Here’s something we see too little of…

… a government official sincerely apologizing for a mistake. Click here.

Here’s something we see too little of…

… a government official sincerely apologizing for a mistake. Click here.

Old Men Worrying About the Future:

Three Predictions We Won’t Live to See

I got into an email chat with my Myrtle Beach crew that got briefly serious. In a single afternoon, we covered the economic, political, and social future of our country. Plus overpopulation. Plus global warming.

I thought the conversation was brilliant. On every topic, the group differed, with about a third presenting a pessimistic view of the future, a third feeling optimistic, and a third admitting they had no idea. Lots of good points were made. But I’ll just give you my best recollection of what I said:

Global Warming

The globe may continue to warm for some time, and that may change our climate and our topography to a significant degree. But it won’t end the world. Nor will it end the presence of Homo sapiens. As the physical world changes, population densities and lifestyles will adapt, aided by technology that will allow human beings to continue to be an important part of Earth’s ecosystem for hundreds or thousands of years. Which is, even in my most forward-caring moments, all I can bring myself to worry about.

Overpopulation

Our more urgent concerns were for our children and grandchildren, with overpopulation seen by many in the group to be a major issue. But for much of the world, and most of the developed world, populations are shrinking. And to my mind, that is going to be a bigger problem than overpopulation for our children and grandchildren – perhaps the most serious economic and cultural challenge they will face.

Life and Lifestyle in the Future

My feeling is that there is a 50% to 60% chance that we will nuke ourselves into oblivion in the next 10 to 20 years. If, however, we can avoid doing that, technological advances that are already underway (e.g., robotics and AI) will change the human experience drastically. The world will no longer be comprised of have and have-not countries. Hunger and abject poverty will be problems of the past, violent crime will be rare, and most other forms of crime will cease to exist.

But what will also cease to exist will be personal privacy and liberty.

This will happen because everyone on the planet will be monitored, 24/7, by ubiquitous cameras, microphones, and other sensors (including some embedded in their bodies) that will feed millions of bits of data about everything they do and say into remote monitoring systems that will provide the government (and who knows who else) with almost instantaneous reports on their actions, statements, and (quite possibly) even their thoughts.

Along with the disappearance of personal liberty and privacy, the appreciation of independent and especially contrarian forms of thinking will be gone. Humans will gradually and happily give up their freedom to be and think differently in return for comfort, safety, and predictability in their lives.

So Many People in Jail for Using Drugs…

What If We Decriminalized It?

It’s no secret that there are more people in jail in the US than in any other country. In recent years, it’s been about 1.8 million and 1.9 million. China is next with about 1.6 million of its population behind bars… and their total population is more than four times larger than ours.

Looked at from a percentage-of-population perspective, the countries with the highest percentage of their people behind bars are El Salvador, Cuba, Rwanda, Turkmenistan, and American Samoa. The US is next, followed by about 16 or 17 countries with underdeveloped economies (such as Panama and Guam) before you get to another country with a developed economy (Russia).

Any way you want to look at it, the US is top of the list when it comes to incarcerating its citizens.

Why?

One reason often given is the growth of private prisons in recent years.

There are many undeniable benefits to the private management of jails and prison – more order, less trouble, and a better cost-per-prisoner ratio. But there’s also a downside. If private enterprise can make jails and prisons profitable, why wouldn’t they do whatever is in their power to grow the prison population, even if it means putting people in jail who should not be there?

I’ve done a little research into this. And while it persuaded me that the privatization of prisons is, in theory, a major factor in the growth of the jailed population, I found no data to support it. (One factual example: In 2000, about 80,000 people were held in private prisons. That number rose to about 140,000 in 2010. But by 2020, it had dropped to about 90,000.)

However, there is one factor that is considerably and demonstrably significant: the illegal drug trade.

In 2019, according to Pew Research, 1.6 million people in the US were arrested for drug-related offenses, compared to about 1.0 million arrested for property crimes, simple assault, and DUI. Among the +/- 1.8 million people locked up at that time, about 20% of them (360,000) were there for drug-related crimes, according to the Prison Policy Institute. Today, the total incarcerated population is about 2.4 million, of which 456,000 are serving time for drug-related offenses, according to The Center for American Progress.

In 1971, President Nixon declared illegal drug use to be “Public Enemy Number One.” Soon thereafter, Congress approved “the war on drugs” – a get-tough policy that has cost American taxpayers more than $1 trillion.

Unfortunately, this acceleration in arresting and convicting people for drug offenses has not deterred substance misuse rates. In fact, they have gone up. If that’s not bad enough, all these extra prosecutions have significantly increased the likelihood that, after being released from prison, ex-prisoners are 13 times more likely to die than the general population.

These facts have led many, including yours truly, to believe that America should end its costly and useless war on drugs by decriminalizing the use of drugs, and spend some of that saved money on deterrence and treatment.

This was the notion that the state of Oregon embraced in 2020, when they decriminalized drug use. I remember being happy about the prospect of so many fewer people being incarcerated for taking drugs, and hopeful that the number of violent drug-related crimes would be reduced because the market for selling drugs would become more relaxed and laissez faire, and less dangerous and competitive.

