Chart of the Week: The Cluster of Woe

I’ve been in the economic and investment prediction business for more than 40 years, and many of my favorite colleagues have been occasional or perma-bears. I was once persuaded by one of them to buy a bunch of gold when it was priced at $400 an ounce. I’ll be forever grateful to him for that. But for the most part, I’d classify my thinking as pragmatically optimistic. I’ve always believed that if you managed your portfolio smartly, you could get richer every day and every month and every year.

About two years ago, I began to lose my optimism about the potential to grow richer. Especially if most of your assets were tied up in stocks. That gloomier outlook was based partly on fundamental and technical analysis of the markets (which Sean is very good at) but also on what I consider the rapidly moving decline of Western civilization and its values.

Today, Sean gives us his perspective. Reading it, I am more convinced than I have been in recent years that now is the time for caution and for rebalancing assets to be as anti-fragile as possible. – MF

There is now mainstream consensus that the US has moved beyond the risk of recession.

The stock market has soared to new highs with all the carefree hubris of Icarus.

But in the wings, there seem to be a few voices left to shout out sensible warnings.

Dr. John Hussman, who I discovered by way of Bill Bonner, suggests we’re in fact entering a “Cluster of Woe”…

A confluence of economic and market indicators that collectively screamed alarm in in 1972, 1987, 1998, 2000, 2018, 2020, and 2022 – moments that preceded pretty sizable stock market losses averaging about -12.5%.

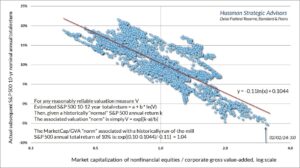

He provides this chart that shows the relationship between subsequent market returns and valuations:

We are currently sitting at the bottom right – the point where valuations look most insane, and the returns we should expect from the stock market over the next 10 years are not very good.

And we know the culprit.

The biggest cause of market overvaluations right now is tech and AI stocks.

Tech has pulled away so massively from the rest of the market that the market – weighted as it is by the perceived value of the stocks in it – has become an index of tech stocks.

Tech stocks now account for 29.5% of the overall market’s value.

One stock, Nvidia, has a larger market capitalization than every energy stock in the S&P 500 combined…

Despite generating only 14.4% of the net income of those companies.

Reader, we’ve seen this movie before. We know how it ends. And it isn’t “everyone got rich from tech stocks and lived happily ever after.”

Simply put, there’s probably a very good reason why Warren Buffett just sold some or all of Berkshire’s stake in tech-adjacent companies like Apple, HP, and StoneCo…

But bought more energy companies.

A cluster of woe is upon us. It is only a matter of time before investors finally realize it.

– Sean MacIntyre

Subscribe to Sean’s YouTube channel here.