One sensible way to acquire wealth is to buy shares of stable, cash-rich companies and hold them for long periods of long time. Most people do something else. They buy a stock at a price they hope will increase, and they plan to sell it at a profit if and when it does.

Although both strategies are generally considered to be forms of investing, I prefer to reserve the term investing for the former and call the latter speculation.

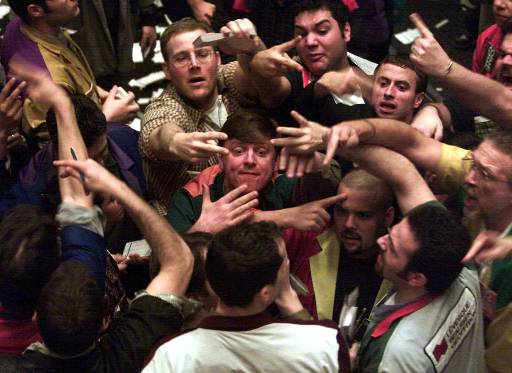

Any dictionary will tell you that speculation is distinguished by the fact that it is based on incomplete information. And that is certainly true of most of what most people – professionals included – do. They have some partial knowledge that suggests a particular company’s stock price will move up. Based on that partial knowledge they put their (or their clients’) money at risk.

I am not saying that you should never speculate. But I do think that if you are going to speculate, you should not delude yourself by thinking you are making a sound investment.

There is a third way people buy stocks that deserves another name. I’m talking about investing in companies about which almost nobody knows anything and whose history of appreciation, in general, is very low.

The market calls this speculation but I think that, too, is a misnomer. When you invest in something that has a less than 50% chance of success, you are not investing nor are you speculating. What you are doing is gambling.

Again, I’m not opposed to gambling. Although it’s certainly a vice (like drinking and smoking opium), it is a vice that I have no objections to so long as the person doing the gambling knows his odds.