That’s not exactly what happened.

Decriminalizing drug use, obviously, drastically reduced the number of drug addicts in Oregon’s prisons. Unfortunately, it increased the number of drug users in the state and had no positive effect on treatment.

The 2020 ballot measure (which was supported by 58% of Oregon’s voters) simply dumped tens of thousands of people that would have been in prison onto the city’s streets. That, of course, hurt retail businesses and increased the cost of maintaining some semblance of cleanliness and safety.

As a result, earlier this month, the state reversed its three-year experiment in leniency and reinstituted jail time for drug use.

In retrospect, this shouldn’t have surprised anyone. Why? Because – like I’ve been telling you for months now – when it comes to bad habits, any kind of bad habits, people almost never change. They may try to change if you ask (or pressure) them to. But they usually only get worse.

So, if decriminalizing drug use only makes things worse, is there anything that can be done to minimize the enormous damage that is done every year because of drugs?

I have an idea that I’ll explain next week. It’s radical. But I think it could work. Stay tuned!

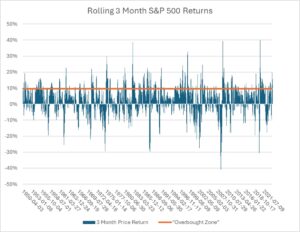

Chart of the Week: Is the Market Overbought?

This week, Sean asks a question that many stock investors and most stock traders have been worried about recently: For nearly 90 days, the market has been outpacing expectations. Is it “due” for a drop. And if so, how deep and when?

His approach to the answer is technical: comparing this most recent three-month streak to streaks in the past, going all the way back to 1950. I don’t use historic patterns to determine what stocks I buy and sell, how much I’m willing to pay for them, and when to get into or out of them. But I do like to read technical analysis because so many things in the universe seem to happen in patterns. And when technical data supports the fundamental analysis I use, it does make me a bit more confident about my buying and selling decisions. – MF

There’s no denying that the market has been on a hot streak over the last 3 months.

But how much longer of a hot streak should we expect to see?

To find out, I looked at all the S&P 500’s 3-month returns since 1950. Then I found out what return in this timespan is way higher than normal (9.5%).

We can set that 9.5% line as our “overbought” level. Any higher? The market tends to slow down or decline afterward, as you can see from the spikes on the chart above.

By this measure, the market has been overbought since late December 2023.

At the time of writing, we’ve had 31 consecutive days that the S&P 500 has delivered an unusually large gain over the previous 3 months.

When the gain is this high for more than a month (about 20 trading days), we only see this streak continue to day 37 on average.

But if we only look at days when the market’s 3-month return has been positive overall, we’re at day 74.

When these positive gain streaks last longer than a month, the streak of positive returns lasts about 99 days on average.

That means, more or less, we should not expect the market to keep carrying on like this for much longer.

We should expect, very soon, the market to go sideways or down, even if just a little bit.

And this is okay.

The market, and money, are like the tide.

Water rolls in. Water rolls out.

Sometimes the market needs to go down before it can go back up again.

Just do not panic when we see the inevitable pullback.

– Sean MacIntyre

Check out Sean’s YouTube channel here.

Alex Berenson on the First Amendment, Part Two

Alex Berenson

Last week, I gave you a link to Part One of Alex Berenson’s lecture on why he fears for the future of the First Amendment. If you missed it, here it is again.

Now, here is Part Two.

All of the Academy Award Nominated Films

This may be the first time I’ve ever done this. Over the past several months, I watched all 10 of the movies that were nominated for the Best Picture Oscar.

It may also be the first time I’ve felt that all of the nominated films deserved to be nominated.

In case you haven’t seen some or all of them and you’re interested in my two cents, here they are in order of my preferences, along with brief notes on each.

1. The Zone of Interest

A distinctly different Holocaust film, with a clever perspective and great performances.

2. Oppenheimer

It aimed to be a big and important film, and it met its ambitions completely.

3. Poor Things

Wild, crazy, inventive, and exuberant, brilliantly shot and with a great performance by Emma Stone.

4. American Fiction

A simple, straightforward drama about something that never should have happened in American book publishing. Jeffrey Wright’s performance was perfect. He carried the film.

5. Past Lives

I have a prejudice towards Asian dramas and particularly Korean romantic movies. Past Lives delivered everything you would want from this genre: a good, believable story, emotionally moving visuals and music, and two adorable leads.

6. Killers of the Flower Moon

The film didn’t quite measure up to the book (which I read for my book club), but it was nonetheless very good, with many good performances and lots of issues to think about later.

7. Anatomy of a Fall

There are several things about this film that could have and did disappoint many critics, including the unsatisfactory denouement. But the photography, the music, the scenery, and the acting kept me fascinated all the way through.

8. The Holdovers

You’ve seen this story a dozen times, and yet you won’t be bored or disappointed seeing done again with a great cast and good performances by all.

9. Maestro

I’ve always been interested in Leonard Bernstein. Not just because of the music he made, but also because of the many rumors I’d read about his personal life. I wouldn’t call Maestro a great film, but it was good enough to earn the nomination.

