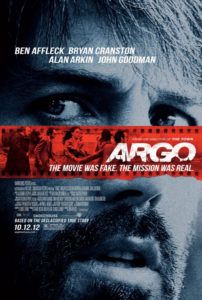

Argo (2012)

Directed by Ben Affleck

Starring Ben Affleck, Bryan Cranston, Alan Arkin, and John Goodman

Available on various streaming services, including Netflix and Amazon Prime

I saw Argo when it came out in 2012. I remembered it as being intense – almost nerve-wracking. And that’s an accomplishment, because it’s based on true events. I was aware of those events and, thus, how the story would end. But, as Aristotle pointed out, that’s the sign of a good drama. You can be familiar with the characters. You can know what happens. And yet, it will grip you and stay with you for days or weeks or sometimes years!

Argo did that for me. And credit must be given to the actors. But above all, IMHO, to the director. In this case, a young actor and unproven director named Ben Affleck.

The Plot

On Nov. 4, 1979, during the Carter administration, 52 American citizens, including six diplomats, were held hostage by Iranian terrorists in the US embassy in Tehran for 444 days. It was all over the news. What wasn’t in the news was that just before the embassy was taken over, nine embassy workers snuck out and made their way to the Canadian embassy, where they stayed hidden while the CIA tried to figure out how to bring them home.

What I Liked About It

* The cinematography: It sometimes felt a bit theatrical – in the sense of a stage play. This was typically when the characters were indoors and seated around a table. But it had the advantage of bringing the interactions of the actors closer to the camera, which gave their conversations more intensity.

* The direction: The movie has a docudrama feeling that, while not overbearing, does add to the verisimilitude and urgency of every scene. Kudos to a young Affleck.

* The editing: Brilliant. The cuts. The timing of the scenes. There was never a single minute that felt unnecessary or lax or elongated.

* The photography: Lots of little tricks that helped enhance the paranoid feeling throughout.

* The script: It could have been, but wasn’t, a good-guys vs. bad-guys story. It acknowledged the meddling of the US in Iran’s affairs to secure its private and geopolitical interests.

What I Didn’t Like So Much

The backstory on the main character – the good dad trying to hold together a broken family. A little cliché.

Critical Reception

Argo was nominated for seven Oscars and ended up winning three of them, including Best Picture. It also won the top prize at the Golden Globes and British Film Academy Awards.

* “Ben Affleck has delivered a knuckle-muncher of a thriller and a satire on Hollywood, both in one unlikely package.” (Kate Muir, Times/UK)

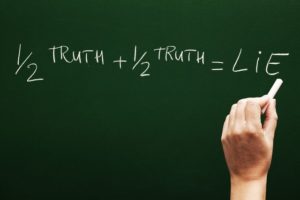

* “If there’s one lesson to be gleaned from director Ben Affleck’s relentlessly tense, painstakingly detailed Argo, it’s that we should consider the possibility that our history has been manipulated more than many of us would care to admit.” (Jason Buchanan, TV Guide)

* “Argo has that solid, kick-the-tires feel of those studio films from the 70s that were about something but also entertained. Only it’s as laugh outright amusing as it is sobering.” (Lisa Kennedy, Denver Post)

You can watch the trailer here.

And click here to read an article about the historical accuracy of the movie.