I know some young people that speak this way.

Some surprising people have come to Trump’s support after he was banned from Twitter, Facebook, Pinterest, Snapchat, Reddit, and Instagram.

* German Chancellor Angela Merkel called Twitter’s ban on Trump “problematic,” and said that freedom of opinion is an essential right of “elementary significance.”

* Clement Beaune, the junior minister for European Union affairs, said he was “shocked” that a private company made this kind of decision. “This should be decided by citizens, not by a CEO,” he told Bloomberg TV on Monday.

* French Finance Minister Bruno Le Maire condemned the move and said that tech giants were part of a digital oligarchy that was a threat to democracy.

* Manfred Weber, the leader of the center-right European People’s Party, called for a stricter regulatory approach. “We cannot leave it to American Big Tech to decide how we can or cannot discuss online.”

* Norway’s left-wing Labor Party leader Jonas Gahr Støre said that Big Tech censorship threatens political freedom around the world.

* Australia’s acting Prime Minister, Michael McCormack, said, “There’s been a lot of people who have said and done a lot of things on Twitter previously that haven’t received that sort of condemnation or indeed censorship. I’m not one who believes in that sort of censorship.”

* Mexican President Manuel López Obrador echoed his global counterparts, calling this kind of censorship by private companies “like an inquisition to manage public opinion.”

3 Facts, 3 Numbers, 3 Thoughts

THE FACTS

* There’s an even more contagious strain of COVID here in the US! With a recent surge in cases, reports in the media, and Dr. Deborah Birx’s comments at a recent coronavirus Task Force meeting, you’d be forgiven for thinking that the situation is a lot more dire than it is. But in a recent press briefing, Henry Walke, the CDC’s COVID incident manager, said that though the evidence to date indicates that newly emerging variants spread more easily and quickly, “there is no evidence that these variants cause more severe disease or increase risk of death.” He also said that, according to all available information, current vaccines will be effective against these strains.

* Psychedelic drugs are generating a great deal of interest as an effective treatment for mental disorders that have worsened in the wake of the pandemic. This interest has been reflected in the market, with psychedelic drug stocks soaring in 2020. Companies like Mind Medicine and Numinus saw their shares climb by 1060% and 360%, respectively.

* There are more potential outcomes to a game of chess (10 to the 120th power) than there are atoms in the observable universe (an estimated 10 to the 80th power). That was the conclusion of mathematician Claude Shannon in a paper he wrote in 1950. Shannon calculated his number by assuming that the average game has about 80 total moves. There have been many, more conservative, calculations done since then. But as pointed out on Medium.com, even if we use the most conservative assumptions, and all humans spent all their time playing chess… it would take us millions or billions of years to play all possible combinations.

THE NUMBERS

* 59 – the percentage of people with COVID that transmit the virus without showing symptoms. 35% of the transmissions have come from people that eventually developed symptoms but transmitted the virus before those symptoms were evident. 24% of the transmissions were spread by people that never showed symptoms at all (asymptomatic)

* 7.05 billion – the number of times “Baby Shark Dance,” the most-watched video of 2020, was viewed on YouTube. It was followed closely by “Despacito,” with 7.04 billion views, and “Shape of You,” with 5.05 billion.

* $84.5 million – the amount paid for Francis Bacon’s Triptych Inspired by the Oresteia of Aeschylus in Sotheby’s first digitally streamed live auction. The painting was won by a collector in New York after a fierce, 10-minute, “socially distanced” bidding war with an online bidder in China.

THE THOUGHTS

* “Only put off until tomorrow what you are willing to die having left undone.” – Pablo Picasso

* “Courage is the power of the mind to overcome fear.” – Martin Luther King

* “Few will admit it, but in the commerce of ordinary life, there is no human characteristic more valued than physical beauty.” – Michael Masterson

Mike Tyson is a terrible interviewer, but Holyfield tells a great story.

Learning from a barefoot movement…

You think you’ve got it all figured out, then you happen upon someone else, halfway across the world, that is one step ahead of you.

After watching this TED Talk, I set up a meeting with Bismarck and Michael to talk about how we can emulate some of these ideas for FunLimon…

“Laughter is the closest distance between two people.” – Victor Borge

Have You Noticed?

Politically Correct Is Not Funny!

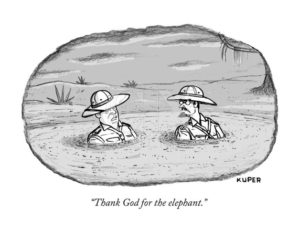

I’ve been bemoaning the fact that sometime since I stopped subscribing to The New Yorker about 10 years ago, their once great cartoons are no longer funny.

Here’s an example:

“See? She’s bound for the Oval Office. Or at least the Senate.”

Now… here is a sampling of what their old cartoons were like – i.e., actually funny!

