What Is the “Wage-Price Spiral” – and Why Is It a Problem?

Prices are going up. And real incomes (nominal income minus inflation) are going down. (Wages up 5%; Inflation up 9%)

From Bonner Private Research:

“Workers will, of course, push employers for wage increases to keep up with inflation. But [thanks to years of Fed-induced malinvestment] productivity is sagging… so the only way employers can pay more is by passing along the costs to consumers – further pushing up prices. This is the ‘wage-price spiral’ that troubles central bankers’ sleep. Wages go up to keep the working stiffs from losing ground. Then, the extra labor costs force up prices. The higher prices cause workers to plead for higher wages. Wages tend to be ‘sticky,’ say economists. Once a raise is given, it is hard to take it away. So, wage-driven price increases ratchet upwards with no easy way to bring them down.”

Another Way That Inflation Is Slowing Growth

Walmart shares slid 10% after the company reduced its profit expectations as a result of changes in consumer spending habits. Shares of other big retailers, including Target and Amazon, also fell. Inflation, Walmart noted, is causing shoppers to spend more on necessities such as food and less on items like clothing and electronics. As a result, inventory of merchandise that customers don’t want is piling up, and retailers are being forced to aggressively mark it down. Click here

And Yet, Yacht Sales Are Booming

Discount retailers like Walmart are seeing the impact of inflation. The same is true with just about every business that sells commodity products to middle-class and working-class consumers. But the luxury market – or at least the upper end of it – exists in its own economic sphere.

For example, last year, 887 “super yachts” were purchased, twice as many as were sold in 2020, according to The New Yorker. Super yachts are just what they sound like. Super-sized (over 100 feet) and super-luxurious, costing upwards of $100 million. Why the jump in sales? The simplest reason is a growth in the number of super-rich people. Since 1990, the number of US billionaires jumped from 66 to more than 700, while the median hourly wage increased only 20%. The number of gigayachts (yachts over 250 feet) jumped from under 10 to more than 170 during the same time

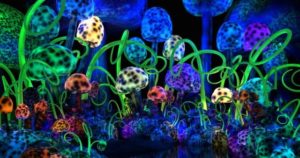

Are Psychedelics the Next Pot Stocks?

Even in bear markets, there are businesses, and even industries, that experience growth. And that makes for opportunities for shrewd investors. One such industry that I’ve been following for several years lives in between the health and recreation industries. I’m speaking of psychedelics.

Since the beginning of decriminalization, the marijuana business has grown the US economy by about $20 billion. It looks like we are going through the same thing with psychedelic drugs. It’s early in legalizing them, but by some estimates the industry will be at about $5 billion in the next five years.