About the Future of America…

Once the Digital Dollar Is Put Into Circulation!

We’ve all been deluged recently with reports on the rise of inflation and the risk of an extended economic recession. And for the past year or so, I’ve been writing about the likelihood that the US will one day adopt a digital dollar and the possible repercussions of that.

I suspect that the economy will get worse before it gets better. And that this will accelerate the move to the digital dollar. The floundering (soon to be foundering) economy should not be a reason to rush towards a digital dollar, but it does provide rationales for pushing it forward by our elected officials that understand how it will increase their ability to have more control over the populace. And they come from both sides of the aisle.

Today, I want to try to accelerate your interest in this topic by giving you some scary but entirely possible outcomes if (when) this happens.

I’ll start with this: The digital dollar will be presented as a solution to three significant problems that – from the government’s perspective – are making it near impossible to balance the budget and build back America’s economy better:

- Institutional favoritism to big companies, including pork barrel legislation, federal regulation, and deregulation. (Remember, this will come from both Republicans and Democrats.)

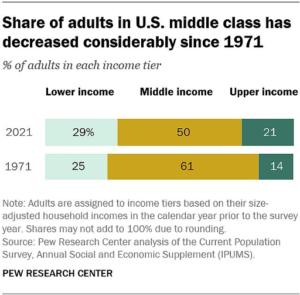

- Wealth and income inequality.

- Tax avoidance and evasion by the one percent of the richest US companies and individuals.

My theory is that the digital dollar will not solve those problems. It will, instead, make them worse. And it could also result in the destruction of the values that made the US the world’s largest and strongest economy. Those values include free enterprise, individual liberty, entrepreneurship, states’ rights, financial privacy, personal privacy, and democracy itself.

Here is an admittedly sensational way to put it. But since I think it’s within the realm of possibility, and feeling less extreme and more likely the more I dig into it, I’m going to give it to you the way I presented it to a colleague that is producing a documentary about the danger.

I said:

This is the story of the digital dollar being used as a government tool to monitor and record every move its citizens make. Calling it a digital dollar, as if its purpose were a simplified substitute for the dollar, is a ruse. It will become a digital monitoring and control technology that will be connected to every other digital tool we use. It will be on the blockchain, so the activity will be permanently recorded and available, but only to the government. They will track, not just every purchase every person (citizen, non-citizen, visitor, etc.) makes, but every place they go, every publication they subscribe to, every cause they contribute to, every person they do business with, etc.

And it will be married, as the Chinese have already done, to a social reputation score that will determine our ability to purchase the products and services we want. No more things that are “bad” for us, including “unhealthy” foods; “dangerous” herbs and medicines; “subversive” books, magazines, and e-publications; access to “disreputable” chat rooms, clubs, and other social groups. Not to mention our ability to purchase firearms, sell our houses, rent second homes, travel, etc.

The technology will make tax avoidance extinct, as well as any sort of business activity that the government deems unwise or improper. And it will reward us by raising our personal social reputation score when we report on any questionable conduct by our family, friends, and neighbors. (Which most Chinese citizens say they enjoy doing!)

The transition to a digital dollar is already underway in this country. All the powers that be – big government, big tech, and mainstream media – are fully behind it. As will be the majority of Americans when the information campaign to support it reaches its peak.

And it is all going to happen in the next 10 years, if things don’t change.

So, there you have it. Is this madness? A delusion? The paranoid perspective of someone that’s been reading too much fake news? You will have to judge for yourself. In the meantime, when new facts emerge, I’ll tell you about them and how I think they fit into this movie.