Chart of the Week: Is the Market Overbought?

This week, Sean asks a question that many stock investors and most stock traders have been worried about recently: For nearly 90 days, the market has been outpacing expectations. Is it “due” for a drop. And if so, how deep and when?

His approach to the answer is technical: comparing this most recent three-month streak to streaks in the past, going all the way back to 1950. I don’t use historic patterns to determine what stocks I buy and sell, how much I’m willing to pay for them, and when to get into or out of them. But I do like to read technical analysis because so many things in the universe seem to happen in patterns. And when technical data supports the fundamental analysis I use, it does make me a bit more confident about my buying and selling decisions. – MF

There’s no denying that the market has been on a hot streak over the last 3 months.

But how much longer of a hot streak should we expect to see?

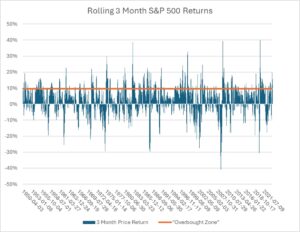

To find out, I looked at all the S&P 500’s 3-month returns since 1950. Then I found out what return in this timespan is way higher than normal (9.5%).

We can set that 9.5% line as our “overbought” level. Any higher? The market tends to slow down or decline afterward, as you can see from the spikes on the chart above.

By this measure, the market has been overbought since late December 2023.

At the time of writing, we’ve had 31 consecutive days that the S&P 500 has delivered an unusually large gain over the previous 3 months.

When the gain is this high for more than a month (about 20 trading days), we only see this streak continue to day 37 on average.

But if we only look at days when the market’s 3-month return has been positive overall, we’re at day 74.

When these positive gain streaks last longer than a month, the streak of positive returns lasts about 99 days on average.

That means, more or less, we should not expect the market to keep carrying on like this for much longer.

We should expect, very soon, the market to go sideways or down, even if just a little bit.

And this is okay.

The market, and money, are like the tide.

Water rolls in. Water rolls out.

Sometimes the market needs to go down before it can go back up again.

Just do not panic when we see the inevitable pullback.

– Sean MacIntyre

Check out Sean’s YouTube channel here.