The Truth About Stress

Stress is bad for you. It wears you down. Makes you irritable. Clouds your brain. And over the long run, it shortens your life.

I knew that.

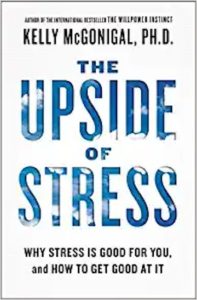

Until I read a review of The Upside of Stress by Kelly McGonigal.

McGonigal argues that stress, in itself, is not necessarily bad for you. What matters is how you think about it.

In one test cited, researchers asked 30,000 adults how much stress they felt in the past year – and whether or not they thought stress was a negative. Eight years later, the researchers checked in on them. And sure enough, most of the high-stress people had experienced both physical and mental health problems.

But not all of them. Those respondents that reported high levels of stress but did not view their stress as harmful did not suffer. And they had lower rates of death. Even lower than respondents that initially reported experiencing very little stress.

The bottom line, per McGonigal: The effect of stress on health is relative. If you view it as harmful, it will be harmful. If you view it positively, it can improve your health and increase your longevity.

The secret for making stress work for you, McGonigal says, is to understand what stress is biologically, and how to think about it when you have it.

“Stress arises, she says, when something you care about it at stake.” (We don’t stress about things we don’t perceive as important.)

Stress produces definite physical responses, such as a faster heartbeat, hypersensitivity, and the production of adrenaline and cortisol. And they arise unconsciously and instinctively.

You shouldn’t try to stop them, McGonigal says. They are normal. In fact, they are healthy. Studies show that these responses, and particularly the secretion of adrenaline and cortisol, allow for better performance under pressure.

Rather than trying to resist or deny your stress responses, do this:

- Notice them. Be aware of how they are affecting your body.

- Accept them for what they are: your body’s intelligent responses to a challenge you are facing concerning something you care about. Ask yourself, “What is at stake here and why do I care about it?”

- Rather than think of the source of the stress as a threat, try to think of it as something that can make you in some ways better.

- Consider the resources you have available to deal with that challenge and make a commitment to use them.

- Put the threat into perspective by recognizing the big picture.

And I would add this (from my own experience): Consider the worst-possible outcome of the challenge you are facing and imagine yourself being “okay” with it.

I’ve put this protocol into practice in preparing for a competition I’ve entered: the Pan American Jiu Jitsu tournament. I’m going to have at least two matches with high-level black belts that will be doing their best to beat the crap out of me – maybe break my arm or choke me into unconsciousness. To make matters worse, it’s a public event, which means that something more precious than my body will be at stake. My self-esteem!

I’ve been nervous about the competition since the day I decided to participate. I’m worried about making weight. I’m worried about getting injured. But most of all, I’m worried about losing and thereby disappointing my training partners and teachers, who are convinced I’m going to do well.

So, every time I feel anxious, I tell myself, “This is normal. It’s good. Your brain parts are helping you get ready.”

I’m getting ready by dieting, sprinting (for stamina), and with brutally tough training sessions with my instructors, who are much younger, stronger, faster, and more technical than I am. And this is helping. I’m getting in better shape and feeling more prepared, if not confident.

What I haven’t yet done is follow my own advice: I haven’t imagined myself losing and feeling okay about it afterwards. That, I’ll have to work on.