Clip of the Week: Not a Great Time to Buy a New Home

Home sales fell to a 13-year low in October – presumably because interest rates are still pretty high and home prices haven’t come down hard enough to meet demand. According to the National Association of Realtors, existing-home sales (which make up most of the housing market) decreased 4.1% in October for a seasonally adjusted annual rate of 3.79%. That’s the lowest since August 2010.

It’s still a question as to what the Fed is going to do with the Fed rate, but I’m betting that home prices will be coming down significantly in the next 6 to 12 months. If I needed to sell my home any time soon, I’d think about upping the ask considerably.

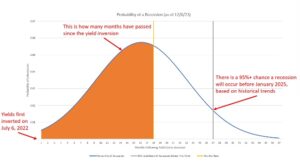

Chart of the Week: How Likely Is Another Recession?

“There is a 95% probability a recession will occur before January 2025,” says my friend and colleague Sean McIntyre in his most recent newsletter. You can read his argument here.

Economic Craziness of the Week: The Only Good News About the Bad News

Janet Yellen and the Biden administration are telling us that, thanks to “Bidenomics,” the US economy is stable and getting stronger, with inflation rates descending and employment moving up. Yet, according to some poll I read somewhere last week, Americans are more stressed about their finances now than they have been in years.

There are good reasons for that.

According to the Social Security Administration, the median wage earner brought home just $40,847.18, or about $3,400 a month, in 2022. Of course, that’s before federal income taxes are withheld, about $500 a month, and another $300 for Social Security and Medicare. The net take home is $2,600. About $2,000 of that will cover the cost of renting a house. Which leaves what? $600 to pay for food, gas, utilities, etc.

And to cope with that, millions of Americans are borrowing and going into debt fast. Balances on non-housing loans have more than doubled since 2003, totaling roughly $4.8 trillion, according to data from the New York Federal Reserve. More than $500 billion of that debt accumulated just in the past two years – a bigger jump than any other two-year period since 2003, the earliest data available. And credit card balances are growing the fastest of all – up roughly 34% from the fall of 2021.

It doesn’t sound like things are improving, but what do I know? In any case, there is a sliver of silver lining to the cloud of bad news. The crazy cost of housing is encouraging divorced and separated couples to move back into one house and try to work things out.

Click here.