“Maybe all one can do is hope to end up with the right regrets.” – Arthur Miller

20 Things You Don’t Know About Me

(That I May Regret Telling You)

I’m not going to tell you all 20 today. I don’t have time and you don’t either. I’ll talk about three of them, and – if this doesn’t turn out to be a huge mistake – I’ll l send a few more in the upcoming weeks.

- Transgender Me

I played a transvestite prostitute in a Herschel Gordon Lewis movie. Yes, that’s me looking like Phyllis Diller on steroids. When I saw myself on film, I was shocked and dismayed. For some reason, I’d always imagined I would make a better looking woman. But Herschel liked the look. Of course, he is the Godfather of Gore and the legendary auteur behind some of the most famously bad movies of the 1970s.

I knew Herschel as a copywriter during the 1990s. He did some work for me. He was a competent, experienced professional. Easy to work with. That’s all I knew about him until my neighbor, Roger, who was a film critic, was telling me about this guy he knew, Herschel Gordon Lewis, a famous filmmaker of the 1970s. I said, “That’s funny. We have a well-known copywriter in our industry with the same name!”

When I realized it was the same guy – and that not only did he have these two very different careers, he was also a respected journalist, a competent piano player, and generally erudite – I decided to make a documentary about him. He agreed, but only if I would produce another movie he’d had in the back of his head for many years. It was called “The Uh Oh!” He wrote and directed it. I co-produced and made this cameo appearance. The movie went on to win many horror film festival awards. Nothing was said about my performance.

2. Repeat Offender

I’ve been arrested at least a half-dozen times. The first time I can remember was in 1969.

RR (a high school friend) and I had set off for Woodstock in a car that a guy that worked for RR’s dad had lent us. But then we decided – I can’t remember why – that Woodstock wasn’t going to be all that much fun, so we turned west and set off for California. We had a tent, some camping equipment, and some “mood enhancers” that RR had brought to enhance our experience, and we had many what-seemed-to-be brilliant conversations along the way.

Many of those conversations were about war, government, and politics. (Vietnam was in full throttle then.) And some were more esoteric – such as the electro-physiological explanation we came up with for déjà vu. (A nanosecond short circuit in the brain’s short-term memory wiring.)

We were at a rest stop in Texas when a cop car pulled up behind us. At the time, I knew that being in possession of pot in Texas could get you a life sentence, so I was gearing up to confess and throw myself on their mercy. In the rear-view mirror, I could see that one of the cops was on his walkie-talkie. Then he put it down, came over to our car, gestured for RR to roll down his window… and apologized. “Sorry,” he said. “You guys matched the description of two armed robbers we were looking for.”

He got back in his car and they sped off.

We drove very carefully out of Texas, scrupulously observing the speed limit, and finally reached California. Exhausted, we decided to pull off the highway to take a nap. I scrunched down in my seat, put my feet out the window, and passed out. Next thing I knew, a highway patrolman was tugging on my shoes. He asked RR for his license and registration. RR handed them over.

“This registration is expired,” said the patrolman.

“I didn’t know,” said RR.

“In fact,” said the patrolman, “it expired 3 years ago.”

He paused. “Where did you get this car?”

I looked at RR. He shrugged his shoulders.

The patrolman asked us to step out of the car, and he started rummaging through it. He found the pot in RR’s bag.

He escorted us to the nearest police station, where we were locked up in a holding cell. We were charged with grand theft auto and possession. Our bail was set at $5000. RR’s father bailed him out the next morning. And although my parents could have scraped up the money to cover my bail, they decided a bit of time in a jail cell would edify me.

I stayed there a week. By that time, the grand theft charge had been dropped. The judge fined RR $600 for possession, and fined me $250 ($50 off for each day I had spent in jail).

I could tell you a few grim stories about what I witnessed and experienced that week, but I won’t do that today. What I will say is that – for me – the worst thing about being in jail was not the tight quarters, hard bed, bad food, threats, intimidation, and occasional brutality, but the fact that I could not just get up and walk out the door. You will never know the amazing value of freedom until you’ve been locked up in jail.

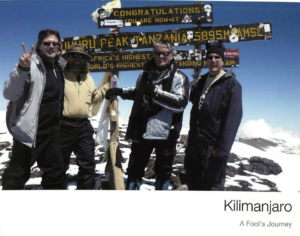

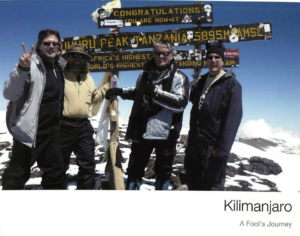

- Manly Mountain Climber

I climbed Mount Kilimanjaro.

For several years, my friend and client Dr. Al Sears had been encouraging me to climb a mountain with him. He was very much into mountaineering at the time, and had been making his way through a series of tall mountains out west.

I had no interest in climbing and was too busy anyway. But I felt guilty saying no over and over again. And so, when he invited me to climb Mt. Kilimanjaro in February of 2010, I agreed, thinking that something would surely happen before then that would make the adventure impossible.

Alas, divine intervention never occurred. And I found myself in Moshi, Tanzania after flying for a total of 17 hours. Our team consisted of Dr. Al, our fearless leader and expert climber; Daryl, the tech expert; Kevin, my childhood friend and one of the funniest most tenacious people I know; and yours truly.

We checked into our hotel (which looked a lot like a military compound) and rested up. We would head for the mountain the following morning.

I woke up with what felt like symptoms of bronchitis, but pressed on to rendezvous with the team and our guide, Raymond, in the lobby. After sorting out a minor miscommunication over weight limits for our gear, we were off. A harrowing bus ride and several warning signs later, we got off the decrepit vehicle and began our climb.

What followed was a five-day ordeal that I can only describe as hellish, painful, unbearable, and insane. Every day was worse and more arduous than the last. I eventually found myself just putting one foot in front of the other while mentally reciting my mantra that it would eventually be over.

My bronchitis worsened and Raymond’s oxygen testing device made it clear that I had pushed myself to the point of concern, but I stubbornly pushed on, pretty much running on fumes. Finally, Raymond put his hand on my shoulder and motioned for me to look ahead. There it was. Uhuru Peak. We had conquered Mount Kilimanjaro.

I staggered to Kibo Hut, a campsite along the mountain route, walked past the table of food laid out for us, and crawled into my cot. Dr. Al checked me out and called for a stretcher.

An hour later, I was on the stretcher, bidding my friend’s adieu. I was smiling. Daryl and Kevin looked envious. Being toted on a stretcher supported by a bicycle wheel was not comfortable, but I was half-delirious and happy to be off my feet. I met up with my buddies at the next stop down, and we all had a good sleep. The next morning, I felt much better and completed the descent with them on foot.

I will say this about climbing Mount Kilimanjaro: If there is a better way to test the limits of your endurance, I don’t know it. I’m glad I did it and will be proud that I did it for the rest of my life. But would I do it again? NO!

This essay and others are available for syndication.

Contact Us for more information.