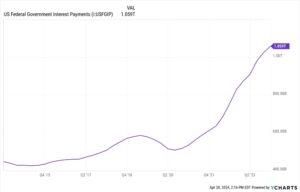

Chart of the Week: Interest Payments Explode

This week’s chart is an appropriate follow-up to Sean’s April 22 column and my April 24 post on inflation. As you can see from the chart, the cost of servicing our now +/- $34 trillion debt – the interest the government must pay on it – is fast approaching a trillion dollars a year. As Sean points out, the US is barreling towards the possibility of a default, which would mean a massive collapse of the economy and the end of US dollar domination.

He also tells you what he’s doing, in terms of his asset portfolio, to protect himself and his family from this possibility. – MF

For all the potential good and bad caused by government deficit spending, one thing is certain…

Every dollar spent beyond what the US brings in in tax revenue is a bill we’ll have to pay later.

The US has collected about $2.2 trillion in 2024 so far. It has spent, however, $3.3 trillion. (Click here.)

To cover these deficits, the US issues government bonds. As E.J. Antoni with the Heritage Foundation writes:

Between new debt issued to cover current deficits and old debt being rolled over, the Treasury will auction about $10 trillion of debt this year, much of it having an interest rate of about 5%. This is less than one-third of the federal debt but will cost $500 billion annually to service.

The rest of the debt, about 70%, will cost another $500 billion annually because the interest rates on the remaining notes and bonds are still relatively low. While that buys America some time to try and [defuse] this debt bomb, it still means we’re paying over $1 trillion a year just in interest on the debt.

Here is a chart showing how interest payments on US debt are exploding upwards in the wake of high interest rates and continued deficit spending:

This exploding cost to service our debts is moving the US ineluctably closer to a point of no return.

The government has three options: Move from deficit to surplus (unlikely anytime soon), let inflation go wild, or drop interest rates dramatically. Otherwise, the US will be in a perpetual debt spiral and will likely default, causing a catastrophic cascade of calamitous economic ramifications.

When will the US have to face a great reckoning?

According to economists at Penn Wharton, we have a bit of time:

Under current policy, the United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly (i.e., debt monetization producing significant inflation). Unlike technical defaults where payments are merely delayed, this default would be much larger and would reverberate across the US and world economies.

They note, however, that this timeframe is a “best case” scenario for the US.

If investors, businesses, or foreign governments lose faith in the US as a debtor, the timeline will likely accelerate.

In the nightmare scenario triggered by a government default, however unlikely, there could be a great churn followed by a great freeze. Big banks would have to find new assets to serve as collateral. And after that, many might step away from the markets entirely – making it more difficult to buy or sell any asset.

Most stocks would likely crash, too, as higher borrowing costs would stifle most lending and growth.

So how can one protect their money?

Tangible assets, like gold and silver, would be a good start. Some amount of foreign currency would be good, too. So might holding international stocks that issue dividends, as well as some basic materials and commodity stocks.

I have, for example, moved about 5% of my net worth into precious metals and foreign cash.

I do not believe a default will happen in my lifetime. But I do know that I’d rather have a fistful of gold and Swiss francs than even the slightest niggling bit of worry about what the future portends.

– Sean MacIntyre

Check out Sean’s YouTube channel here.

Trump’s Truth Social: Does It Have a Future?

I don’t entirely share Sean’s feelings about Trump, but in this video on Trump’s Truth Social stock, he does a clear (and amusingly sarcastic) job of not just telling us why its share price tumbled, but in explaining some of the fundamentals of how SPACs and IPOs work, and what investors should understand before they buy them.

The American Dream That Isn’t

Emma Tucker, in the April 27 WSJ, says that young Americans are “getting left behind” in terms of enjoying the American Dream because of an unfortunate combination of historically high real estate and stock prices. “Higher prices are considered signs of a good economy,” she writes, “but for many, they hurt more than help.”

Read more here.