10. Barbie

I didn’t know what to expect, but I was prepared to be disappointed. I wasn’t. I was happily entertained and not bothered by the various woke “messages” because the film never took itself very seriously.

Bill Bonner on the Two Important Ways Government Spends Our Money

“There are only two key issues in government – how it raises and spends its money… and against whom it goes to war. Everything else is a footnote. But on the two important issues, American voters have almost no say. Foreign policy is determined by the Foreign Policy Establishment, working hand in glove with the rest of the firepower industry’s shills and toadies – the press, the universities, Congress, and the bureaucracy.” – Bill Bonner, Bonner Private Research, March 8, 2024

How Much Do You Know About Beer?

Relatively easy… but I still got four wrong. Click here.

From BY re “My Crazy New Eating Strategy” in the Mar. 4 issue

“Fasting works well for the exact reason you mentioned. You are eliminating the insulin peaks and valleys that lead to craving and binging. The lack of hunger is a pretty magical side effect. It’s a lot easier to diet when you don’t have a devil on your shoulder telling you to eat something.

“I fast for 16 hours a day and have five meals in the remaining eight hours. I’m currently getting 3,000 calories a day and losing a pound every month or so. I’m actively putting on core muscle as well. Total weight loss… 145 lbs since May 1, 2023.

“My ‘secret’… no added sugar foods. Like you, I have no cravings because I have no insulin spikes. It can be a giant pain in the ass going to restaurants. I feel 30 years younger, though… and I’ll take that trade any day.”

My Response: Wow… 145 pounds! That’s amazing!

The thing I like best about this eating plan is that I give myself permission to indulge in anything – ice cream, candy, cake, booze. The only restriction is one hour.

The first few days on it, I was eating 2,400 calories per meal, which is more than my normal range (1,800 to 2,100). But since then, I’m eating less. Not because I’m restricting myself, but because, knowing I can eat all I want, I eat just until I’m full.

From IK: “What’s your investment strategy right now?”

“After trying a bunch of different assets, I’m not sure which one can be a reliable strategy that I can lean on for the next 20 years. I’ve got some money in mutual funds, stocks, crypto, and some real estate. But I don’t have one go-to strategy. Since you’ve walked the path I’m on, I was wondering if you could share any insights on what’s best and any resources you’ve found helpful?”

My Response: I don’t think there is one go-to asset class today. There are too many seriously dangerous economic issues, such as the US’s $33 trillion debt and the inevitable digital dollar. And then there is AI. That has the potential to change the world fast and completely.

My strategy, like yours, is diversification, including gold and direct investments in small businesses I control.

From GA: “Totally agree about Nicaragua”

“I totally agree with what you said about Nicaragua in the Mar. 4 issue. I’m more comfortable and feel safer here than in the US, as well. I say this with a great deal of sadness, but then I’m from the fascist state and city of NY. I’m at Rancho now… own several properties here for about 14 years.”

From IR re my goal-setting routine:

“I’m reading The Pledge. Thoroughly enjoying it. I’d like to know what kind of planner you use to keep track of your progress in achieving your short-term/ long-term goals. Digital? Manual?”

My Response: Thanks for the question. When the book was first published, I was asked about that a lot.

Back then, I used a commercially produced paper journal and planner for my daily goals, and I used a Word document for my yearly and monthly objectives. When writing with a pencil became difficult for me (basal arthritis), I switched my daily records to Word and created a template that has itself evolved over the years as I discovered more ways to maximize my productivity,

Whether keeping track of my progress online or on paper, I’ve always highlighted the important-but-not-urgent tasks on my monthly, weekly, and daily to-do lists to remind me to handle them early in the day when I could use my best energy to move them forward.

Online, I am able to visibly reward myself for accomplishing specific tasks by changing their colors. I initially enter them in red, then change them to black when accomplished or blue when half-accomplished. And I copy/paste all of my completed goals for each month at the bottom of the document.

I know this sounds very anal, and it is. But I still get a bit of a good feeling every time I change a task from red to black.

From EA: “Can you help me?”

I shortened EA’s VERY long message to these three paragraphs:

“I am a 22-year-old entrepreneur who has been following your work and has been inspired by your writing. I have decided to reach out in faith, hoping that you will have an interest in a problem that horrifically kills so many. The problem is that 100% of reported home fire deaths in America happened in homes where fire alarms were present but did not work. You can check that statistic here on the official US Govt. FEMA website.

“I believe that you may be able to help me on my mission to put an end to this problem and save the lives of countless people now and in future generations. I hope to hear back from you, Mr. Ford, to receive any guidance, wisdom, and even funding if you would like to contribute towards a seed round.

“Thank you for taking the time to read this. I really appreciate all the work that you’ve done and all the wisdom you’ve shared through your writing. It has already changed my life and the lives of countless others.”

My Response: EA, if you can send me your business plan in no more than 100 words, I can help you. I will give you my advice in a future blog post so that other readers in your position can learn from it.

“The Old Philosopher” by Eddie Lawrence

From JM: Life bumming you out? Listen to this pep talk by Eddie Lawrence from 1956. (Stay with it to the end. It gets funnier as it goes.)