Chart of the Week: Retail Declines Again

Before I read Sean’s piece for this week’s issue, I was looking at retail numbers myself. I was wondering why the data was still largely positive when so many of my friends and acquaintances in the retail field are feeling like sales are slowing down.

At the same time, there are still more retail jobs open than are being filled. That again feels wrong to me. I don’t doubt the data, but I wonder if the scarcity of job hunters isn’t because millions of formerly employed workers are still hanging out, spending the last of the cash they received from the COVID bailouts and stimulus packages that the Biden administration enacted.

As you will see from his comments, Sean has a better grasp of this sort of data than I do. But when my personal sources are giving me the same sort of cautionary signals that Sean sees in the numbers, it leaves me wondering when the bill is going to be paid. – MF

I’m going to start calling it the “slow roll recession.”

Signs of US economic weakness keep appearing in the data. Taken individually, none of it feels particularly scary. But added up, we have a pretty strong reason to worry.

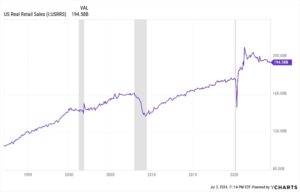

Here’s the latest thing I’ve seen that has me mildly concerned: Inflation-adjusted retail sales fell 0.9% in May and are currently about $15 billion below their April 2021 peak.

Right now, if this trend continues, we’re on track for a retail recession, with two consecutive quarters of year-over-year declines.

US recessions are labeled in gray in the chart above, and you can see how retail recessions are often a precursor to broader economic recessions.

That’s because consuming products and services makes up about 70% of US GDP. And retail sales account for nearly 40% of consumption.

Retail sales are like a canary in the coal mine. If they drop dead, you know we’re in trouble.

So should we be worried right now?

Well, if the American economy had a tachometer, the engine’s not running in the red yet – but lots of data suggests we’re somewhere in the yellow “warning” zone.

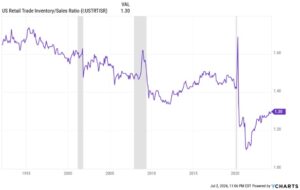

There’s another measure I’m watching closely, which is the ratio between retail inventory value and sales.

We sometimes don’t know we’re in a recession until months after a recession has begun.

But what we do know is that, when recessions occur, people stop buying stuff. Sales go down while inventory piles up.

Hence, we see big spikes in the Inventory/Sales ratio during recessions.

And we’re just not seeing that yet. Though “yet” is doing a lot of heavy lifting in that previous sentence.

So what should investors do?

Well, let me tell you this. I run stock screeners looking for value plays in the market pretty much every week. A value play in the market is simply a stock that looks like it is performing better financially than its price action would suggest.

Recently, a lot of retail stocks have been showing up on my screens. Dillard’s (DDS) for example. Dillard’s financial performance up to now has been exceptional… their price action, also exceptional… their valuation based on historical fundamentals, extremely attractive.

But what has happened tells us nothing about what will happen.

If American consumption is starting to sputter and there’s a risk that it starts to plummet as prohibitive cost inflation and high debt take their toll?

Retail stocks that don’t sell essentials are probably the last place you want to be as an investor.

So be careful out there.

– Sean MacIntyre

Check out Sean’s YouTube channel here.