I could enjoy in my free time while I was still working and eventually do full-time when I retired. (My main job was in publishing, but I had also started to develop several entrepreneurial businesses.)

Reality did not comport to my imagination.

In my role as co-owner, I learned that the art business was 80% about selling and only 20% about the art. And one needed to work just as hard to sell art as one would work to sell anything in any other industry.

So, instead of the leisurely hours of enjoyment I had imagined, I was spending all my time there trying to make sales.

I stuck with it for more than a year. But I finally had to admit to myself that it wasn’t for me.

I took my partner out for drinks one evening and told him that I wanted out. He wasn’t happy. But he wasn’t surprised. “What the hell did you think this was?” he said, shaking his head sadly. “It’s a business!”

He was right. The gallery business – at least the way he did it – was intense and non-stop person-to-person selling. He expected me not only to close a sale with every warm body that wandered into the gallery but also to harass my family and friends into spending money there.

The deal that we worked out was interesting. Rather than buy me out with cash, he would give me artwork from the gallery with a retail value equal to my original investment. I understood the difference between retail and wholesale was considerable, but I figured that was the tuition I owed him for learning two very important lessons: One about what sort of work I was willing to do at that point in my life. And the other about the day-to-day business of buying and selling art.

I had closed the door (at least temporarily) on my dream of living out my retirement years as an art dealer. But I had opened the door to the equally enticing dream of becoming a collector.

An Excerpt from Wealth Culture

Introduction

In The Wealth of Nations, the 18th-century Scottish moral philosopher Adam Smith said that “wherever there is great property (private wealth), there is great inequality.” And “for every rich man… there must be at least five hundred poor.”

When Smith wrote those lines in 1776, the English and American economies were still largely agrarian. And notwithstanding a rising middle class consisting of artisans, merchants, and traders, the aristocracy owned 90+% of the farms and virtually all the large industries of that era, including textiles, shipbuilding, and metalworking.

The “First” Industrial Revolution

In the 60 to 65 years that followed the publication of that book, the economies of England, America, France, Spain, and Portugal grew rapidly. Buoyed by trade with and investments in their colonies, the middle classes of these countries (merchants, artisans, shipbuilders, textile manufacturers, metalworkers, and traders) grew even more. Along with this growth in their gross domestic product (GDP), PCI (per-capita income) grew as well.

And yet, the gap between the richest and the poorest grew wider. Not because the poorest got poorer (that would have been nearly impossible) but because the middle and upper classes became considerably richer.

Fact: In the years leading up to the 1789 French Revolution, the top 10% of the country’s population held around 90% of the wealth, and the top 1% held up to 60%.

The Second Industrial Revolution

Beginning in about 1880, a second Industrial Revolution occurred. This one lasted only about 40 years. But it was larger than the first one because it was spurred by the advent of modern technology, the availability of natural sources of energy, and the globalization and sophistication of banking, including the expansion of free-market Capitalism, which allowed entrepreneurs and business visionaries to finance their profit-making dreams.

During this Industrial Revolution, the aristocrats and wealthy families that had occupied the highest strata of wealth for hundreds of years were replaced by industry leaders – i.e., the factory owners, oil diggers, coal miners, railroad builders, and bankers that rose to the top of their industries.

The middle classes also grew and prospered during the second Industrial Revolution, as merchants, tradespeople, and small business owners profited from the ever-increasing flow of money that was generated by the now much richer and more populous upper class.

The Working Classes

Much has been written about the plight of the working classes during the second Industrial Revolution – most of it depicting working 12-hour days, six days a week, for meager wages.

In fact, the working classes saw financial improvements during the second Industrial Revolution. Their incomes and savings went up – not as much as those that employed them, but enough to provide them with slightly more comfortable lives.

What has been talked about considerably less in discussing the economics of the time was a new and fast-growing group of people. I’m talking about the “unemployed.”

