Americans Are Still Losing Money on Their Money

As the Fed raised interest rates over the past two years, the returns on bonds and other debt instruments have increased substantially. While I’ve seen so many investment options become more expensive and/or more risky, the lure of getting 4.5% to 5.5% guaranteed is getting stronger. Such ROIs are still only a point or two above inflation, but it’s still a lot better than what I was getting previously – which in some cases was less than one-half of one percent.

That, by the way, is what you can expect from a bank savings account these days. One-half of one percent. Who would want to see the real value of their savings depreciate every year?

A whole lot of people, apparently. According to the WSJ, commercial banks are currently holding about $17.5 trillion in their vaults (on their ledgers). That is a whole lotta money sitting there and losing money. Click here.

I wrote the above before I saw Sean’s column this week. His thoughts and his data will give you the bigger picture. – MF

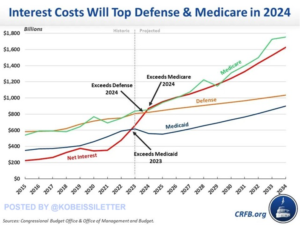

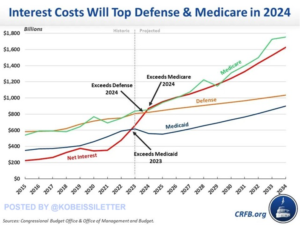

Chart of the Week: The Effect of Interest Rate Expenses

This week’s chart comes by way of The Kobeissi Letter, which had this to say:

For the first time in history, annual interest payments on US national debt will overtake defense spending in 2024, according to the CBO.

It is projected that for the full Fiscal Year 2024 (FY 2024), interest spending will hit $900 BILLION.

In Q1 2024, interest costs hit $1 trillion on an annualized basis and were $29 billion higher than defense outlays.

In the first 7 months of FY 2024, interest was also higher than spending on Medicaid, Medicare, and Defense, at $514 billion.

Meanwhile, in 2023, interest as % of GDP was the highest in 25 years and even exceeded World War II levels.

The US government needs lower interest rates more than ever.

As bad as $900 billion spent on debt servicing sounds, the US is projected to spend $6.5 trillion and bring in $4.9 trillion in 2024.

To make an analogy: Lenders typically look for a debt expenses-to-income ratio of 36% or lower. $900 billion is 18.3% of the US’s projected revenue. So we’re about halfway to the point where a theoretical lender would deny the US a loan on that basis.

But, importantly, debt servicing is economically stimulative. So is deficit spending. Government tax revenue would not remain flat if both persist. We’d see growth.

The whole thing is a calculus problem. Fortunately, someone else already did the math.

As I related in my column in the May 1 issue, we have about 20 years, probably less, before the US public debt spirals out of control. And that’s if the crazy monetary and fiscal policies we have persist.

But that likelihood will diminish if any combination of four things happens: Lower interest rates, lower government spending, steadily higher inflation, and higher taxes.

Of those four, we’re likely to see lower interest rates the soonest, though certainly not as low as we’ve come to expect since 2008.

The Swiss central bank recently lowered rates. As did the European Central Bank and the Bank of Canada.

Now that headline unemployment in the US is creeping up above 4%, we’re starting to see some shakiness in the job market.

And now that Target, Walgreens, Walmart, and Amazon are lowering prices, we’re going to see inflation start to level out. Rates were raised to combat high inflation. Now that deflation is happening in some sectors of the economy, there’s less of a need to hold high interest rates in the first place.

I stand by what I’ve said in the past: We’re probably going to see some rate cuts in late 2024, and we’re definitely going to see some in 2025.

This will be good for bonds and bond funds. It might also be good for profitable dividend-paying companies and utilities. And it will probably be bad for growth stocks in the short term, but beneficial long term.

Allocate accordingly.

– Sean MacIntyre

Check out Sean’s YouTube channel here.