I’ve always thought my perfect retirement gig would be to get a job writing for the Onion. So far they haven’t made an offer.

Crazy!

I thought it might be a joke when I first read about it this weekend. We fact-checked it yesterday. It’s not.

Happy Tuesday!

Today, I wanted to share some very good thoughts on smart investing with you. But before we do that, I wanted to make sure you’ve heard about this crazy bill that’s just been proposed in New York.

Assembly Bill A416 – currently in committee in the New York State Senate – “relates to the removal of cases, contacts, and carriers of communicable diseases who are potentially dangerous to the public health.”

It gives Governor Cuomo the right to send anyone who he feels might be endangering public health in any way – either by having an illness, being in proximity with others, or for virtually any other reason – to a detention center for up to 60 days without due process.

Moreover, the bill would allow Cuomo and his deputies to impose medical procedures on such detainees without their consent.

Some key provisions of the bill:

* If a person or group is determined “by clear and convincing evidence” to be a danger to others as a case, contact, carrier or “suspected case” [of an illness] by the governor and commissioner, “the governor or his or her delegee… may order the removal and/or detention of such a person or of a group of such persons by issuing a single order.”

* Those being detained are to be held in a medical facility or “other appropriate facility or premises designated by the governor or his or her delegee.”

* Anyone who is detained “shall not conduct himself or herself in a disorderly manner, and shall not leave or attempt to leave” until they are given permission.

* Anyone “who may have been exposed to or infected by a contagious disease” can be forced to complete an appropriate, prescribed course of treatment, preventive medication or vaccination.”

The bill’s sponsor, Assemblyman Nick Perry, wrote in a tweet, “There is no intent, no plan, or provisions on my bill to take away or violate any rights, or liberties that all Americans are entitled to under our constitution, either state or federal.”

Really?

You can read the full text of the bill here.

If you have any interest in investing, you’ve probably heard of the efficient market hypothesis. It’s the theory that stocks are always priced as they should be at any given moment, and therefore it’s futile to try to achieve better than average returns by buying at discounts and selling when prices are high.

It won the Nobel Prize for Economics. And many economists and stock market experts believe it. But it’s not true.

Bill Bonner explains…

True Confessions

By Bill Bonner

Let me begin with a confession. Actually, it is a confession in two parts… because I have a lot to confess.

First, I have been publishing investment advice since 1980. But I only became interested in investing itself, not economics, when I became serious about my children’s and grandchildren’s money.

It’s one thing to make money in a business or profession. It is quite another thing to protect your fortune by investing it properly.

Investing is not economics. Economics is the study of how people work together to build wealth… what kind of conditions help them… what kind of circumstances and policies hinder them… and why some people prosper and others don’t.

The study of economics is endlessly fascinating, because people are fascinating… And the collective action of people – the great things they undertake together – is particularly entertaining.

But you want to keep your distance from it. Because large-scale, centrally planned, collective action is almost always counterproductive and frequently disastrous.

Since we are so badly equipped to deal with modern public policy issues, we tend to make a mess of them. We can understand small-scale issues in a small community. We know what things are worth. We have a pretty good idea, in a small group, of how to work together.

But get people in a big group… of millions… and confront them with healthcare, government debt, or war… and ignorance multiplies by the square of the number of people involved. The result is almost always a full-blown disaster.

I Was Wrong…

But I haven’t told you the second part of my confession, have I? Part of the reason why I had no interest in investing for the first 60 years of my life was because I believed it was largely a waste of time. I was wrong about that…

I thought it was a waste of time because I first learned about investing in the 1970s and 1980s. Back then, the efficient market hypothesis (EMH) was popular. And though I was skeptical of it, I accepted it as mostly true. Not completely true. And not provably true. But logically and theoretically, it made sense to me.

The gist of the EMH is that the stock market reflects all of the available facts and opinions at any given time. It then aggregates that information and comes up with a price.

It’s not necessarily a perfect price, since it is often based on things that turn out to be unreasonable, unimportant, or untrue. But it’s the best you can do. And if you’re able to beat the market – that is, if you are able to come up with a better price – it’s probably luck.

I thought that view was correct. And I still think it’s more true than false… and worth believing, even if it’s not true.

Investors who think they can’t beat the market, in other words, are less likely to use their primitive, tribal brains trying to do so. They usually come out ahead.

A Winning Formula

You’ve probably seen the studies. There are many of them. And they all show that the typical investor would be better off not trying to beat the market.

By trying to pick the best stocks… and timing trades in and out of the market in an attempt to do better than the market itself, the typical investor handicaps himself – with performance that’s not even one-fifth as good as the market itself.

The EMH guys look at this and say: “See… We were right; you can’t beat the market.”

But I know now that the EMH is less correct than I thought. And we proved it ourselves…

Two of the investment letters we publish in the US more than doubled the performance of the S&P 500 over a 10-year period.