These people were largely penniless, like the working classes before them, But one could argue that they were worse off because they were forced to rely on scarce charitable sources (mostly religious organizations) to survive.

There is no doubt that for most people at the time, the two Industrial Revolutions produced more economic opportunity for more people than anything else that had ever happened. But the wealth gap between the richest and the poorest was even greater than it had been in the previous hundred years.

In the 20th Century…

Wealth and income inequality was far higher in some parts of the world than others. Nevertheless, the wealth gap between the richest and poorest within each country did not disappear. In some cases, depending on how you measured it (median vs. mean incomes, for example), it widened.

The Communist revolutions of Russia, Eastern Europe, China, Cuba, and some African countries were, in theory at least, an attempt to narrow the gaps. And they succeeded, although not greatly, with the gaps between the middle classes and working classes. But the gaps between the richest and the poorest remained wide.

In the 21st Century…

In 1989, the total household wealth in the US had been $32.87 trillion.

* The top 10% of Americans owned (67%) of US wealth.

* The next 40% owned less than a third (30%).

* The bottom 50% owned only 3% of the wealth.

In 2016, 27 years later, total household wealth in the US nearly tripled, to $86.87 trillion.

* The top 10% of Americans owned (77%) of US wealth.

* The next 40% owned less than a quarter (22%).

* The bottom 50% owned only 1% of the wealth.

And in 2024, the top 10% of Americans owned 67% of the country’s wealth, while the bottom 50% owned only 2.5%.

Observations on Historical Patterns

In free-market economies, when countries grow richer, so, too, do their populations. The degree of enrichment is never even.

Those at the top – the entrepreneurs, owners, and leaders of high-growth industries – generally become vastly wealthier, proportionately, than everyone else.

Those that directly support economic growth (bankers, lawyers, CEOs, senior marketing executives, brokers, etc.) are usually next in terms of the disproportionate advancement in net worth.

Next are the high-earning professionals, such as doctors, lawyers, analysts, engineers, real estate brokers, art and collectible dealers, and others who service the wealthy.

Then comes the larger middle and working classes, whose incomes rise at a rate equal to or a bit above the general escalation of wages and products.

And finally, there are classes that, for whatever reasons, are unemployed and/or depend on private charity or public welfare. These people are generally unaffected by the trickle-down growth of the economy. Thus, in terms of relative income and wealth, the gap between them and the rest of the population increases.

In countries whose economies are agrarian or oligarchical or centralized and controlled, there is usually little or no advancement in personal wealth among any of the classes except for the government officials and bureaucrats that tax the GDP growth and take most of it for themselves.

In short:

* In agricultural economies, the richest are those who inherit power or seize it.

* In Socialist economies, the richest are those that garner the most political power.

* In Capitalist economies, the richest are those that create industries.

However, this is not the whole story. What is more interesting for the purposes of this book is that within all countries with free-market economies, there is always a significant disproportionality between cultural groups.

And that is because some cultural groups are already positioned, in terms of where they are in the hierarchy of income and wealth, to enjoy the disproportionate increase in the growth of their economy’s overall increase in wealth.

This book is about those cultural groups. Why is it that they are almost always positioned to see their individual incomes and rates increase over everyone else’s?

And why is it that even if they emigrate from a middling economy to a strongly growing one, they move quickly into higher positions in the wealth hierarchy and almost always rise faster than others at the same higher levels?

My research suggests that there are certain groups of people in the world – ethnic, religious, and cultural – that have ingrained values and habits that give them a significant advantage to not only get into superior positions of wealth advancement, but also move up the ladder of income and wealth accumulation faster.

Thus, my thesis is that by learning what these values and habits are, and by adopting them into one’s own values and habits, anyone can have the same wealth-accumulation advantages as those at the top of the hierarchy, regardless of their race, ethnicity, religion, or the financial position they’re in at the beginning of their income and wealth-building transformations.

In the first chapter of this book, I will identify the cultural groups that are predisposed to building wealth. I will provide data to support the conclusions of my research – that these values and habits are the essential factors in capturing higher incomes and accumulating wealth.

