Chart of the Week: The Effect of Interest Rate Changes

Most Americans, including college-educated Americans, know little about economics and next to nothing about how the decisions made by the US Treasury and Federal Reserve affect the US economy.

I was as ignorant as the next person until I went to work for a publishing company that specialized in following, interpreting, and predicting the investing markets. That was forty years ago. Since then, I’ve read reams of book chapters and essays on economic history and theory, as well as dozens of ideas about how to invest in the financial markets according to the actions of the Treasury and the Federal Reserve.

My level of understanding on this subject is still very basic. But I can say that I have come to a place where it is clear to see that fiscal and monetary policies do have big and undeniable effects on the financial markets, including not just stocks and bonds, but also every other asset class.

I have also learned that this is only a part of what one needs to know to make wise investment decisions. And that’s because the US economy, as large as it is, is nevertheless just a part of the considerably larger economy of the world.

This week, Sean presents us with several charts that track Japan’s fiscal and monetary policies and demonstrates, quite convincingly in my mind, why astute investors must understand what is going on there. – MF

The media has been hanging on every word Jerome Powell utters. Investors want to know when interest rates will decrease.

But while this has been happening, there’s been a major development in global monetary policy that hasn’t generated enough attention.

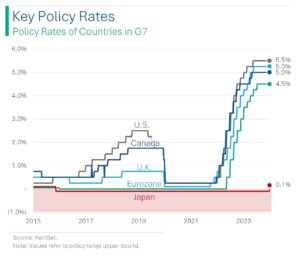

Most developed nations increased rates to curb inflation, but the Bank of Japan was the last holdout.

On March 19, that changed.

In the wake of higher inflation and a weakening yen, the Bank of Japan raised their interest rates for the first time in 17 years.

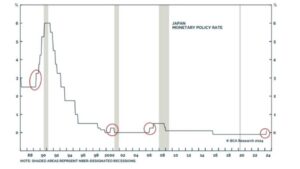

Japan is usually late to the party when it comes to hiking interest rates.

Just as US central bankers are terrified of repeating the monetary policy mishaps of the 1970s that triggered a decade of stagflation…

Japanese central bankers do not want to repeat the monetary policy mistakes that cast a frost on their economy in recent decades.

This policy change is going to have a series of complex ripple effects through the global economy.

For one, the yen carry trade that has been generating huge amounts of money for US institutional investors will become less lucrative.

In a carry trade, investors borrow in a currency with a low interest rate and invests in a higher-yielding currency. A 3-month dollar-yen carry trade can earn as much as 5% annualized.

Secondly, because Japan tends to be late to hike rates, their monetary policy decisions are a bit of a “canary in a coal mine.”

For the past 30 years, their interest rate hikes have inevitably preceded global economic recessions.

Is this a clear sign that global economic catastrophe lurks around the corner?

I doubt it. It could be months or years before we feel the chilling effects of monetary policy changes.

But it is a sign that we should continue to be incrementally more cautious.

– Sean MacIntyre

Check out Sean’s YouTube channel here.