Are Big Cities Dying?

I’ve been writing a lot about the demise of America’s big cities: Chicago, LA, New York, San Francisco, Houston, etc. Crime is up. Property values are down. COVID lockdowns taught corporations and their employees that they don’t really need to be downtown to make things happen.

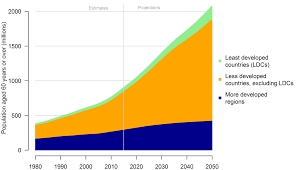

It feels to me that we are five to 10 years away from the end of multimillion-person urban centers. I wouldn’t be surprised if, by 2030, the US would have only two cities (LA and NYC) with populations above a million. NYC would be down from 8.6 million to… hmmm… 3.6 million. And LA would drop from 4 million to about 2.5 million. (LA will retain more on a percentage basis because it is already a sprawling suburb.)

In the last three years, we’ve seen big, scary changes. On top of the list are the hysteria-fueled, power-grabbing government lockdowns, which unintentionally revolutionized the way businesses and employees think about work. Nobody wants to commute 30 or 40 minutes to work in a nondescript cubby in a nondescript city tower anymore. The future is two- or three-day in-office workweeks. And that is probably optimistic.

BLM riots, which destroyed blocks and blocks of formerly healthy retail businesses, including hundreds of Black- and Brown-owned businesses, are gone and don’t seem to be coming back. And there are stretches of formerly upscale retail streets that are eerily half boarded up.

The rise in violent crime in the big cities isn’t of much interest to anyone because it is mostly drug-related and Black-on-Black crime. What’s scaring businesses away is the huge increase in all forms of theft effectively allowed by city mayors and their DAs that believe there are too many people of color in jails.

On top of that, you have big inventories and higher interest rates that have a greatly negative impact on commercial real estate. In New York, San Francisco, London, Hong Kong, and Madrid, luxury office towers are only half-filled. And some landlords are walking away from their debt rather than pouring good money after bad. In San Francisco, for example, the owners of the largest shopping mall have abandoned it.

Even as stock markets rally and interest rates ebb, the problem for commercial real estate in cities is getting worse every week. The center will not hold.