War and Inflation: The Deadly Duo

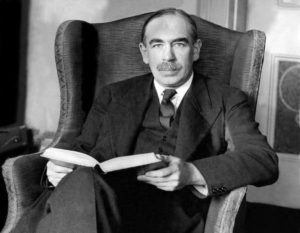

Ernest Hemingway, not a geopolitical analyst, was nevertheless a geopolitical thinker. He had it right when he said that there are two sure ways to ruin a country. War and inflation.

We’ve got both now.

War

On February 24, following weeks of mounting tensions, Vladimir Putin ordered a land, sea, and air invasion on Ukraine. Americans and Western Europeans were outraged, considering the invasion an affront to national sovereignty and democracy. Most of them, in a rare moment of political consensus, committed to helping Ukraine resist.

Meanwhile, it’s impossible to ignore the terrible costs. They have been enormous. And as the war continues, and it may continue for some time, those costs keep rising.

In terms of human life, it’s estimated that, as of the end of June, between 6,000 and 11,000 Ukrainians and more than 25,000 Russians had died. Economic losses to the Ukraine range from $564 billion to $600 billion since the war started. At least 195 factories and businesses, 230 healthcare institutions, and 940 educational facilities have been damaged, destroyed, or seized. Damage to residential buildings and roads account for almost $60 billion in losses.

The economic costs to Russians are now estimated at more than $20 billion a day. Inflation has climbed to at least 13%. The ruble has lost more than 20% of its value, and Russia’s GDP, according to an economist at the Institute of International Finance, will likely shrink by more than 10%.

At a time of already high food and energy prices, the conflict has caused the worst spike in commodity prices in 50 years. Russia, now facing crushing Western sanctions, is a major exporter of natural gas, oil, and coal. And Ukraine – the “breadbasket of Europe” – is a key source of wheat and corn. The likely wholesale disruption of its harvest this year could be a disaster. Especially in the developing world, where rising grain prices are a life-and-death issue for millions afflicted by poverty.

So, yes, the war in Ukraine has been bad for everyone involved in every conceivable way.

Now, if you believe everything you read in The New York Times, you may see it as an unprovoked, maniacal attempt to expand the Russian ex-empire. I’m not a geopolitical expert myself, but I have read bits and pieces about Ukraine over the years and, more recently, did a cursory study of the Cold War. And that narrative didn’t ring true to me.

The US and Russia have been in a military/political contest for as long as I’ve been alive. It has ebbed and flowed, but it did not end, as many say, on Dec. 26, 1991.

As, I recounted in my July 19 blog post, the proxy wars we’ve been fighting since the end of WWII have not stopped. Nor have our efforts to reduce Russia’s military danger by strengthening our diplomatic and military alliances. That was our main objective when we, along with Canada and our Western European allies, formed NATO in 1949. And the movement – however legitimate on the part of some Ukrainians – to join NATO, was, to the Russians, a threat comparable to the Cuban Missile Crisis.

I’m not trying to justify Russia’s decision to invade Ukraine. But I am trying to put it in what I think is a broader and fairer context. It’s too easy to think of it as unprovoked. It was, in part, a terrible and tragic response to our continuous commitment to the Cold War.

Inflation

In the simplest terms, inflation is the general increase in the prices of goods and services over time.

As prices rise, the amount of goods and services that can be bought with a unit of currency decreases. Another way of putting it is that inflation is the decrease over time of a currency’s purchasing power.

Inflation is not always or completely bad. Most economists agree that a small amount is a good thing. When an economy is healthy, wages rise, and consumption rises along with it. An inflation rate of 2% to 3% is usually considered healthy. But a rate of 9% or 10%, like we have now, creates a significant strain on the economy. At this rate, the cost of living is rising considerably higher than wages. And when you get into rates of 20% or 30%, the economy nosedives.

Of all the costs that determine inflation, the cost of energy is the most important. That’s because every business and every industry – from toilet paper to electric cars – consumes energy for the manufacturing, storage, delivery, and distribution of goods. And that’s what makes our current situation particularly onerous. The overall inflation rate is about 10%, but the cost of energy is much higher.

In a free market, the rising cost of energy would be tempered by reduced demand. But since the US abandoned the gold standard in 1971, our government has attempted to regulate the economy by printing more dollars when our elected officials want to “stimulate” the economy. The problem is: The more of these “make-believe” dollars they print, the more inflation they build into the system. The inflation, of course, happens after those responsible have left office, so they don’t have to worry about being blamed for it.

In a future post, I’ll tell you what I’m going to do about it.