Chart of the Week: US Debt Reaches $35 Trillion

Today, Sean provides visuals to illustrate the greatest threat (next to a nuclear war, which is also looming) to the world’s economy right now: US debt.

This is a subject I’ve referred to dozens of times in past issues, and I’ve been meaning to write about it at length because so many of my well-educated friends are unable to see it as a real and present danger.

I’ll leave it to Sean to set the picture. – MF

While the media prattled on about Kamala calling Donald Trump “weird”…

A much weirder story got pushed to the back pages last week. One that will impact America far more than whoever becomes president in November.

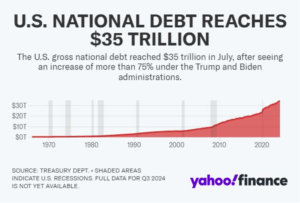

I’m talking about the US national debt, which just hit a whopping $35 trillion.

Since January 2020, the debt has ballooned by 50%, mainly due to the wide gap between what the US government spends versus what it brings in.

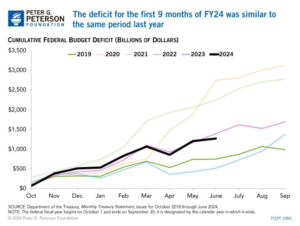

And right now, 2024 is shaping up to be another year of high spending and low tax revenues, which puts us on track to add an estimated $1.9 trillion to the debt this year.

Now, the debt is just a number. It becomes a problem only when the US can no longer service that debt, putting the country at risk for default.

Higher credit risk can halt lending, which seizes the financial system, which cascades a long way down to you eventually saying, “Hey! Why can’t I buy bread anymore? And why is my retirement money worthless? And are those gunshots I hear?”

So the number we want to pay extra close attention to is how much it costs to service that debt, and what percentage of the US government’s revenue that is.

Here’s what we’re seeing: Interest payments on federal government debt has already surpassed $1 trillion over the last year.

As a share of federal revenues, federal interest payments are expected to rise to 20.3% by 2025, exceeding the previous high of 18.4% set in 1991.

This number, if it gets too high, is the “danger number” – the number that matters.

Because if the US is spending all of its tax revenue to service its debt, it won’t be able to spend money on anything else. That means more money printing, which means hyperinflation, which –I reiterate – is double-plus ungood.

How close are we to the danger number?

Well, think about this. Lenders often require that the ratio of debt to a person’s income should be less than about 30% to 40%.

The higher your debt-to-income ratio, the less likely it is that an institution will lend to you.

The US is probably going to hit 20% next year. The higher this ratio goes, the fewer people will want US government bonds.

And that puts everything we know, like, and cherish at greater risk.

This number is going to keep creeping higher under three conditions: (1) more deficit spending, (2) lagging tax revenue, and (3) high interest rates.

Since 2020, we’ve had the perfect storm of all three. And neither political party has proposed a meaningful fix.

It will be some years before we hit the point of no return, however. About 20 to 30 years at the current pace, by some estimates.

That means that, for now, bonds are still an attractive speculation – especially heading into interest rate decreases.

But otherwise, it might be wise to buy and hold a basket of stocks that generate revenue internationally. That can include American companies that do business overseas, like some of the stocks in the Legacy Portfolio.

But it can also include a portion of your portfolio going into emerging market funds or international stocks. (Just don’t expect them to offer the wild returns of tech stocks.)

And if you’re truly, immensely, can’t-sleep-at-night worried about the debt collapsing the whole economy? Here’s what you want: international real estate, foreign cash, and a mix of the three most precious metals in a crisis – gold, silver, and lead.

Personally, I’d mostly just stick to bonds and stocks.

– Sean MacIntyre

Check out Sean’s YouTube channel here.