In the second chapter, I will identify what I believe those values and habits are and provide evidence to support my claims.

And in subsequent chapters, I will attempt to create a template that can serve groups of people, large and small, as well as individuals to move rapidly up in the income and wealth hierarchy, regardless of where they begin.

A Quick Video Course on Economics in 8 Lessons

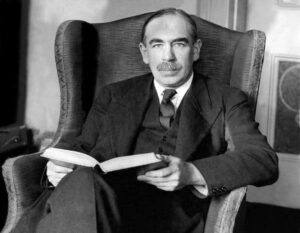

The ABCs of John Maynard Keynes and Keynesian Economics

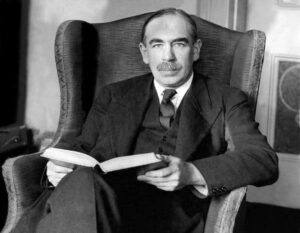

John Maynard Keynes and Milton Friedman were the two most important and influential economists of the 20th century. I published my first quick video course on economics – on Friedman – in the Nov. 1 issue. This one is about Keynes.

But before we get to the videos, let me give you a brief history of the man and an explanation of why his ideas are necessary if you want to understand how the world works today.

Who Was John Maynard Keynes?

John Maynard Keynes was born on June 5, 1883 in Cambridge, England, into a well-to-do academic family. His father was an economist and a philosopher; his mother became the town’s first female mayor. He excelled academically at Eton College and then at King’s College, Cambridge, where he studied mathematics.

After graduating, Keynes worked in the civil service, joining the Treasury when WWI broke out. In 1919, following signing of the Versailles peace treaty, he published The Economic Consequences of the Peace, in which he criticized the exorbitant war reparations demanded from a defeated Germany and predicted that it would foster a desire for revenge among Germans. The book became a bestseller and made him world famous.

Keynes amassed a fortune from the financial markets. He became a prominent arts patron and board member of several companies and was part of the Bloomsbury group of intellectuals. In 1926, he married Lydia Lopokova, a Russian ballerina.

In 1942, he was made a member of the House of Lords, and in 1944 he led the British delegation to the Bretton Woods conference in the United States. At the conference, he played a significant part in the planning of the World Bank and the International Monetary Fund.

He died on April 21, 1946.

“Keynesian economics,” as his theory is called, has become a cornerstone of modern economics theory and undergirds the structures of most advanced economies in the world.

Keynes’s best-known book, The General Theory of Employment, Interest, and Money, was published in 1936. In it, he challenged what economists call Classical Economics Theory, a philosophy derived from the ideas of David Hume and John Stuart Mill and realized in Adam Smith’s The Wealth of Nations, published in 1776.

The core tenets of Classical Economics Theory were:

1. The concept of private property

2. The establishment of laws to protect private property

3. The establishment of free markets absent of government interference or regulation

4. The employment of private capital to fuel economic growth through industry and trade

Keynes believed in three of those ideas, but not the third. He believed that there was a role for government in smoothing out market fluctuations and preventing massive economic downturns.

“For my part I think that Capitalism, wisely managed, can probably be made more efficient for attaining economic ends than any alternative system yet in sight, but that in itself is in many ways extremely objectionable. Our problem is to work out a social organisation which shall be as efficient as possible without offending our notions of a satisfactory way of life.” – John Maynard Keynes

And now for the video lessons…

Lesson One: An Introduction to Keynesian Economics

Part 1

Watch Time: 11 min.

Watch it here.

Part 2

Watch Time: 10 min.

Watch it here.

Part 3

Watch Time: 12 min.

Watch it here.

Notes:

* Keynes’s economic theories existed in the space between the theories of Adam Smith and the ideology of Marx and Engels.

* Keynes believed that government should play a role in managing its economy to avoid major recessions and depressions and to smooth out the smaller economic ups and downs.

