More Data on the Next (Biggest?) Financial Crisis

* The stock market crash of 1987

* The dot-com crash of 1995

* The real estate, banking, and liquidity crisis of 2007

* The COVID-19 government lockdown crisis of 2020 and 2021

Of these four, only the crash of 1987 surprised me. And the market bounced back relatively quickly, so I didn’t have a chance to learn anything from it. The dot-com crash seemed inevitable, given the crazy P/E ratios for dot-com stocks. The only question was: When? The real estate bubble was predictable in the same way. Prices were hyperinflated. They couldn’t possibly land. I was able to avoid getting hurt on that one by sticking to a simple, fundamental rule I use for investing in real estate. (I’ve written about it many times. Most recently, here.) The economic cost of the COVID lockdown was also easy to predict. But there was so much fear around it that nobody wanted to talk about it.

Recently, I’ve been feeling like we are about to go through another financial crisis. And this time, it won’t be short-lived, like the 1987 crash. Nor will it be restricted to segments of the market, like 1995 and 2007. This time, I’m betting it’s going to be across all investment classes and across the globe. And to make matters worse, it’s feeling like it’s going to be a long and debilitating period of stagflation.

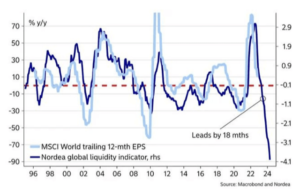

I hope I’m wrong. Here’s a chart I found last week (from Agora Confidential) that is worrying.

This chart offers insight into the amount of global capital sloshing around to purchase bonds and stocks. The Nordea global liquidity indicator – which signals a sharp contraction – typically leads the MSCI (corporate earnings) with a lag.

The MSCI signals that a slowdown is coming for corporate profits into 2023 and 2024. (Mainly as the impact of central bank rate hikes start to affect the global economy.)

If valuation comprehension was the story of 2022… looks like the story of 2023 will be earnings compression. Barring a dramatic pivot by the Federal Reserve, we can expect more volatility and lower stock prices in the year ahead.