Could it be luck? Well, there may be some luck involved. But it seems unlikely for lightning to strike twice in such a small place… and for both of the analysts who beat the market to be using a similar approach of value investing – the same approach used by a certain well-known gentleman from Omaha, Nebraska.

According to Bloomberg, Warren Buffett’s rate of return consistently beats the market over the long term. Pure luck? Not likely…

Profiting From Errors

Time, patience, energy, hard work, and discipline – in almost every aspect of life, these qualities pay off. I believe they pay off in the investing world, too. That is, it makes sense to invest the time and effort to try to discover what stocks are really worth.

And if you work at it long and hard enough, I think you can beat the market…

Let me explain why this is so.

In a nutshell, it’s because most investors are not doing their homework. They’re using their tribal brains to try to beat the stock market. This leads them to make serious errors of judgment as to the value of companies.

The prudent investor, with a sharp pencil and a sharp mind, profits from these errors by buying, or selling, the mispriced equities.

Investing is primarily a rational, logical attempt to determine the present value of a future stream of income. I’m not talking about speculating – where you guess about what is going up or down. I’m talking about serious investing, as it was taught by Graham and Dodd… and practiced by Warren Buffett and many others.

If every investor did it, stocks would be more or less properly priced all the time… and it would be very, very hard to beat the market.

But most investors don’t do it. Most investors use their small-scale, small-group brains. They buy and sell investments based on what someone told them… or rumors… or what they read in the papers… or half-baked ideas of all sorts. They root for stocks like they root for a football team.

Seeking Alpha

A friend of mine told me that he once knew the top of the market was near because his mother asked him if she should try to get in on a new IPO. She’d read about it in the paper and it sounded exciting to her.

The last time his mother wanted to get into the stock market was in 1999, when she wanted to buy dot-com stocks.

It is only because most investors are so unserious that there are still some good opportunities available to more serious investors.

Another way to look at it is this: The system also functions as a moral system. That is, virtue is rewarded. Vice is punished.

What’s virtue? Hard work, patience, and self-discipline.

What’s vice? Greed, vanity, the need for immediate gratification. And laziness.

It just makes sense that, over time, the hardworking, patient, disciplined investor – calmly calculating what stocks are really worth – will do better than the great mass of unserious speculators and trend-followers.

That’s how you get alpha. You just do a better calculation than most people. You don’t have to read the paper. You don’t have to watch TV. You just do the numbers.

And yes, there is always some guesswork involved. And some judgment. You should get to know the business model. And the people running the business. And the product. Those are qualitative judgments.

You’ll be right sometimes and wrong sometimes. But – at the margin – you’ll be making better stock selections than the typical investor. And, with a little luck, you’ll get a better result.

Betting on Beta

And now, let’s go to a better way you can beat the market: Beta.

It’s tough to beat the market chasing alpha… and most who try fail. That’s why we pursue opportunities to make above-average returns when the markets move to inefficient extremes.

This is really where I focus my attention, because I don’t have the patience for stock analysis. You can get beta by simply getting out of the stock market when it is at a historic high… and getting back in when it is at a historic low. This is very broad-brush timing. But it works.

Taken together, stocks are almost never really worth a price-to-earnings (P/E) ratio of greater than 20. The only exception might be when you have a fast-growing economy. Then you can expect the stream of income to increase.

But if the market is trading at more than 20 times earnings, there is likely more downside ahead than upside.

The P/E ratio for the stock market is a very rough measure. Earnings can be defined in a number of ways. Wall Street prefers anticipated earnings rather than reported earnings.

And reported earnings themselves are subject to quite a bit of manipulation. When interest rates are artificially low, for example, earnings will be flattered. And companies often report “pro forma” earnings – in which they have cooked the books – rather than the generally accepted accounting principles (GAAP) earnings the IRS requires.

When you do “alpha” analysis, you have to get into the books and root around until you understand what is really going on.

Beta analysis is different; you’re looking at the big picture. For example, you can look at the whole capital value of the stock market compared to GDP.

This is the way Warren Buffett prefers to do it. In an interview with Fortune magazine back in 2001, he said that looking at total market capitalization relative to GDP is “probably the best single measure of where valuations stand at any given moment.” This approach eliminates the problem of the manipulation of earnings. It’s the way I prefer, too.

You can also tell when a market is too high by looking at what Lord Keynes called “animal spirits.” This is a great expression because it goes to the heart of the way most people actually do invest – as primitive animals… moved more by greed and fear than by any rational calculation.

When the animal spirits run wild, markets – bonds, US stocks, contemporary art, real estate – head toward bubble territory. That’s when you should sell out of these things rather than try to pick the absolute top.

That’s market timing… It usually doesn’t work. But it can work, rarely, when markets are at the extremes.

You may have seen this already… I hadn’t. This kid is obviously the product of Tiger parents, but his voice is not something that can be learned.