* The government tools for limited intervention that Keynes recommended were industrial and business regulation and stimulating the economy by borrowing and spending money to increase demand.

Lesson Two: Key Distinctions Between Keynesian and Classical Economics Theories

Watch Time: 13 min.

Watch it here.

Notes:

* Keynesian Economics is not a refutation of Classical Economics, but an addendum.

* Classical Economics (Adam Smith) argued that economies work best if governments leave them alone and that any attempt to regulate or manipulate an economy will only make matters worse. Keynes believed this was wrong and that there was a place for “judicious” limited involvement.

* “The invisible hand” is a metaphor for the unseen forces that move a free-market economy. Because of flexible prices and wages, it naturally correct itself. As consumption increases, inflation takes place and prices rise. Consumption slows and prices go down (deflation). Aggregate demand slows and the economy decreases. Prices get lower and, because prices are lower, consumption increases.

* Keynesian Economics says that during a deflation, some point prices “stick” and won’t go down. The same is true of wages. If they go too low, they stop falling. The GDP may decrease but prices and wages won’t move.

Lesson Three: Keynes’s Supply & Demand Theory

This video lesson comes from the Kahn Institute. The approach here is technical. Other lessons in this course cover the same material, but this one provides extra value in acquainting you with some of the easy-to-understand-but-fancy phrases used by economists.

Watch Time: 12 min.

Watch it here.

Lesson Four: Demand-Side Economics in 60 Seconds

The same information as Lesson Three… but in only one minute!

Watch Time: 1 min.

Watch it here.

Lesson Five: The Aggregate Supply Curve (The Keynesian Curve)

Watch Time: 13 min.

Watch it here.

Notes:

* Why it is that when there is an economic recession or depression costs don’t increase as you grow out of it?

* A difference between Classical Economics and Keynesian Economics explained through “the silly story of a young couple.” The lesson is about spare capacity vs. full capacity and undercapacity.

Lesson Six: Keynesians vs. Monetarists on Macroeconomy

From Enhance Tuition, a brief lesson on the difference between Keynesian and Monetarist theories.

Watch Time: 5.5 min.

Watch it here.

Notes:

* Classical Economics Theory (Milton Friedman) believed that the financial markets would adjust themselves to economic irregularities naturally in time because of the natural fluctuation of interest rates and the decisions of individual economic actors pursuing their best interests.

* Keynes believed that sometimes – during stubborn recessions and depressions – the free-market solution can take too long. And that government spending can speed up that process and thus obviate the worst conditions.

Lesson Seven: Problems with Keynesian Economics in Action

From The Kahn Academy: In this video, the narrator identifies the primary weaknesses of “Keynesian Thinking.” You may find it, as I did, a bit too technical. B ut it has the advantage of identifying the problems with specific and pragmatic examples.

Watch Time: 8 min.

Watch it here.

Notes:

* When governments spend large sums of money to stimulate a stagnant economy, the rise in wages and prices that follows is nearly impossible to reverse.

* Over the long run, priming the economic pump can work. But when that government spending is fueled by debt, the long-term result is almost certainly bad – a choice between high inflation or a crushing recession.

Lesson Eight: Other Schools of Economic Thought

From Crash Course Economics, a brief summary of different economic theories from Malthus to Friedman to Hayek to Marx and Engels to Keynes.

Watch Time: 10 min.

Watch it here.

Notes:

* Thomas Robert Malthus: Predicted world population growth would lead to inevitable global famine. He was wrong. He didn’t factor in technological advancements.

* Adam Smith: A person following their own self-interest will produce a greater common good.

* David Recardo: Free trade is better for everyone.

* Marx and Engels (Communism): A natural conflict between workers and capitalists.

* Principles of Economics by Alfred Marshall (published in 1890): introduced the concepts of supply & demand and the diminishing marginal utility of income and wealth.

* Keynes: Governments needed to interfere by using monetary and fiscal policies.

* The Great Depression was caused by bad monetary policy.